Happy Spring (Almost!) We hope this newsletter finds everyone happy and healthy.

Markets & Economy

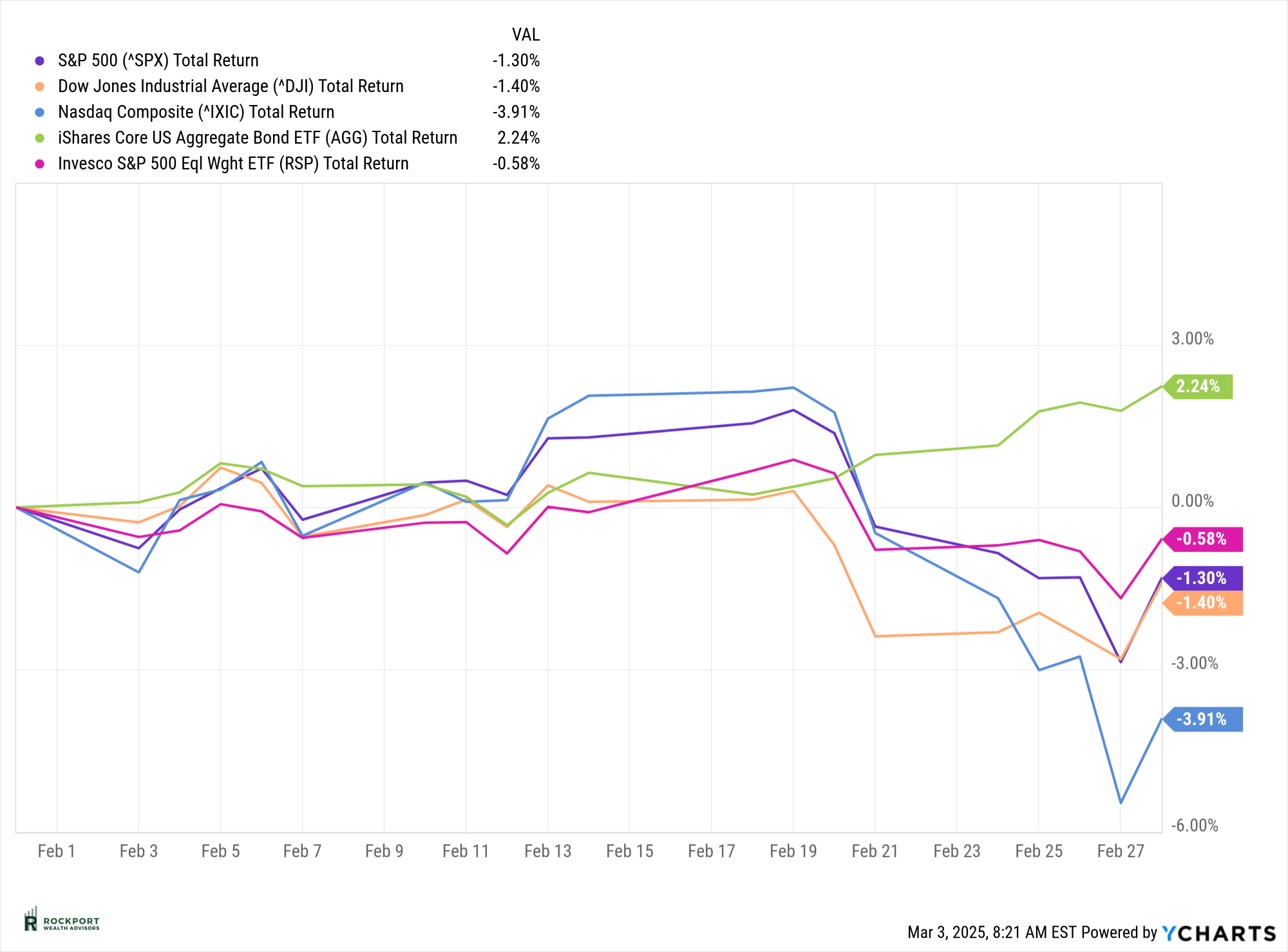

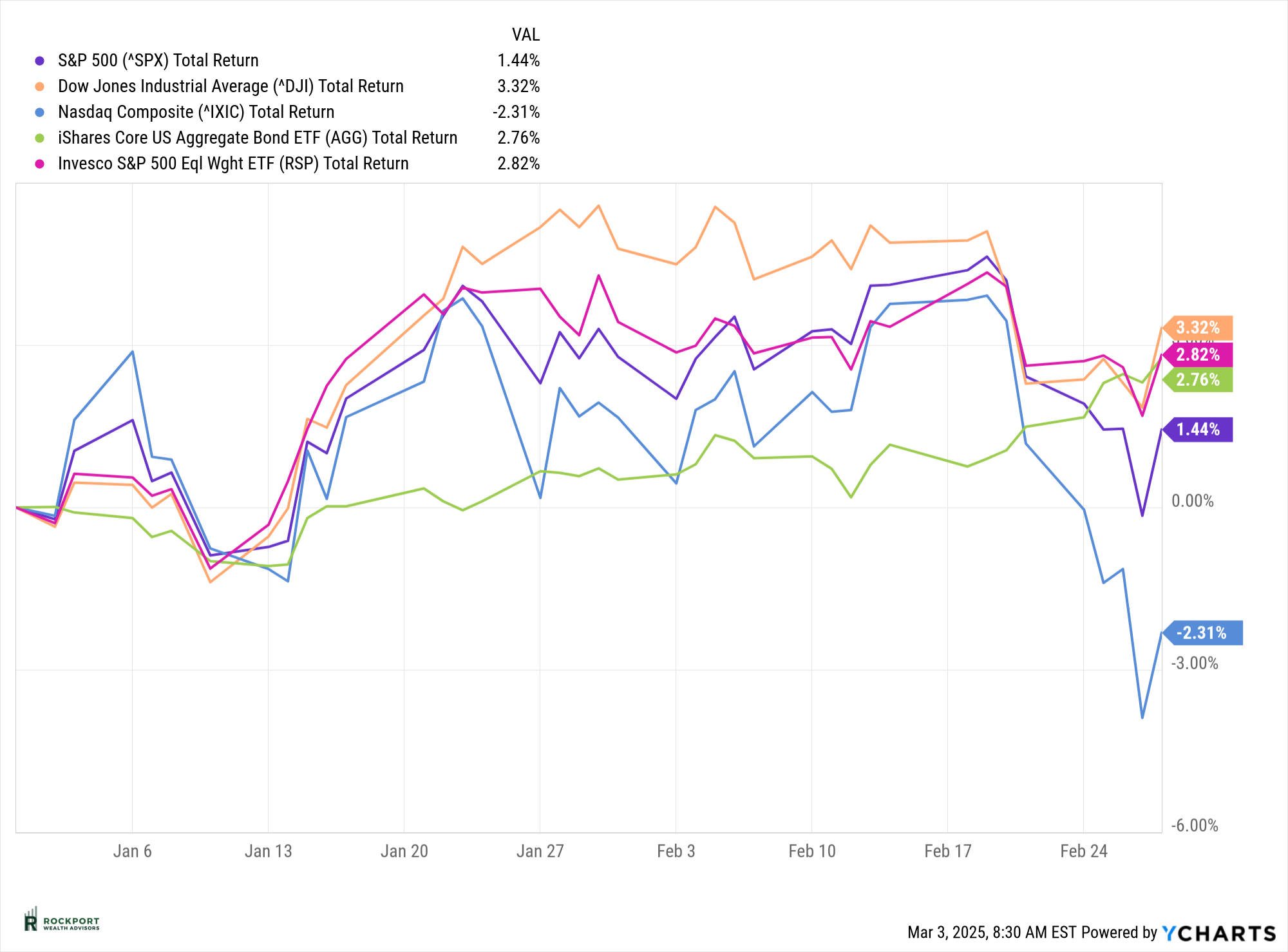

As we mentioned in our last newsletter, we anticipated increased market volatility, and February proved that expectation correct. The S&P 500 declined by 1.3% for the month but remains in positive territory for the year, up 1.44% through the first two months of 2024.

Other major indexes followed suit, with the NASDAQ experiencing a more significant decline of 3.91% in February. This index, which has been the hardest hit so far this year, is now down 2.31% year-to-date. A key driver of this weakness has been the performance of the “Magnificent 7” stocks (NVDA, GOOGL, MSFT, AAPL, AMZN, etc.), which have pulled back even more than the broader index. However, this isn’t entirely surprising, given that these stocks had seen some of the biggest gains in the preceding months and year.

While market pullbacks can feel uncomfortable, it’s important to remember that they are a natural part of investing. Historically, 5% declines occur several times a year, and a 10% correction from recent highs happens about once per year. These dips, while normal, can still feel unsettling—but they are an expected part of long-term market cycles.

Interestingly, the best performing areas of the market this year have been the equal-weight S&P 500, the Dow Jones Industrial Average, and bonds. Essentially, the investments that lagged in the previous year have led the way so far in 2024, signaling a broadening of market performance at the expense of high-valuation growth stocks.

