Happy New Year! Welcome to 2023.

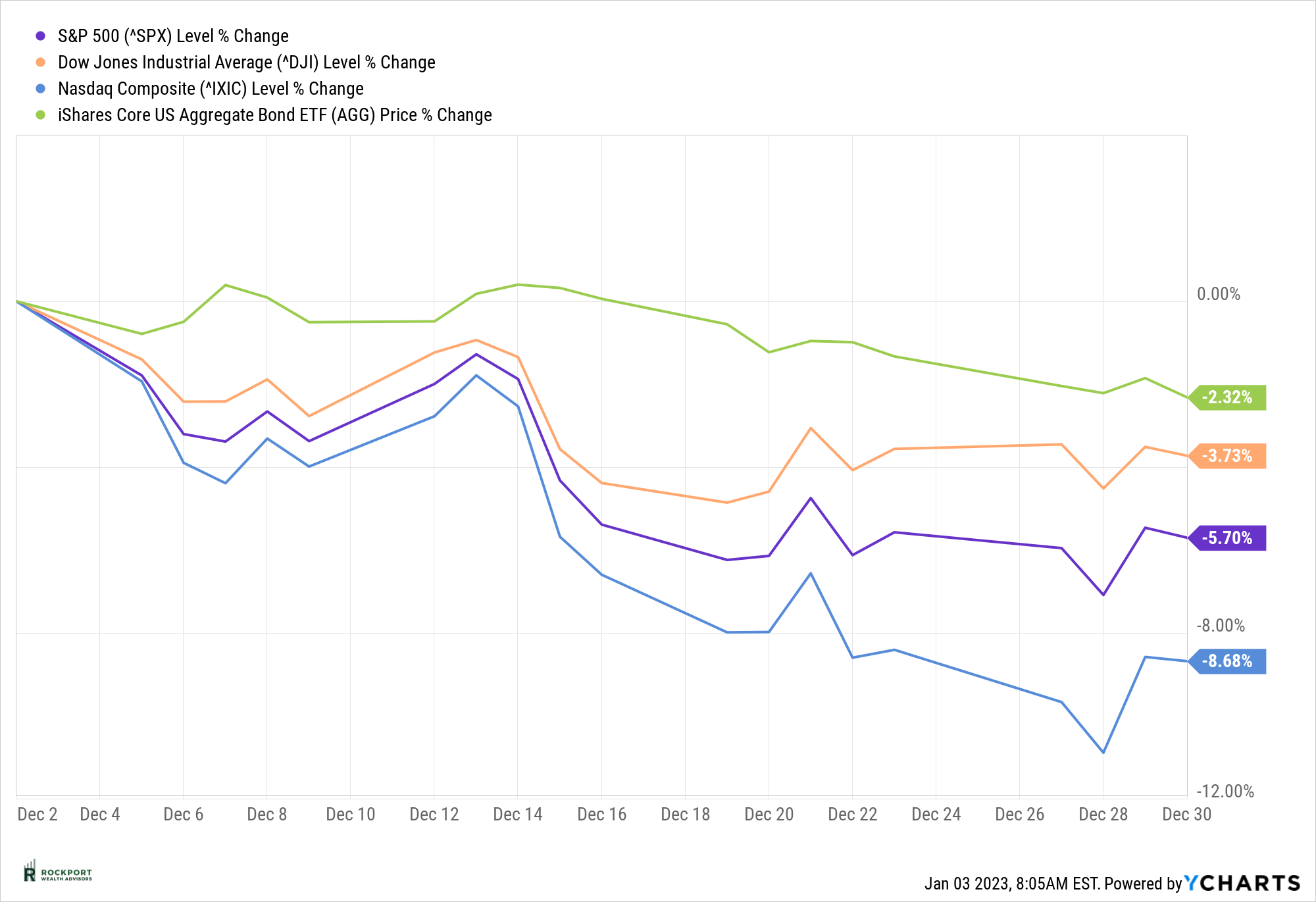

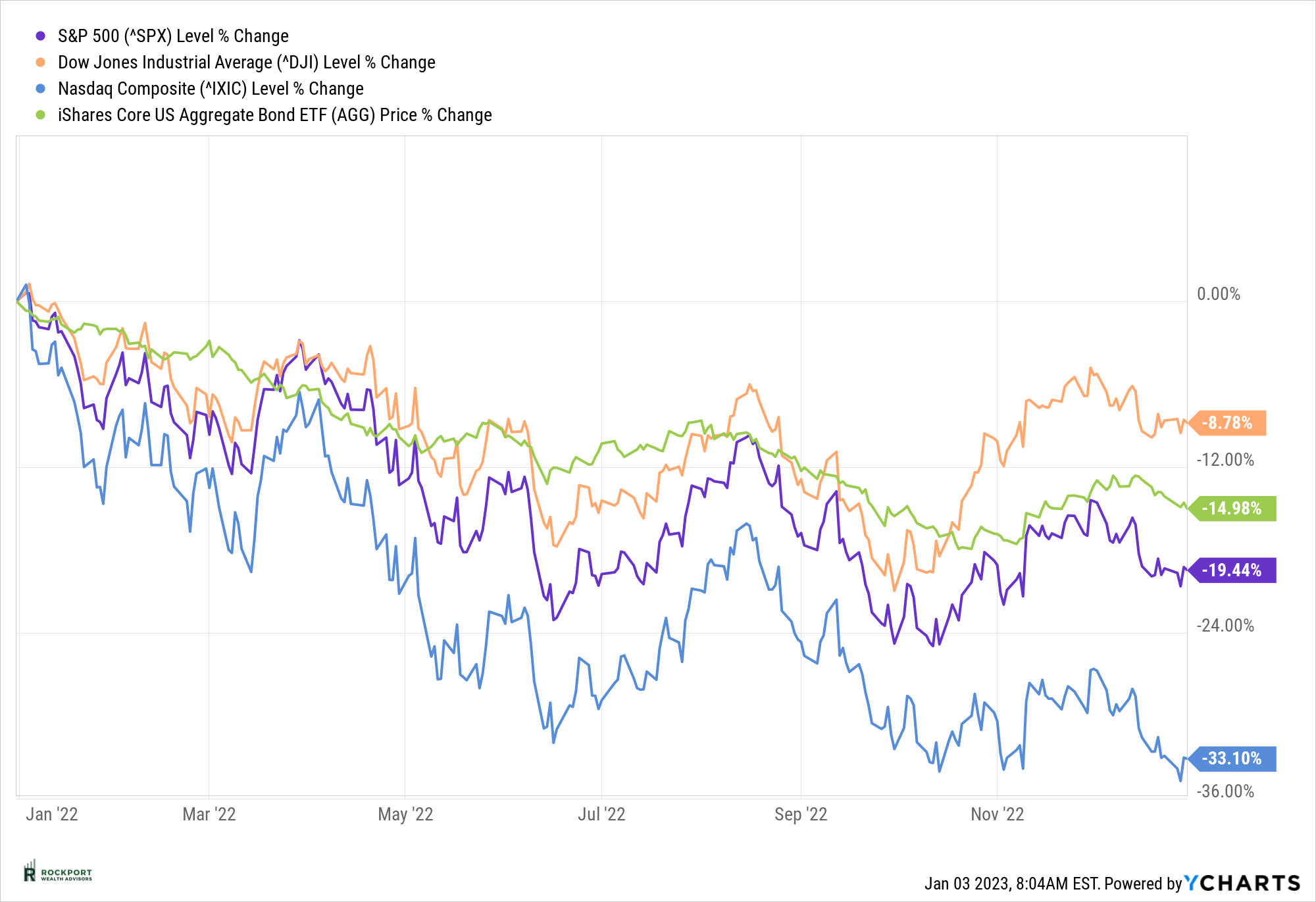

Stocks and Bonds closed out what has been a challenging year to say the least on a sour note. For the month, the S&P 500 index was down 5.7% which brought the index at the close to down 19.44% for the year. It is important to note that the index was down over 27% in the September early October time frame so taking just a little longer perspective than month vs. month we did close out the year in somewhat a better position. We realize this is of little consolation in a down year but felt it important to note that the market, despite all the negativity and naysayers proclaiming things will get so much worse by year end, in fact did not and improved in the 4th quarter.

