We hope you enjoyed the 4th of July weekend!

Markets & Economy

Market Recap: A Strong June Despite Global Headlines

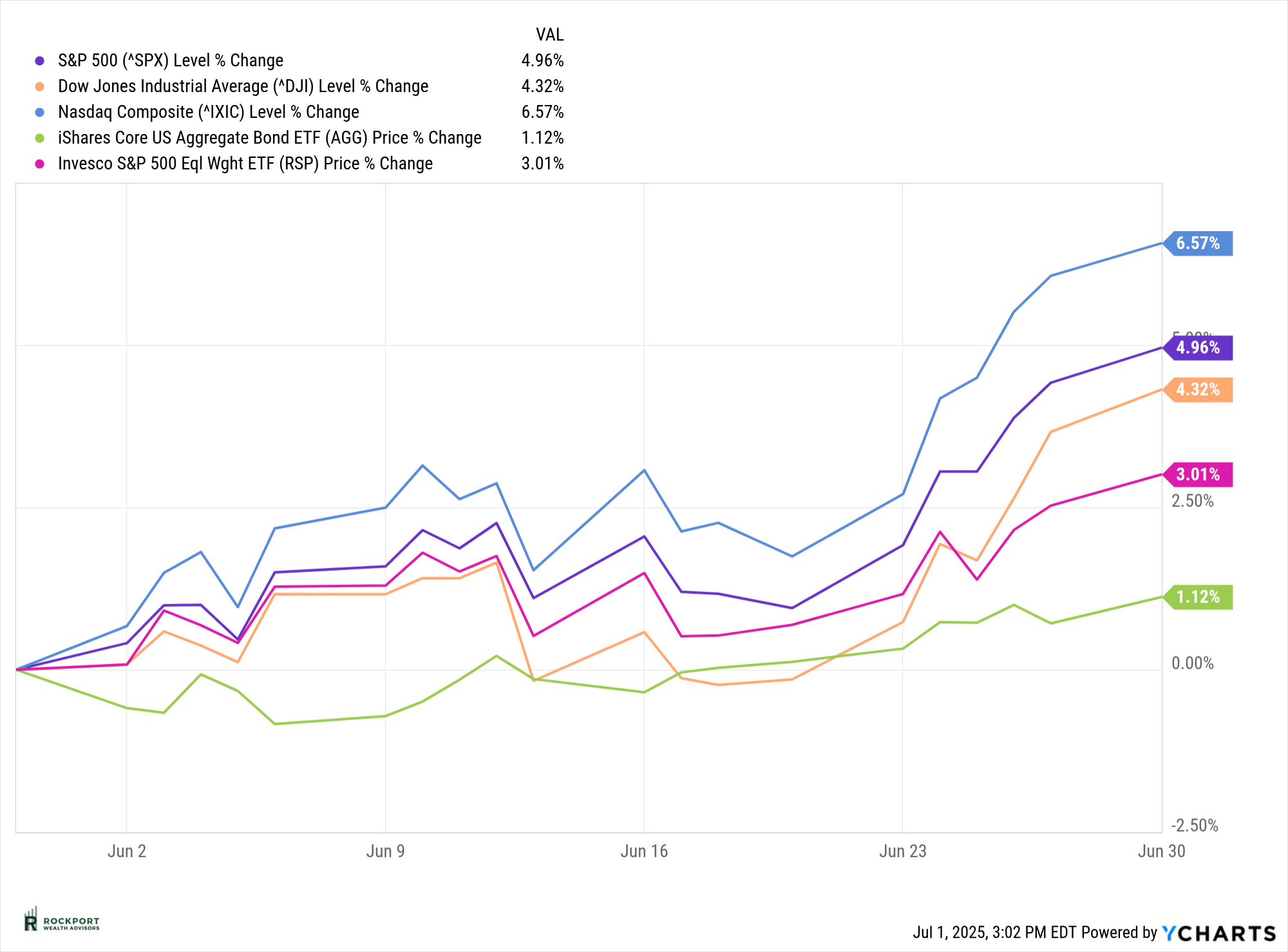

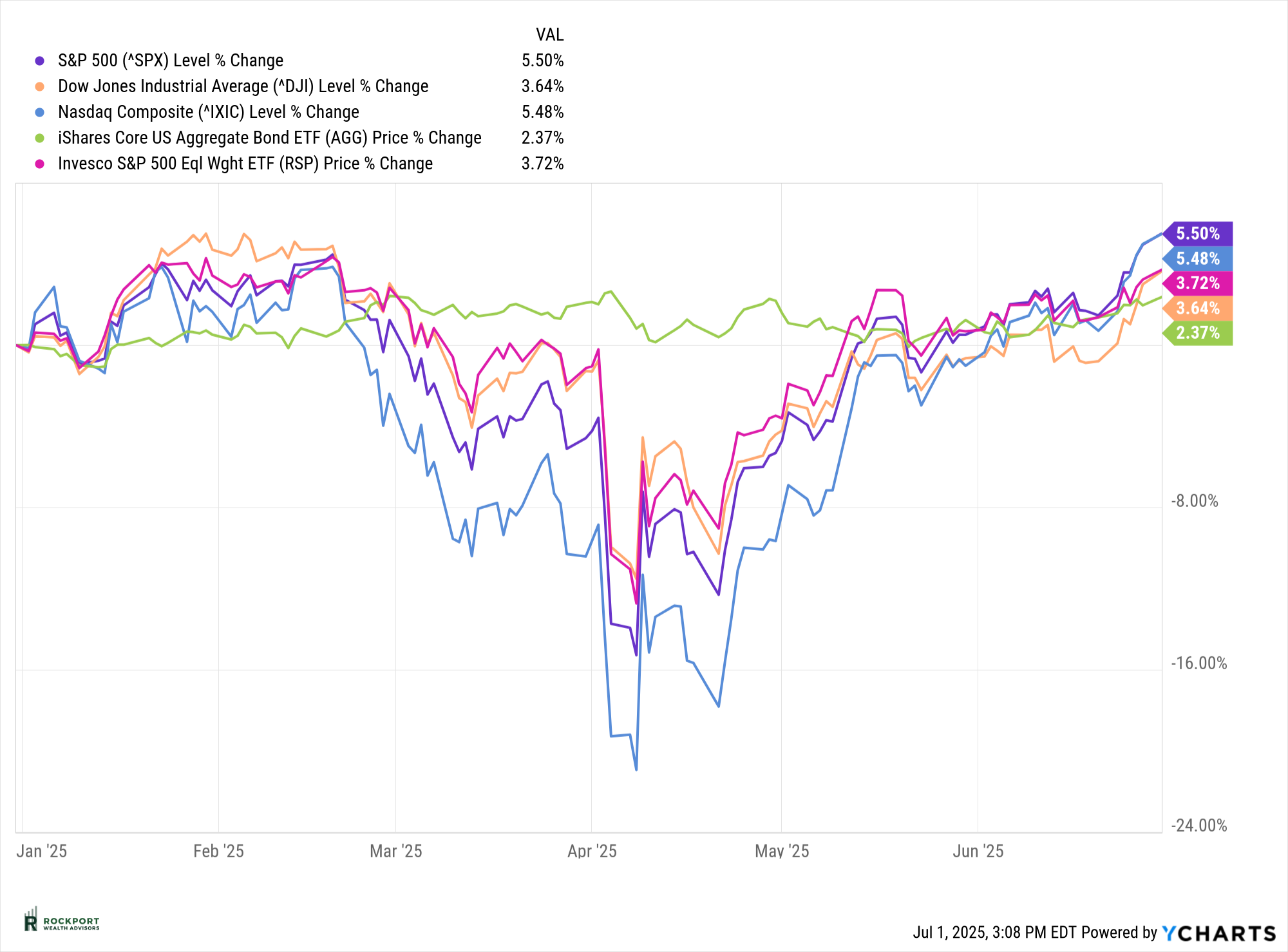

Despite ongoing concerns around tariffs and geopolitical tensions, the stock market delivered a surprisingly strong performance in June. The S&P 500 posted an impressive gain of 4.96% for the month, bringing its year-to-date return to 5.5%– a remarkable rebound from the market lows experienced in early April.

Other major indexes also saw solid gains, with the NASDAQ leading the way. It climbed 6.57% in June, which not only marked a standout month but also pushed the index into positive territory for the year, now up 5.48%. These results highlight the resilience of the market in the face of continued uncertainty.

