Good start to 2023!

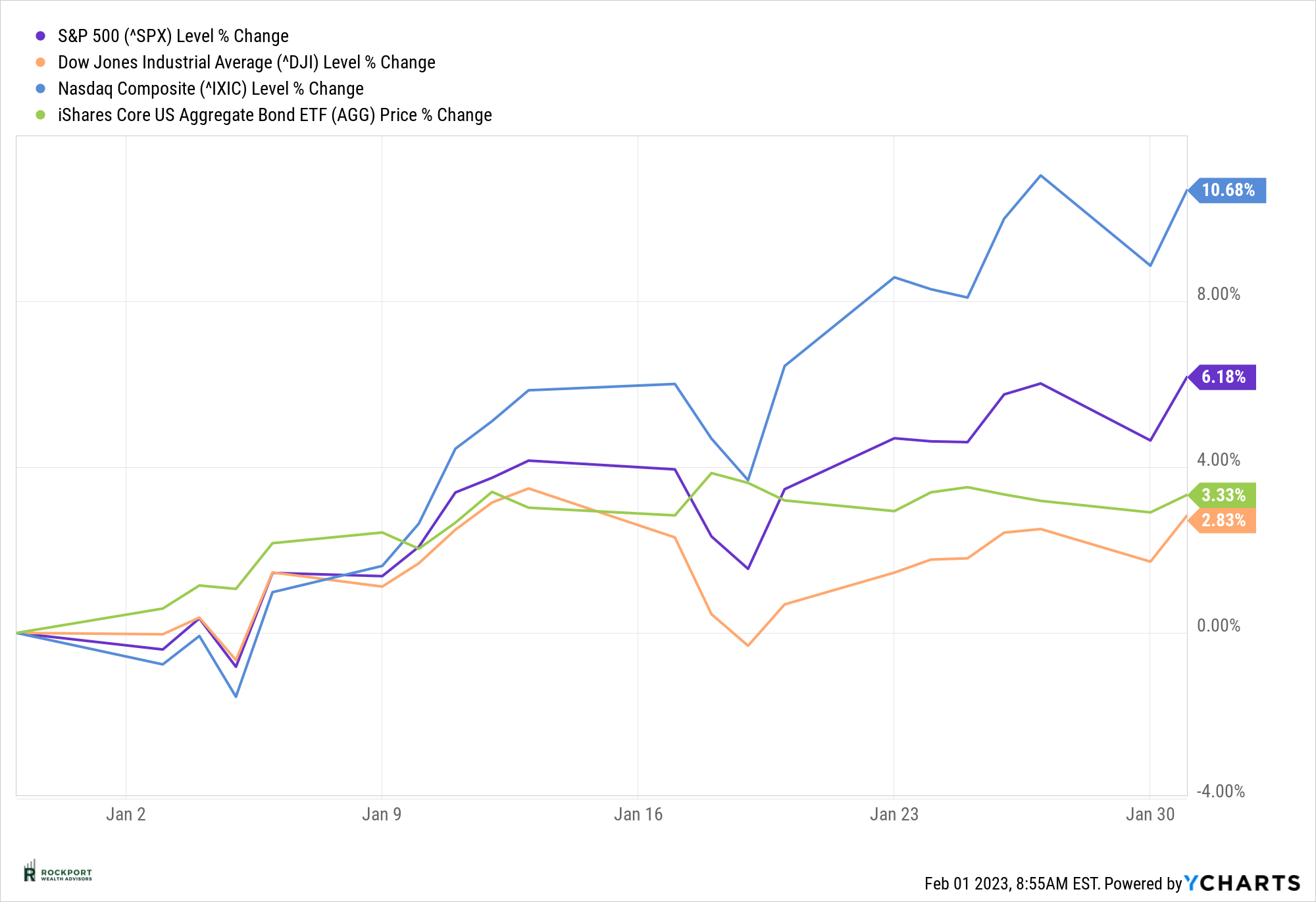

We are off to a good start. Much to the surprise of many if not most in the media and Wall Street analysts, which seemed to be overwhelming on the side of things getting “so much worse”, the markets have had a great start to the year. Once again, as it always seems to do, the market has made as many pundits and media look as foolish as possible. We realize that it’s only been one month into 2023 and it’s way too early to call an all clear on the market but it sure helps and feels nice to have a strong month to start the year. The S&P 500 returned 6.18% for the month and bonds as represented by the Aggregate Bond Index were up 3.33%. (See chart) Other major indexes have also showed nice gains for the month.

One possible reason for market strength is very technical in nature. On January 13th a Whaley Breadth Thrust occurred in the market. This is a technical indicator that historically has shown some accuracy in predicting upward market movements. With the proliferation of computer trading, many of which are programmed to trade both buys and sells based on technical events, it is possible that this has played a role in our good start.