As previously mentioned in several of our newsletters throughout the year, the decline in the bond market was perhaps the biggest surprise/disappointment for the year. The Aggregate Bond Index was down 14.98% for the year (see chart below). These are stunning declines for a sector of the market that is perceived to be “safer”. Conservative investors really felt the pinch of this. If you are a conservative investor and wanted for example only 30% of your money in stocks and 70% in bonds (to help avoid the volatility of the stock market) you received no support from the 70% bond portion as many would have expected based on previous years stock market declines. If there is any good news in this equation, it’s that it is highly unusual for markets (both stock and bond) to have back-to-back negative years. Yes, it has happened but has been very infrequent. Let’s hope that 2023 follows the instances in past history of good years following bad and things reverse to some degree.

The 1-million-dollar question at this point that no one can answer is has all the bad news been priced into the stock and bond markets? Looking back in 2022, here is a list of news/facts that the markets have had to take on:

- Central banks both domestically and globally raising interest rates (sometimes at feverish paces)

- US Economic Growth slowing

- Global Economic Growth Slowing

- Inflation both domestically and abroad at multi-year highs

- Russia/Ukraine War

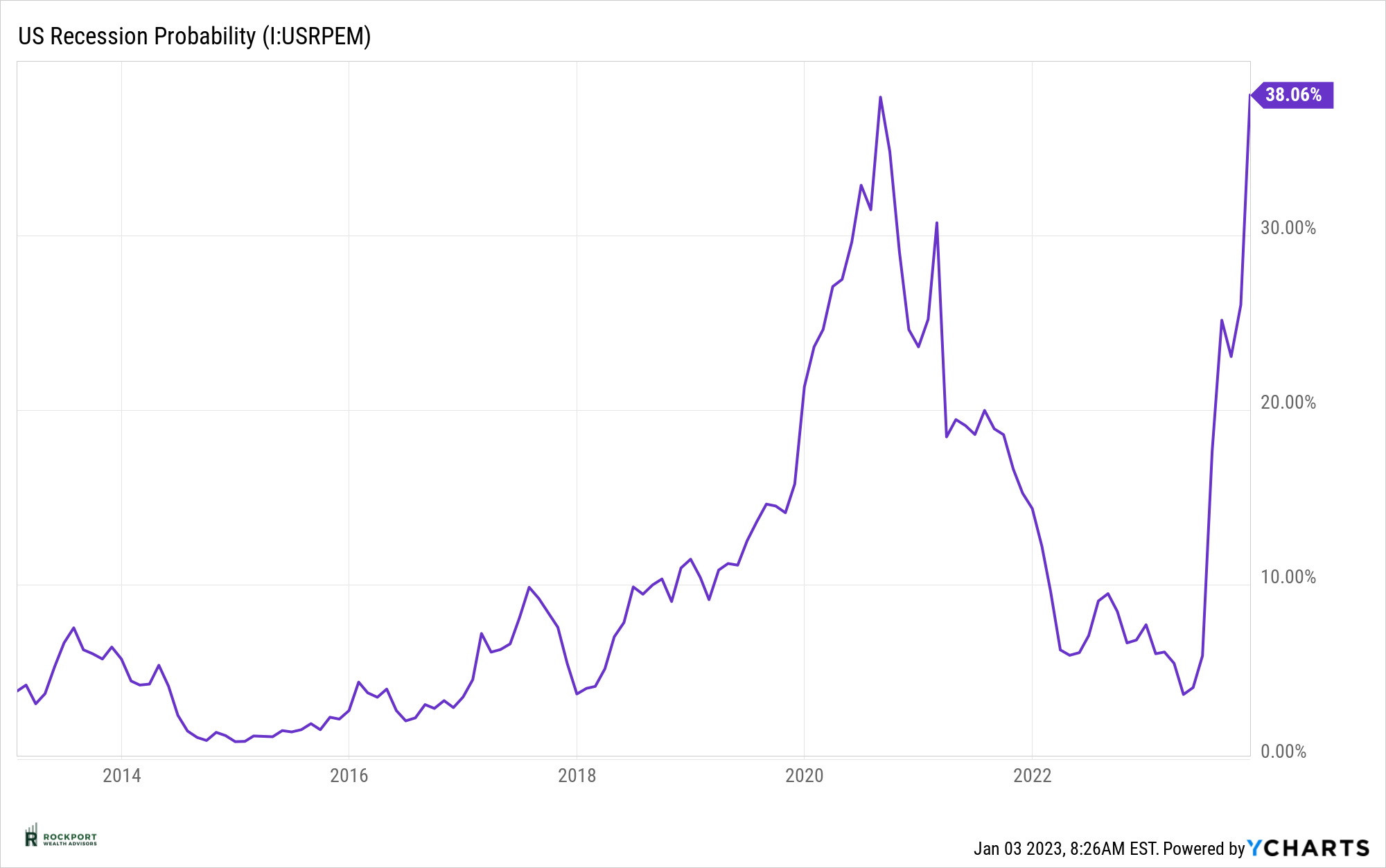

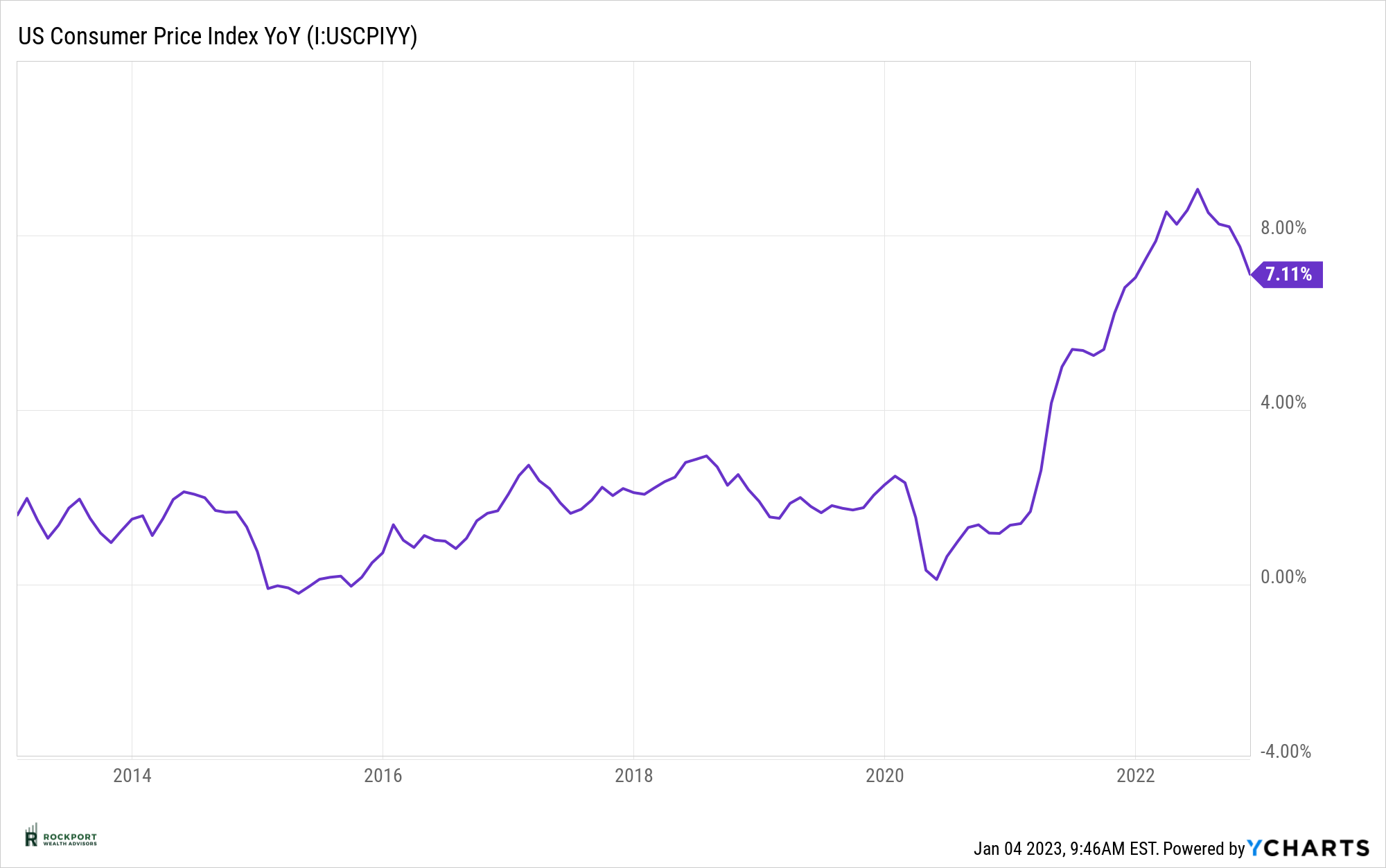

This list is not all inclusive but represents the lion’s share of issues for the calendar year and WOW what a list. As we enter 2023 most if not all of these are still intact. The Federal Reserve likely still has more interest rate increases to go. The amount is to be determined but the good news is that it appears as if the pace of increases is slated to slow down. Internationally most countries have