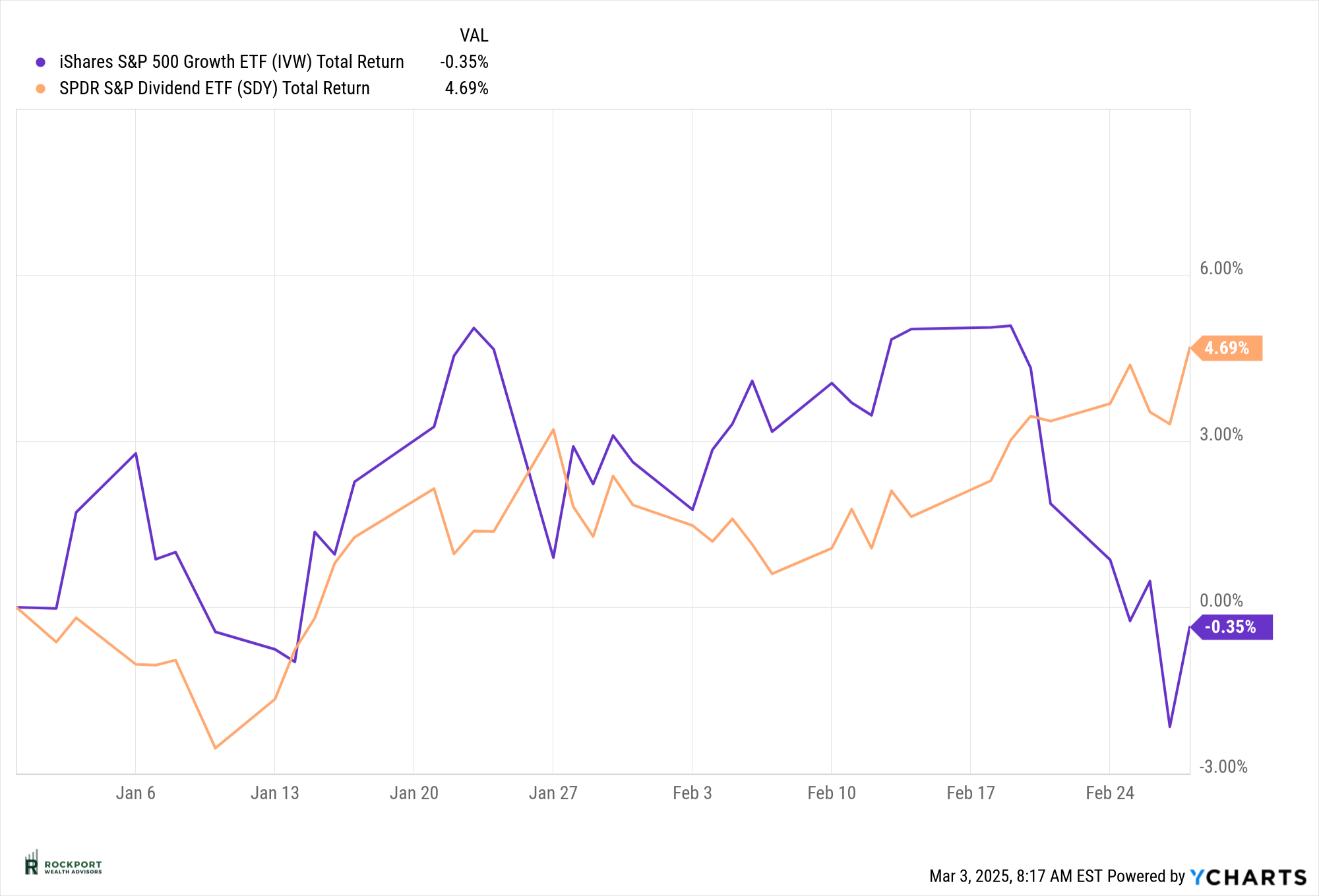

One final noteworthy trend: for the first time in quite a while, value stocks are outperforming growth stocks. It feels like ages since this has been the case, but so far in 2024, portfolio composition has played a significant role in returns. Investors with a heavier allocation to technology and growth stocks have underperformed those with greater exposure to value and dividend-paying stocks.

Several factors seem to be driving the short-term market volatility we’ve seen recently. Ongoing trade tariffs, uncertainty around economic growth, persistent inflation that complicates the Federal Reserve’s decision-making, and concerns about employment have all contributed to the market’s choppiness.

Let’s take a closer look at this issue. The current administration has implemented tariffs on multiple countries, raising concerns that inflation could worsen as a result. Adding to the uncertainty, these tariffs have been announced, reversed, and then delayed—sometimes within days—creating a lack of clear direction. This inconsistency in messaging has been unsettling for the stock market, as uncertainty is one of the biggest challenges for investors. Unfortunately, this remains a wait-and-see situation, and we should expect this storyline to continue playing out for some time.