One possible reason for market strength is very technical in nature. On January 13th a Whaley Breadth Thrust occurred in the market. This is a technical indicator that historically has shown some accuracy in predicting upward market movements. With the proliferation of computer trading, many of which are programmed to trade both buys and sells based on technical events, it is possible that this has played a role in our good start.

So, what has really changed? Answer, not much other than Psychology perhaps. It appears that the markets are looking forward at this point and anticipating interest rate cuts by the end of the year or what is referred to as a Fed Pivot (i.e., Fed changing from raising interest rates to cutting them). This is the second possible reason for market strength.

Thinking back to the list that we posted in last month’s newsletter, all are still intact:

- Central Banks domestically and globally are still raising interest rates, although the rate of increases in the US appears to be slowing finally

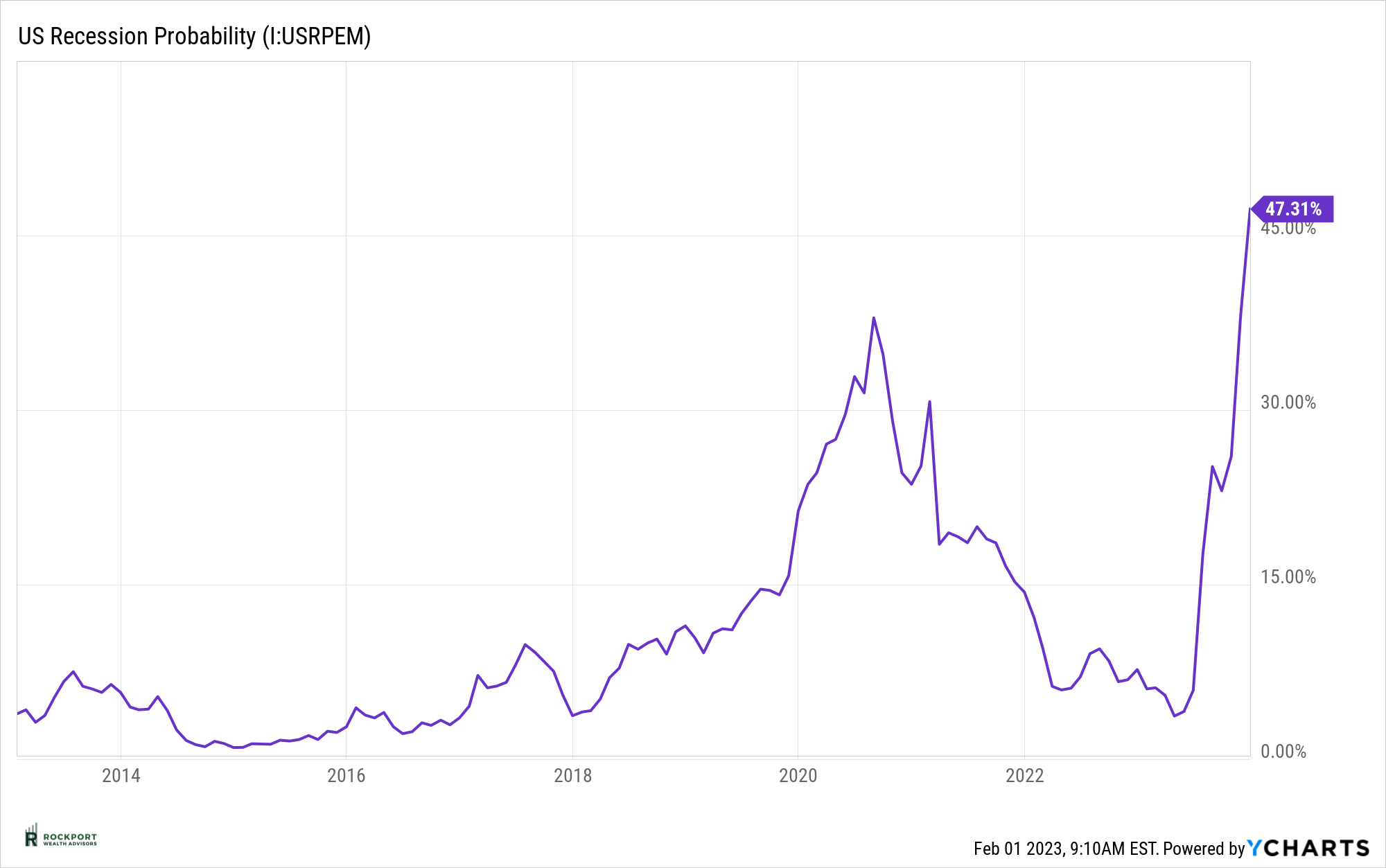

- US Economic Growth is still slowing, in fact the New York Fed’s Recession Probability model has increased from 38% last month to over 47% (See chart)