Valuations Revisit Elevated Levels

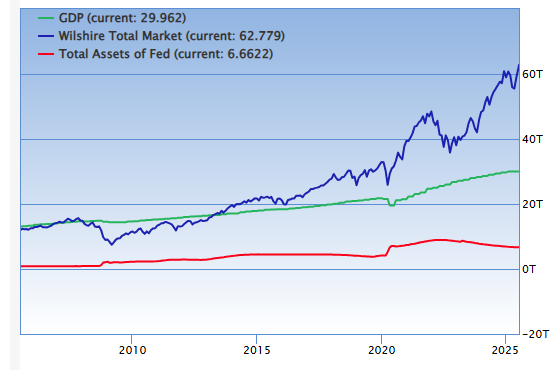

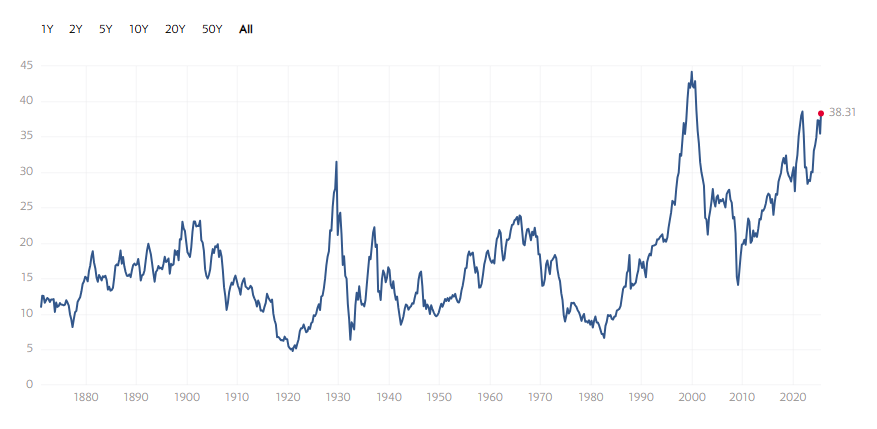

Interestingly, the strong market gains over the past couple of months have brought us back to a familiar place– high valuations and increased market concentration, similar to what we experienced last year. Two key measures we’ve referenced before highlight this trend: as indicated in the charts below, the Buffett Indicator has once again reached all-time highs, and the Shiller P/E ratio is nearing record levels, excluding the extremes of the 2000 tech bubble.

While elevated valuations aren’t reliable predictors of market tops, they do tend to signal that future returns may be more modest. Historically, such levels suggest a period of more tempered growth in the months or quarters ahead.

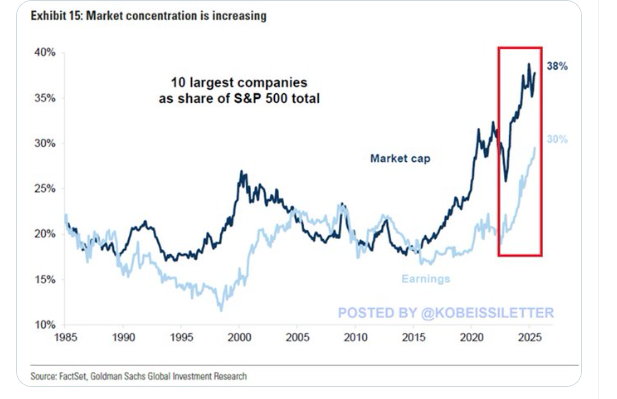

Market Concentration Reaches Elevated Levels

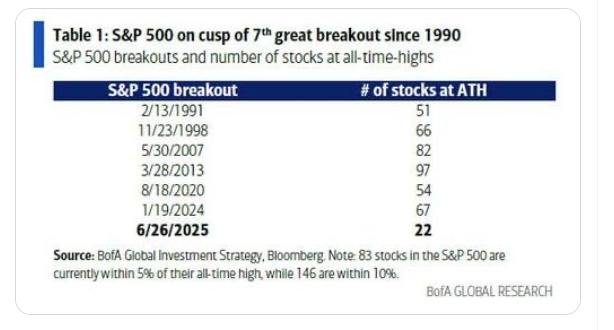

In addition to high valuations, the market has once again become highly concentrated– much like we saw in late January and throughout much of last year. The 10 largest companies in the S&P 500 now account for nearly 38% of the index’s total market capitalization and approximately 30% of its earnings. This level of concentration is even higher than what we saw at the peak of the market in 2000, as illustrated in the chart below.