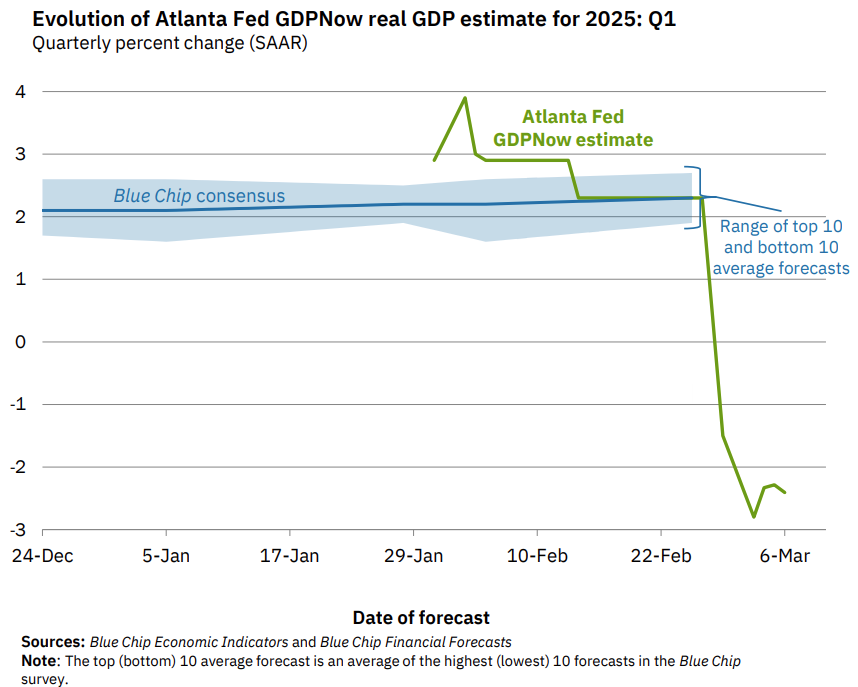

The strength of economic growth is now in question. One key measure of growth, Gross Domestic Product (GDP), is closely watched by economists and investors alike. As shown in the chart below, the Atlanta Fed’s latest GDP Now forecast is currently projecting negative growth for the first quarter of this year (green line). While this is just one of many forecasts and should not be viewed in isolation, it is noteworthy as the first negative projection we’ve seen in some time. This will be an important trend to monitor closely.

It’s also worth remembering that a technical recession is defined as two consecutive quarters of negative GDP growth. While we’re not there yet, this is a development that warrants attention in the months ahead.

