As we are sure you have noticed, we have not yet exited the turbulence that started the flight of calendar year 2022. Please continue to have your seat belts fastened.

The markets in February took a very similar pattern to January in that there were large sell offs early and mid-month and a large recovery end of month. When the month closed out the S & P 500 index is down nearly 8% for the year.*

Two major headlines continue to dominate investor psychology those being Inflation and the Russia invasion of Ukraine. Let’s explore both of those for a moment.

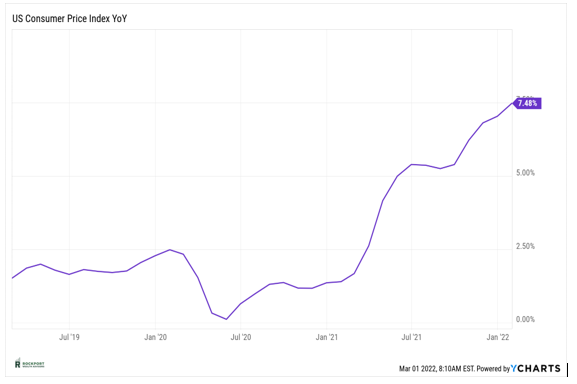

Inflation has continued to move higher (See Consumer Price Index Chart below) and we continue to see readings we have not had in nearly 40 years. You have to go back to the early 1980’s to find Consumer Price Index readings as high as they are now. Supply chains continue to be a problem and as we have stated in the past this is going to take time, possibly a year or two to clear up. When it does clear up the supply side of the equation should assist in lowering inflation. In addition, The Federal Reserve’s primary tool to help fight inflation is raising interest rates in an attempt to slow everything down. This is the Canary in the coal mine at the moment. It appears they will make the first rate increase in March. Will it be a quarter or half point? How many rate increases will we see? These are questions that need to be answered and should become much clearer in the coming months.*

As for the Russian invasion of Ukraine, simply put war is hell. Our thoughts and prayers go out to all involved and hoping for a swift and hopefully as peaceful as possible outcome. In terms of the invasion’s effects on our economy and markets, generally wars are disruptive but it’s too early to tell how the economy may be affected. Supply chain issues are likely to become more problematic short term which will also continue to increase Inflationary Pressures. If there is any good news in this, it is that it may keep the Federal Reserve more in check in terms of raising rates.

As for the Russian invasion of Ukraine, simply put war is hell. Our thoughts and prayers go out to all involved and hoping for a swift and hopefully as peaceful as possible outcome. In terms of the invasion’s effects on our economy and markets, generally wars are disruptive but it’s too early to tell how the economy may be affected. Supply chain issues are likely to become more problematic short term which will also continue to increase Inflationary Pressures. If there is any good news in this, it is that it may keep the Federal Reserve more in check in terms of raising rates.

They may be more unlikely to raise rates quicker for fear of over tightening during a time of economic uncertainty. We will just have to see how this all plays out.

They may be more unlikely to raise rates quicker for fear of over tightening during a time of economic uncertainty. We will just have to see how this all plays out.

Lastly, we have not mentioned this for some time, but it bears repeating. During times like this the media is not your friend. Their job is to create interest and unfortunately, they do this through fear. We would all be well advised (including ourselves) to keep the viewing of financial news to a minimum.

So, we still expect a fair amount of market volatility for the foreseeable future and as previously stated the potential of lesser returns than we have experienced over the past several years. Patience will be a key attribute for investors in 2022. The one thing markets seem to hate most is uncertainty and we are loaded with that at the moment. As some of the uncertainty clears up around the interest rate picture as well as the Russia Ukraine situation, we would expect things to settle down.

Please stay safe and healthy and as always, we welcome any comments or questions.

*The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. Results can be found at slickcharts.com.

*Treasury yields can be found at finance.yahoo.com.

*Charts produced at yCharts.com