What’s also notable is that, despite the index trading near all-time highs, the number of individual stocks reaching new highs remains unusually low. While this divergence doesn’t necessarily indicate an imminent market top, it does highlight a structural imbalance in the S&P 500. With so much weight concentrated in a handful of names, this could introduce challenges for the broader market over time.

Quick Updates: Inflation, Growth, and Interest Rates

The 2-year Treasury yield declined slightly in June, giving the Federal Reserve a bit more flexibility as it weighs potential interest rate cuts. There is growing speculation that the Fed could begin cutting rates as early as its July meeting. While we view a July cut as unlikely, it’s not off the table. Our base case remains that the first rate cut will likely come in September.

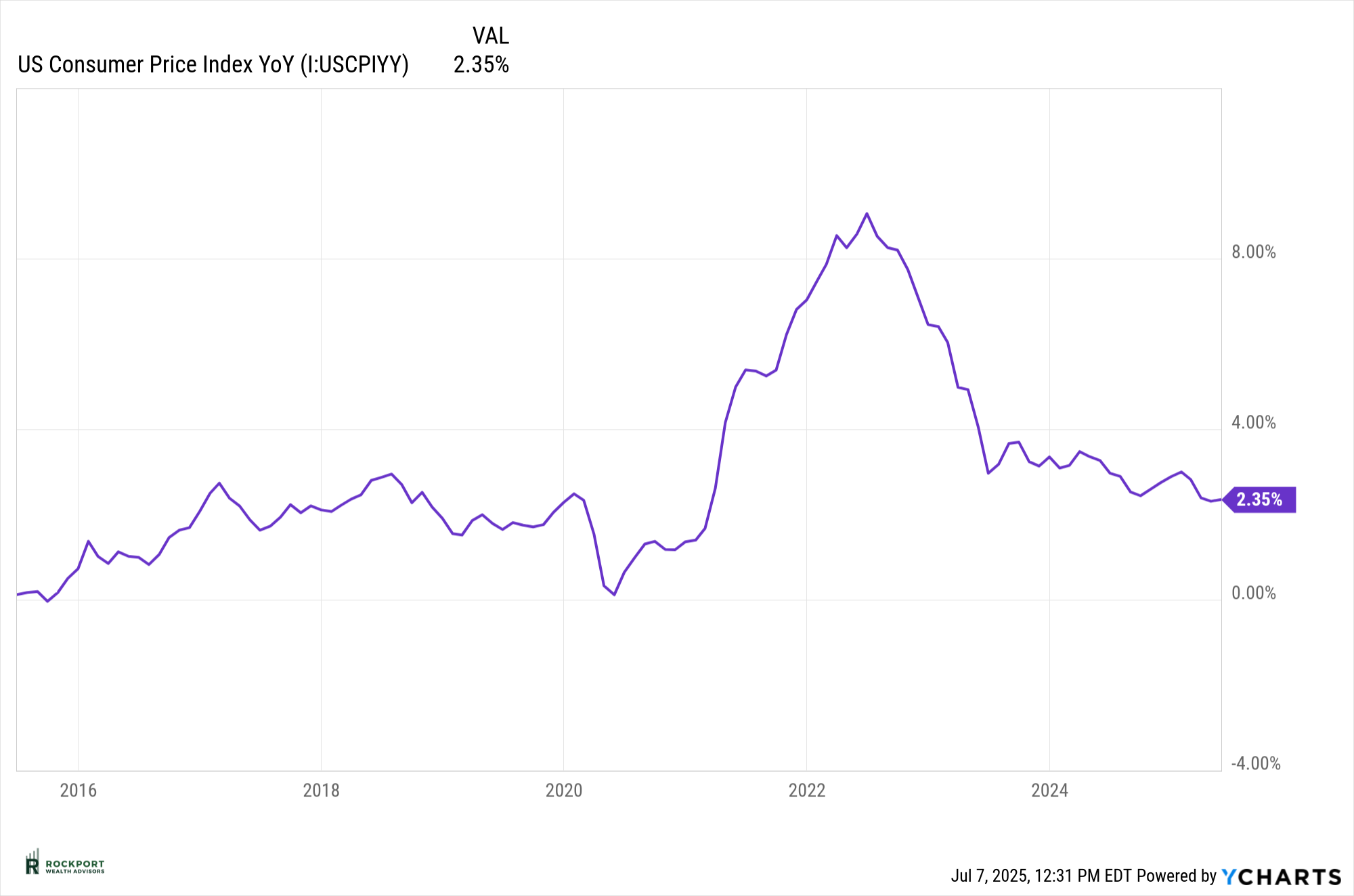

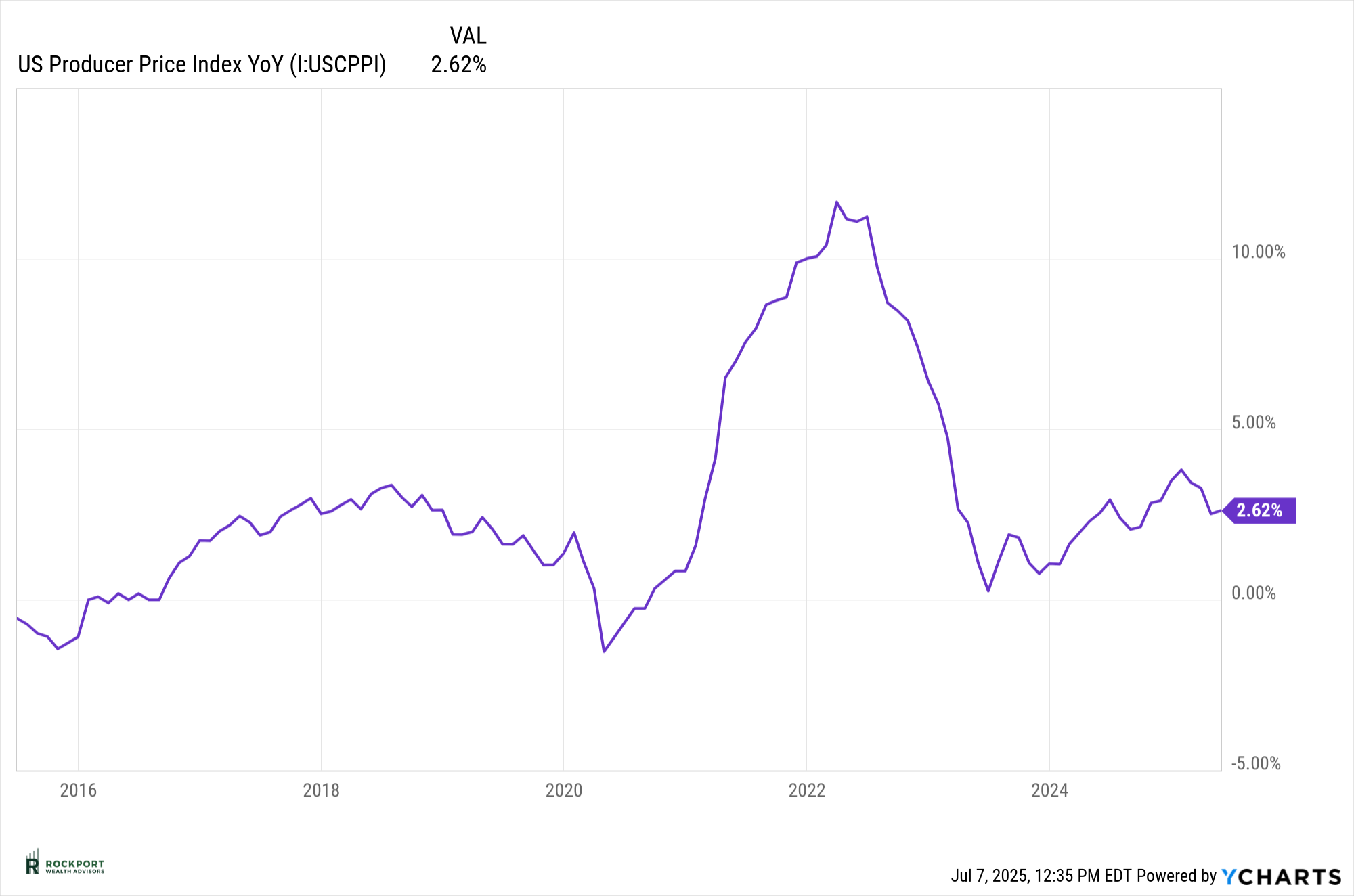

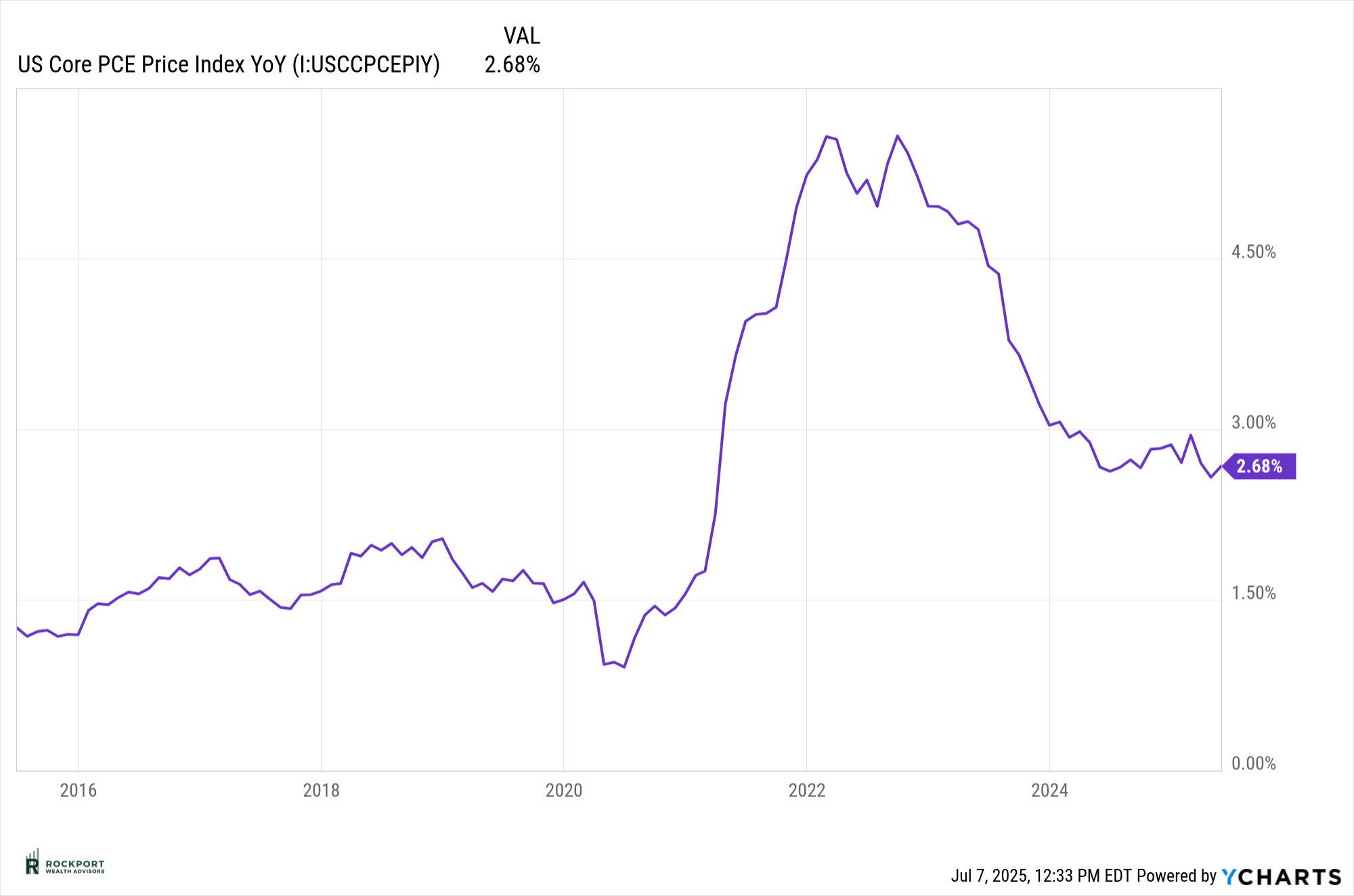

On the inflation front, as expected, all major measures ticked higher in June. We had noted that the recent stretch of steadily declining inflation was likely to pause– and that has indeed materialized. The key question now is whether this marks the start of a new upward trend or is simply a temporary bump.

We continue to expect inflation to rise moderately over the second half of the year, though not to levels that would raise significant concern. However, the reintroduction or expansion of tariffs by several countries could add upward pressure to prices and make the Fed’s job more complicated.