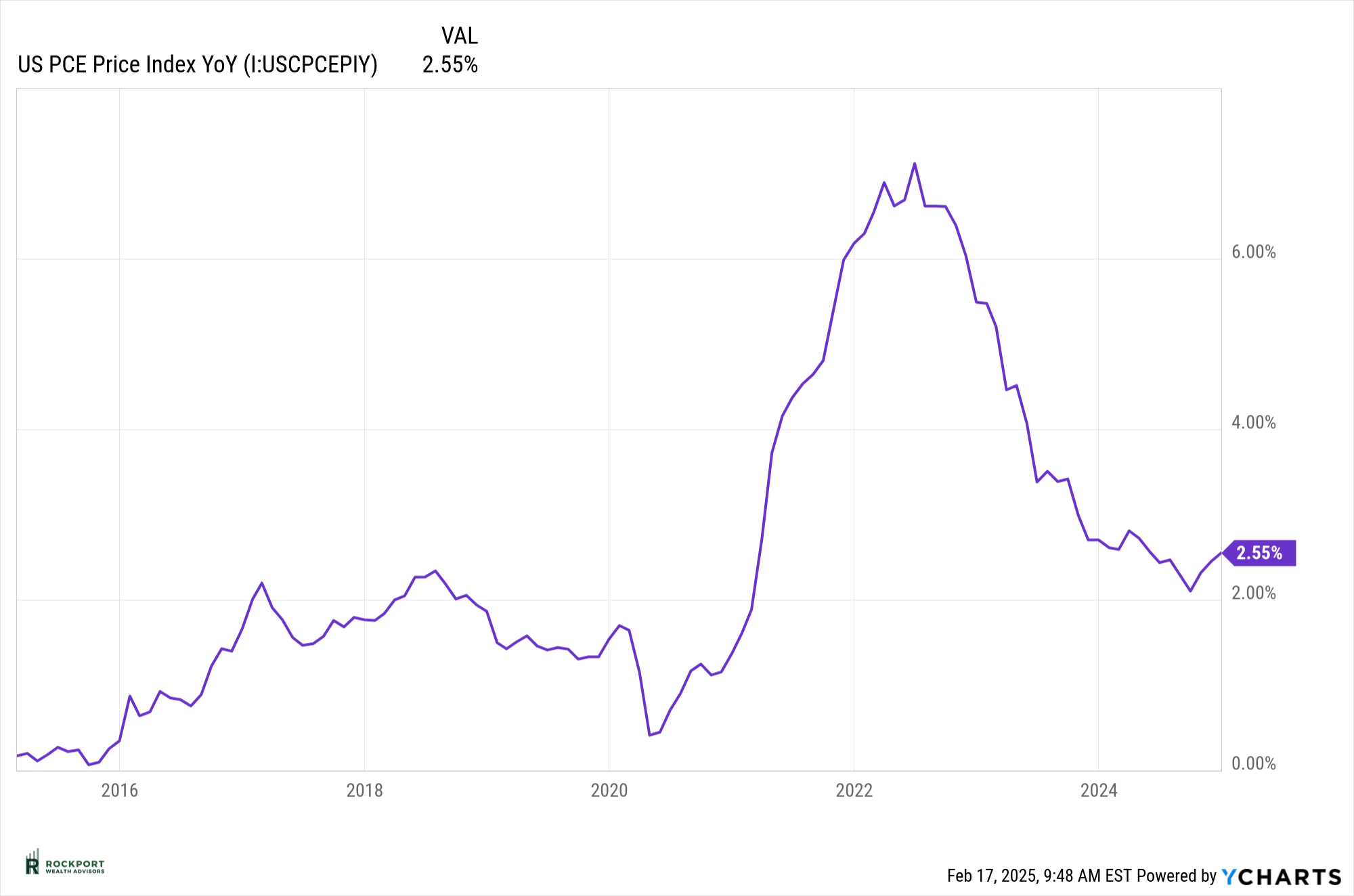

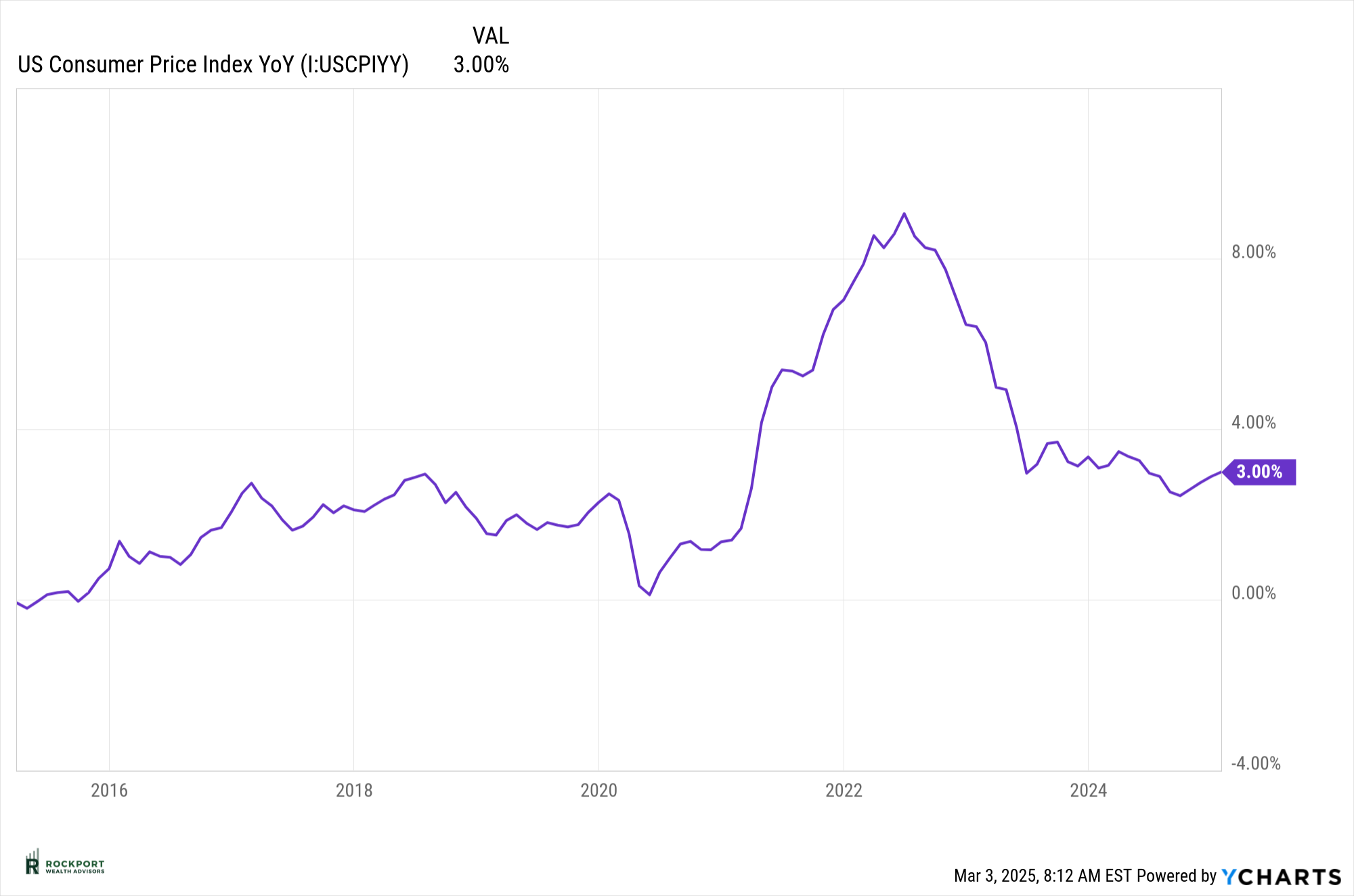

Inflation has remained a key concern for some time now, as we’ve discussed in previous newsletters. As of January, inflation continued to rise, with both the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) index maintaining their upward trend since September. While this persistence is not ideal, there are emerging signs that inflation may be cooling.

