Happy February! For those of you up North with us brace for 6 more weeks of winter as Punxsutawney Phil saw his shadow!

Markets & Economy

The markets kicked off 2025 with a strong start. However, the month was not without its share of drama, as a few key events shaped market sentiment—topics we will explore in more detail later.

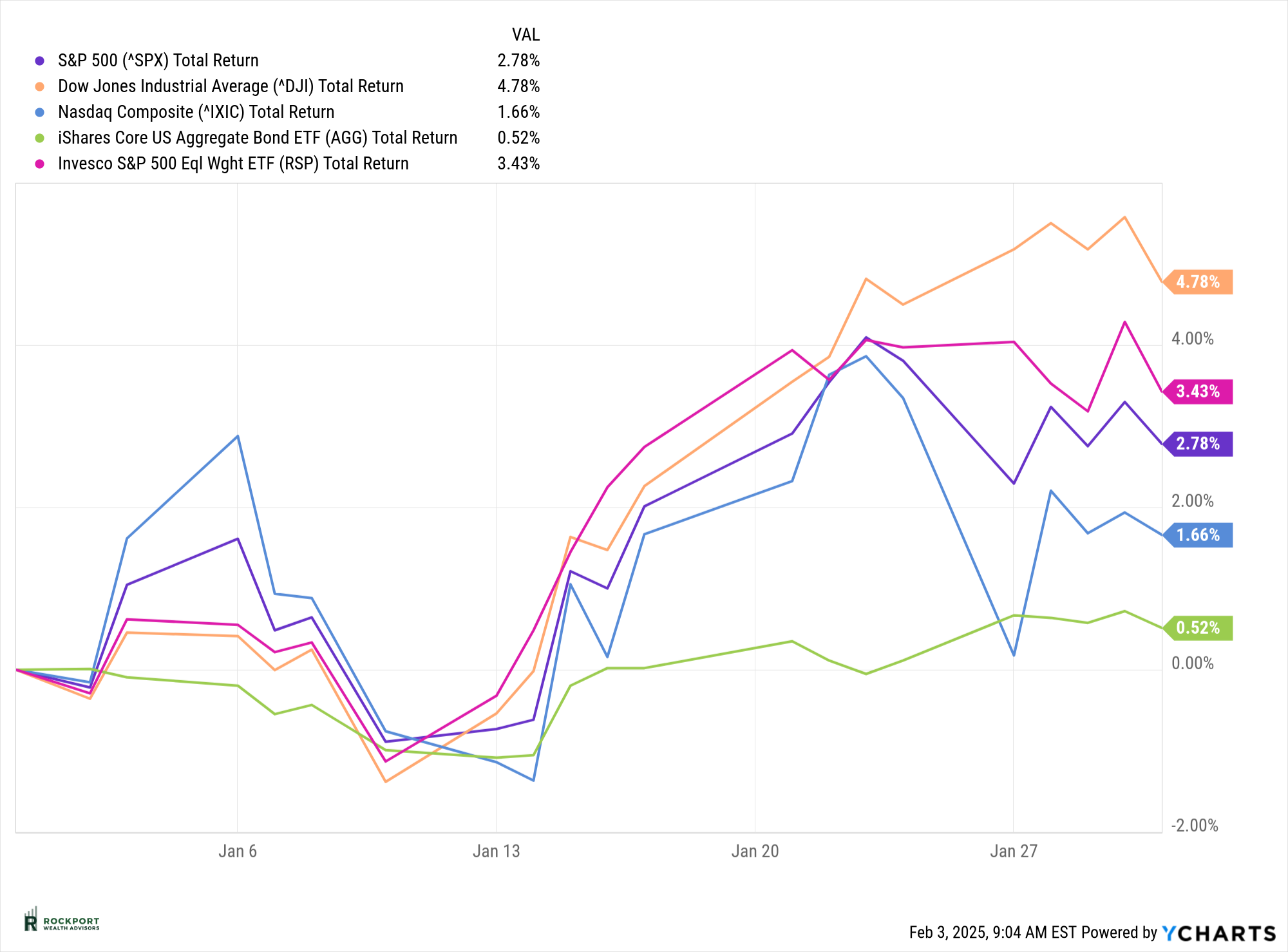

The S&P 500 Index posted a 2.78% gain for the month, while two notable indices outperformed the broad market. The Dow Jones Industrial Average surged 4.78%, and the S&P 500 Equal Weight Index delivered a 3.43% return—both exceeding the performance of the traditional market-cap-weighted S&P 500. While this is a short-term trend, it underscores the value of diversification and the importance of not being overly concentrated in the top seven mega-cap companies we’ve previously discussed.

For January, the two major themes driving headlines were Inflation and Tariffs—critical topics that had meaningful impacts on investor sentiment and market direction.

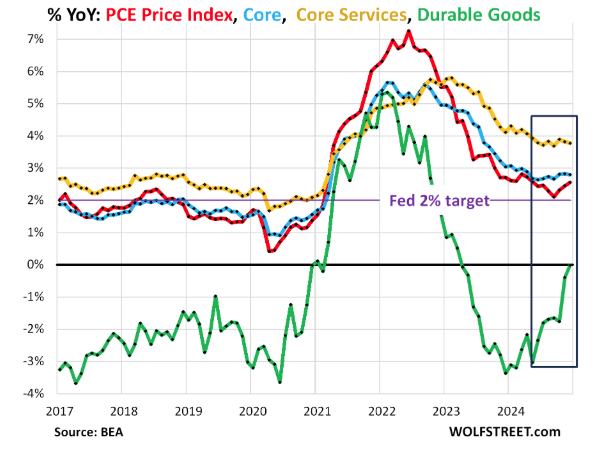

Inflation continued its gradual upward climb in January. As shown in the chart below, most inflation measures remain above the Federal Reserve’s 2% target, with little progress toward that goal. The Fed appears to be taking notice, as it chose not to cut interest rates in January—a potentially significant shift in policy.