just started raising interest rates noticeably. Yes, economic growth is slowing but will we have a recession? The Federal Reserve Bank of New York’s Recession Probability model currently stands at 38.06% (see chart below), the highest it has been since the pandemic in 2020 but far from a certainty this will occur. Clearly this will be a driver of investment returns in 2023. Inflation is coming down. The most recent CPI (Consumer Price Index) reading was 7.11% year over year increase (see chart below) and this has fallen every month since June’s high of 9.06%. Unfortunately, the war between Russia and Ukraine does not appear to be ending anytime soon. Let’s just hope for the best there.

Let’s take a closer look at the inflation situation as it ties into what the Federal Reserve’s next interest rate moves will be. The Fed would love to see inflation back down around the 2% range where it had been essentially since the late 1990’s and while inflation has fallen as stated above, we have a long way to go to get to their target. In fact, the target of 2% may end up taking many, many years to achieve, if at all. The reason for this is that while many commodity prices have fallen which will help the overall CPI, two components, those being wages and rents, are extremely slow moving and will remain resilient (Sticky), likely for years to come. Ultimately, the Fed may end up adjusting the target inflation number upward to say 3-4%? We will need to see how this plays out. For now though, it appears as if the worst of the inflation has occurred at least, barring any shock to the system. One additional note on the Fed and interest rates is that the last thing the Fed wants is a strong stock market rally. This would only add to their inflation issue. Perhaps you have noticed that seemingly every time the stock market has a nice rally (days or a couple weeks) some Fed official comes out and talks things down with comments about