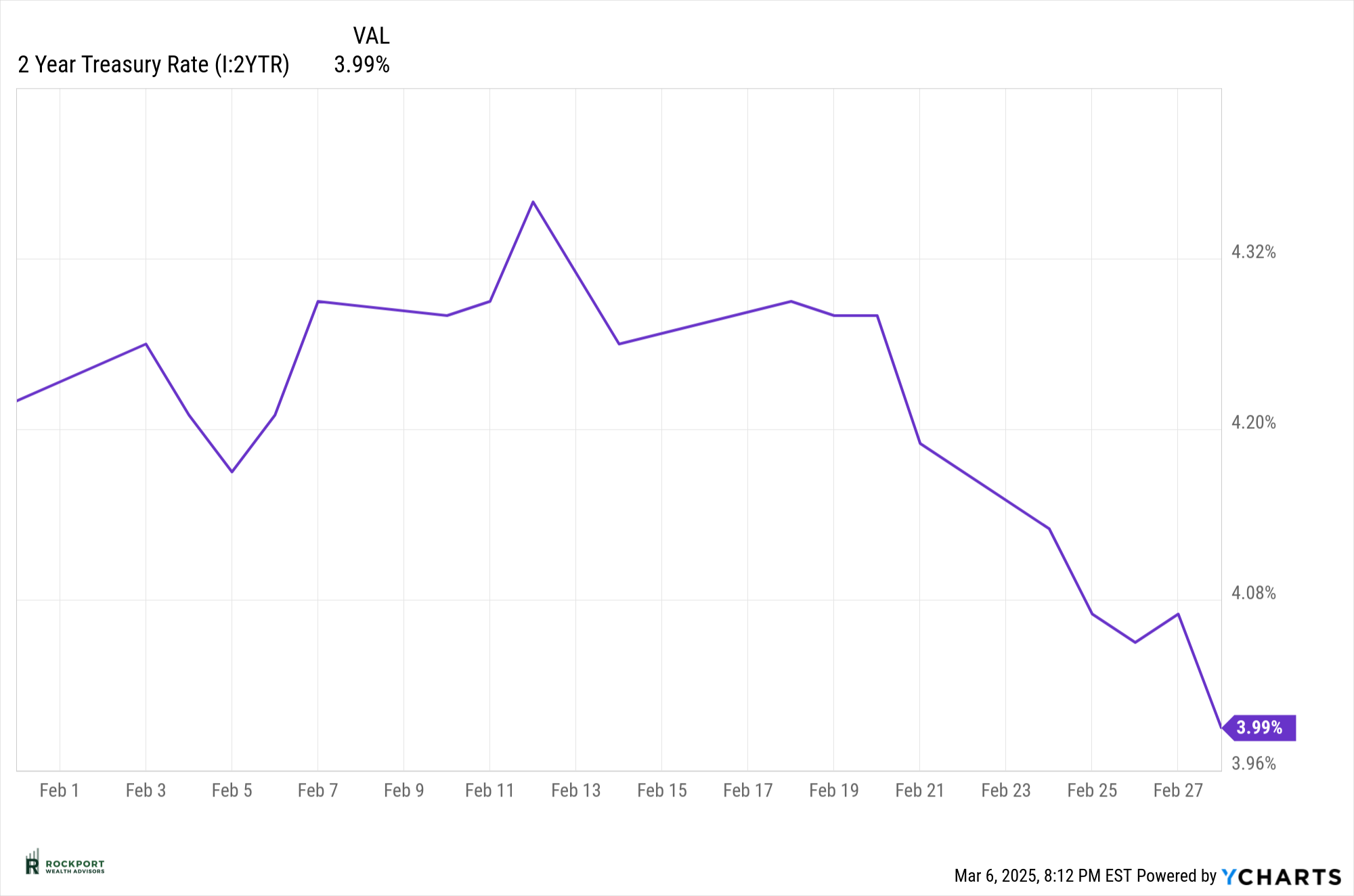

One potential indicator is the recent movement in the 2-year Treasury yield. Since mid-February, the yield has fallen notably from 4.36% to 3.99%. This decline is significant, as the 2-year yield is now well below the Federal Funds rate of 4.50%, which could suggest that inflationary pressures may ease in the months ahead. Historically, the 2-year Treasury yield has been a strong indicator of where the Federal Reserve may be headed with interest rates.

Just a month ago, market expectations suggested little to no room for rate cuts in 2024. Now, with this shift, forecasts have adjusted to potentially two to three rate cuts this year. While nothing is certain, we will be watching this closely in the coming months to see how the Fed responds to these evolving economic conditions.