Just a few months ago, the Fed had projected as many as four to five rate cuts in 2025. That forecast has now been revised downward to just one or two, reflecting persistent inflationary pressures. Additionally, the recent disaster in Los Angeles is expected to further fuel inflation, driving up building material costs and insurance premiums.

While the general expectation is for some rate cuts this year, we would not be surprised if the Fed ultimately keeps rates steady. As we have over the past year, we will continue to monitor these developments and keep you informed. The path of interest rates will play a key role in shaping market stability and direction in the months ahead.

Tariffs have quickly become the hot topic. It didn’t take long after President Trump’s inauguration for his administration to begin implementing tariffs on Canada, Mexico, and China. In response, each country swiftly announced retaliatory tariffs, raising concerns that we may be entering a classic trade war. While it is still early in this process, we will continue to track developments and assess their potential impact.

One key question is whether these tariffs will be inflationary—a topic with widely differing opinions. One of our favorite economist, Brian Westbury of First Trust, offers an insightful perspective:

“How tariffs will affect inflation, however, is often misunderstood. Yes, tariffs will put upward pressure on prices for any items being tariffed. But ultimately, inflation is a monetary phenomenon, and as long as the new tariffs are not accompanied by looser monetary policy—and it doesn’t look like they will be—then higher prices for those products mean consumers have less money to spend on other goods and services, putting offsetting downward pressure elsewhere.”

This ties back to the previous discussion on the Federal Reserve’s decision to scale back expected rate cuts—fewer cuts mean a tighter monetary policy, which helps keep inflation in check. Ideally, the tariffs will not contribute to rising inflation, but this remains an area to watch closely in the months ahead.

January saw a dramatic resurgence in market volatility, with a notable event shaking investor confidence. On January 27th, news broke about a new Artificial Intelligence model called Deepseek, sending a clear chill through the U.S. stock market. The reaction was swift, with additional losses in the days that followed.

One of the hardest-hit stocks was Nvidia (NVDA), a Wall Street favorite, as concerns mounted over potential competition in the AI space. However, the market ultimately recovered from this short-term disruption, finishing the month with strong gains.

Looking ahead, the key question remains: Was this an isolated event, or is it the start of a larger trend? The emergence of new AI competitors that can operate more efficiently and cost-effectively could pose challenges to industry leaders. We will continue to monitor this evolving landscape and its potential impact on the broader market.

We highlight this event primarily to illustrate how even a small dose of uncertainty can rattle markets, especially in an environment where valuations are elevated. As we move through 2025 and beyond, we anticipate more events like this, as technological advancements inherently lead to faster, more efficient, and lower-cost innovations.

The long-term impact on companies like Nvidia remains uncertain, but one thing seems clear: the relatively smooth market ride of 2024 is unlikely to continue. Increased volatility appears inevitable as markets adjust to new challenges and shifting economic conditions.

That said, the stock market’s ability to quickly rebound from disruptions over the past few years has been remarkable. While this resilience won’t last forever, for now, FOMO (fear of missing out) continues to dominate investor sentiment, with market dips being swiftly bought up.

Legendary Investor Howard Marks perhaps said it best. “A mistake that people often make is they compare themselves with others who are making more money than they are and conclude that they should emulate the others’ actions…after they’ve worked. This is the herd behavior that so often gets them into trouble.”

Rockport News

Tax Forms

Tax Forms for most IRA accounts were sent out by the end of January. Some tax forms for non-IRA accounts (individual, joint and trust for example) will largely be available and sent out by the middle of February. If you are unsure if you have all your tax forms, please contact our office.

Axos Change

For those of you that have brokerage accounts at AXOS, we will be terminating our relationship with them by year end. We will be in contact with you mid-year to arrange for a transfer of accounts to our other clearing firm Charles Schwab. This is not a decision we took lightly. However, in the current regulatory environment RIA (Registered Investment Advisory) firms such as ours are heavily encouraged to operate with one custodian to keep the same playing field for all clients.

Salute to Service Golf Outing

Save The Date: August 11th, 2025

It’s never to early to be thinking about summer fun! The event will be at the beautiful Red Tail Golf Club in Avon, Ohio again this year. We look forward to a WARM fun filled day of golf, food and drink as we raise money for some worthy Veterans.

As always, if you have any questions on anything we have talked about here or anything else that is on your mind, please feel free to reach out.

*Treasury yields can be found at finance.yahoo.com.

*Charts produced at yCharts.com

*The LEI can be found at Conference-board.org

*Bonds can be found at https://www.bloomberg.com/markets/rates-bonds

*CME FedWatch Tool – CME Group

*University of Michigan Consumer Confidence found at SentimentTrader.com

*FRED Charts produced by Federal Reserve Bank St. Louis

*PMI Manufacturing and Services Indexes, and Consumer Confidence and Future Expectations at Conference-board.org

*Buffett Indicator produced at currentmarketvaluation.com

*Distribution of S&P 500 Returns found at Macrotrends.net

*S&P 500 forward P/E ratios can be found atBusinessinsider.com

*The Asset Managers Positioning Chart found at The Daily Shot

* Rockport Models – Please remember we are referencing our model portfolios, and your portfolio may differ from the models mentioned depending on your individual needs and circumstances.