- Global Economic Growth is still slowing as well

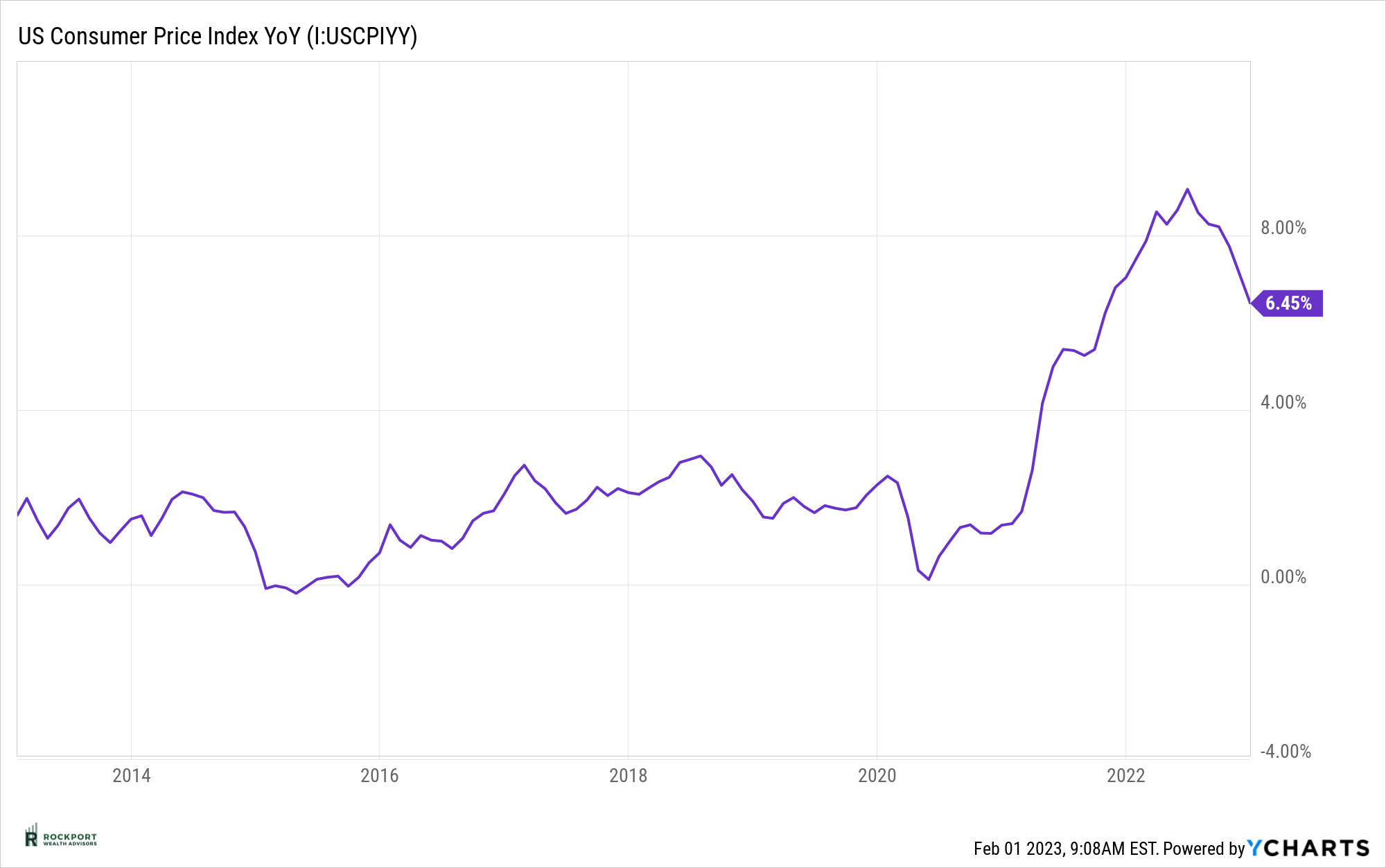

- Inflation while coming down is still much higher than the Federal Reserve would like (See chart)

- The Russia/Ukraine War unfortunately rages on which economically does have an effect on supply chains and commodity prices

Clearly a lot of challenges still exist and the markets and economy have a lot to overcome as we work our way through 2023. Let’s hope that as the year rolls on we can begin to talk about other topics other than inflation and interest rates!

Lastly, portfolio rebalances have begun and will continue through the month of February so if you see activity in your model portfolio this would account for that. We have also noticed a pickup in activity with new clients, many of which have been referrals from you! We can’t thank you enough for keeping us in mind and trusting us with your friends and family. After a difficult year many may be thinking they need a second opinion, and we welcome any and all referrals and would be happy to set up a consultation.

As always, if you have any questions on anything we have talked about here or anything else that is on your mind, please feel free to reach out.

*The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. Results can be found at slickcharts.com.

*Treasury yields can be found at finance.yahoo.com.

*Charts produced at yCharts.com

*Bonds can be found at bloomberg.com/markets/rates-bonds