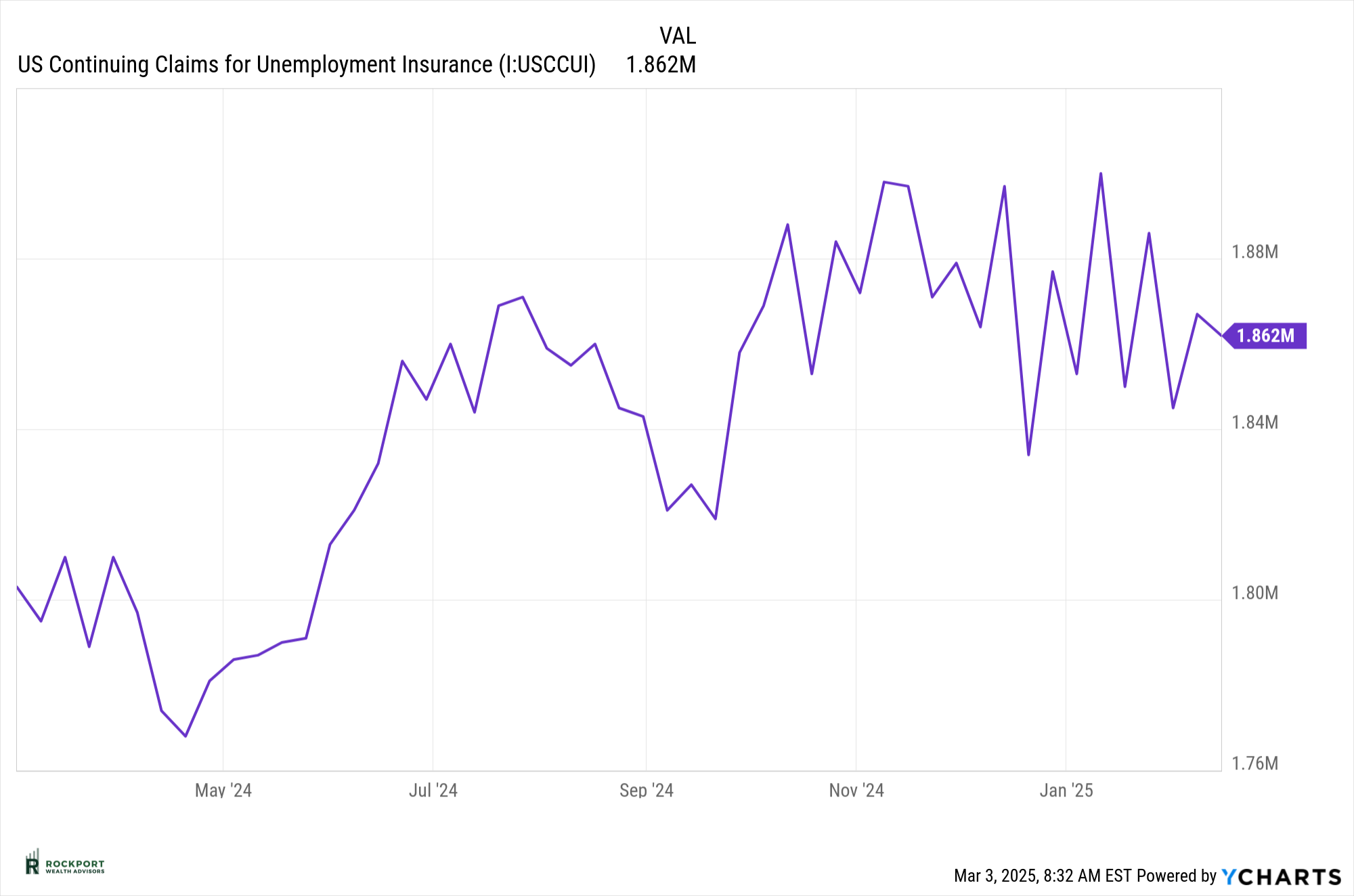

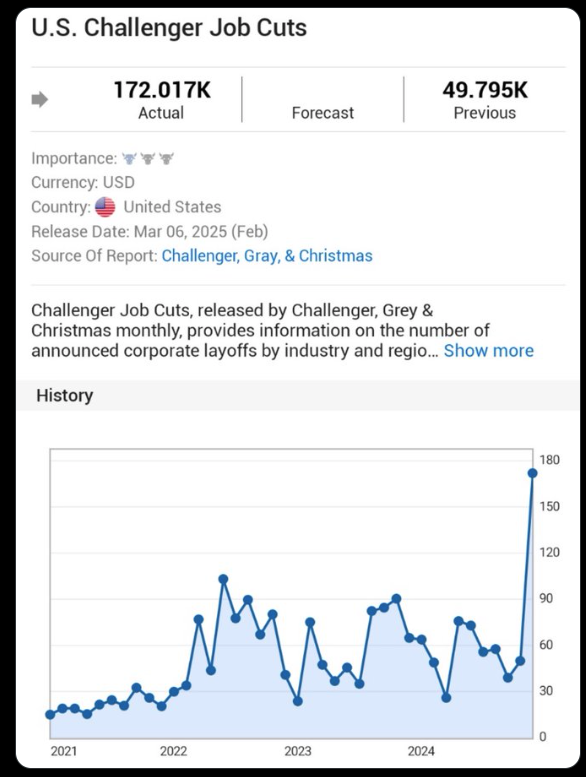

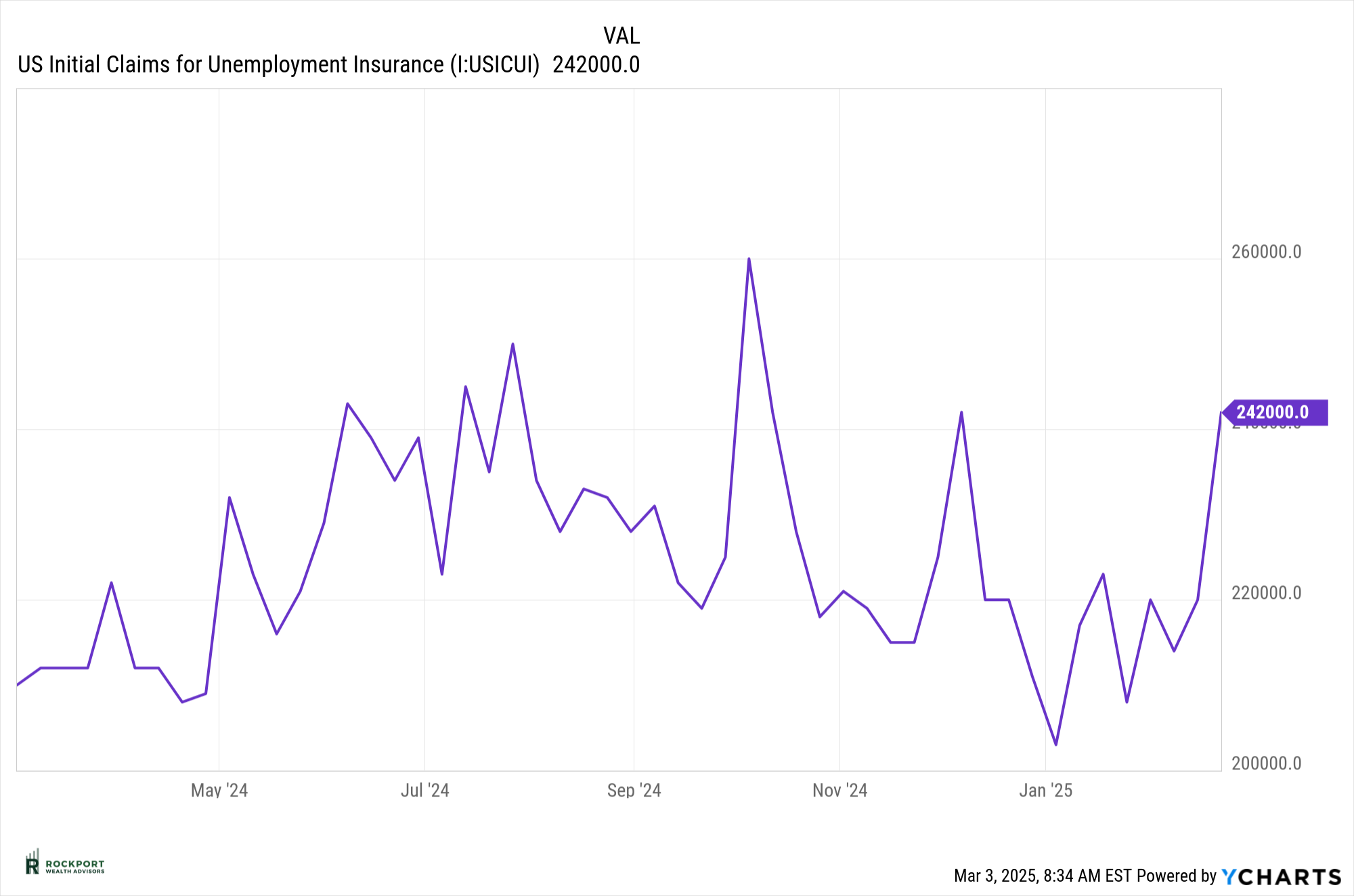

Employment may become a key concern in the months ahead. While continuing unemployment claims have remained stable for now, initial jobless claims are beginning to trend higher. Additionally, as shown in the chart below from Challenger, Gray & Christmas, job cut announcements have spiked, signaling potential trouble ahead for the labor market.

With widespread layoffs already announced across various industries—and additional cuts expected at the government level—unemployment could be on the rise. This will be an important trend to monitor as we assess the broader economic outlook.

As we move forward in 2025, the year is shaping up to be an eventful one. With headlines dominated by tariffs, foreign relations, and economic concerns, the media’s tendency to amplify uncertainty can make it challenging to separate noise from reality.

One key question remains: Will the long-anticipated recession that never materialized in 2024 finally arrive, or will the economy continue to defy expectations? As the government embarks on the gradual unwinding of the unprecedented fiscal stimulus that has fueled the U.S. economy over the past 8-10 years, we are likely to experience additional volatility. Much like a child coming down from a sugar high.

While challenges lie ahead, staying focused on long-term fundamentals rather than short-term headlines will be essential. We’ll continue to monitor these developments closely and provide guidance along the way.

Rockport News

Axos Change