how long interest rates will go up and how long higher rates will last. This is not by accident. The Fed is not going to telegraph when they will be done raising and certainly will not telegraph when/if they are thinking of cutting rates as the mere mention of it would likely cause the market to rally strongly.

So, as we embark on 2023, uncertainties remain high, and the range of outcomes is wide. For our clients that like to do a lot of reading (which is a good thing as we always encourage education) please be careful of the forecasts you will see for the stock market. Last year the major Wallstreet firm’s analysts had year-end targets for the S&P 500 ranging from a low of 4400 to a high of 5300. They could not have been more wrong as the index closed out the year at 3839. The point is these are some of the smartest people in the world on the markets and if they were that wrong it’s clear that no one knows exactly where the market will end up at the end of a given year. Currently there is a lot of pessimism while last year there was a ton of optimism as we entered 2022. Perhaps just like last year the opposite will happen and pessimism will turn out to be a good thing, the way that optimism turned out to be bad. In the words of Warren Buffet “Investment vision is always 20/20 when viewed in the rear view mirror.”

Finally, we will be doing our annual rebalance of models starting in January. Rebalancing is nothing more than getting the portfolios back in line with original parameters of stock vs. bonds. We will also be reviewing each holding as to its performance and strategy and will make changes as necessary if any.

If you have any questions, please feel free to reach out.

*The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. Results can be found at slickcharts.com.

*Treasury yields can be found at finance.yahoo.com.

*Charts produced at yCharts.com

*Bonds can be found at bloomberg.com/markets/rates-bonds