For those of you that have brokerage accounts at AXOS, we will be terminating our relationship with them by year end. We will be in contact with you mid-year to arrange for a transfer of accounts to our other clearing firm Charles Schwab. This is not a decision we took lightly. However, in the current regulatory environment RIA (Registered Investment Advisory) firms such as ours are heavily encouraged to operate with one custodian to keep the same playing field for all clients.

Model Changes

Lastly, with the rapidly changing conditions this year expect more changes in our models than in years past. Especially our Sector models. As these occur if you have any questions please reach out.

As always, if you have any questions on anything we have talked about here or anything else that is on your mind, please feel free to reach out.

*Treasury yields can be found at finance.yahoo.com.

*Charts produced at yCharts.com

*The LEI can be found at Conference-board.org

*Bonds can be found at https://www.bloomberg.com/markets/rates-bonds

*CME FedWatch Tool – CME Group

*University of Michigan Consumer Confidence found at SentimentTrader.com

*FRED Charts produced by Federal Reserve Bank St. Louis

*PMI Manufacturing and Services Indexes, and Consumer Confidence and Future Expectations at Conference-board.org

*Buffett Indicator produced at currentmarketvaluation.com

*Distribution of S&P 500 Returns found at Macrotrends.net

*S&P 500 forward P/E ratios can be found atBusinessinsider.com

*The Asset Managers Positioning Chart found at The Daily Shot

* Rockport Models – Please remember we are referencing our model portfolios, and your portfolio may differ from the models mentioned depending on your individual needs and circumstances.