Looking Ahead: Key Questions for the Second Half of 2025

There’s still much to be determined as we move into the second half of the year. Will inflation continue to trend higher, or was June an outlier? Will the Federal Reserve begin cutting interest rates– and if so, by how much and when? And what will the upcoming GDP report at the end of July reveal: accelerating growth, a slowdown, or even contraction?

As always, we remain focused on the long term. Our approach continues to be forward-looking, grounded in data and disciplined strategy– not driven by emotion or political noise, which can lead to short-sighted decision-making. We’ll stay vigilant and ready to adjust as conditions evolve, while keeping your financial goals at the center of every decision.

Naming Trusts as Beneficiaries

We are often asked about naming Trusts as beneficiaries on IRA accounts. Generally speaking we do not subscribe to this being a good theory mostly due to tax reasons. However, there are situations where naming a Trust as beneficiary may makes sense. These are outlined below in an article from Sarah Brenner at Ed Slott and Company.

When You Should Name a Trust as IRA Beneficiary

Published June 11, 2025

By Sarah Brenner, JD

Director of Retirement Education

Here at the Slott Report we hear many stories about trusts being named as IRA beneficiaries and the problems that follow. Often, there seems to be no purpose for naming the trust and it brings unnecessary complications. Trusts won’t help with income taxes. In fact, they can increase the tax hit because IRA funds may be subject to high trust tax rates.

Naming a trust is not something that should be done without a clear purpose. Here are six good reasons to name a trust as an IRA beneficiary:

- Minor Beneficiaries. When there are minor children involved, naming a trust can be a good plan. Having a minor be named directly on a beneficiary form is a recipe for disaster because a minor cannot legally conduct business on the account. It may be possible in some cases to name a Uniform Trust for Minors (UTMA) or Uniform Gift to Minors (UGMA) account as an IRA beneficiary, but not all custodians allow this. Also, these accounts don’t offer the ability to control funds after the minor reaches the age of majority the way a trust can. Especially with larger IRAs, when minors are involved, naming a trust as the beneficiary may be necessary.

- Special Need Beneficiaries. For special needs beneficiaries, a trust is essential to manage money and to protect government benefits when IRA funds are inherited. A special needs trust drafted to comply with the SECURE and SECURE 2.0 rules can still use the stretch instead of the 10-year rule, allowing payments to be paid out over the life expectancy of the special needs beneficiary.

- Substance Abuse Issues. No IRA owner would want to see their life’s savings support a beneficiary’s drug problem or gambling addiction. By naming a trust as beneficiary, instead of naming a beneficiary with substance abuse issues directly on the account, controls can be put in place to ensure this does not happen.

- Vulnerable Beneficiaries. There is no shortage of con artists and scammers looking to take advantage of vulnerable or naïve beneficiaries with large inheritances. To protect these individuals, naming a trust as the IRA beneficiary can be extremely useful for limiting access and warding off those with malicious intent.

- Divorce Concerns. While most people love their children and grandchildren, they may not feel as warmly towards the people their offspring marry. There may be concerns about money ending up in the wrong hand if marriages go south and there is divorce. A trust named as an IRA beneficiary can alleviate these concerns.

- Creditor Protection. Inherited IRAs are not protected under federal law either in bankruptcy or from other creditors. There is some protection under state laws, but this can vary. A trust can help shield IRA funds from the beneficiary’s creditors.

Rockport News

AXOS Update

As stated in previous newsletters, we will be terminating our relationship with AXOS Clearing and moving all accounts to our other custodian Charles Schwab. We anticipate beginning this project in August and will be reaching out to all clients. If you have any questions in the meantime, please feel free to contact us.

Salute to Service Golf Outing

Our 5th Annual Salute to Service Golf outing is taking place August 11, 2025 at Red Tail Golf Club in Avon.

Rockport Wealth Advisors honors the service and sacrifice of America’s veterans by providing free financial education and tools to those who serve. We team up with established veteran support nonprofits such as the National Veterans Memorial and Museum and GallantFew that share the same vision to ensure military heroes excel once they return home. The Salute to Service Golf Outing is an extension of our philanthropic efforts for veterans.

Since 2021 the Salute to Service Golf Outing has raised more than $65,000 for our military veterans! If you are a golfer and want to join this year’s fun, use the link below to learn more and register. Donations are also greatly appreciated and can be made through the link. All are welcome!

Salute to Service Golf Registration

As always, if you have any questions on anything we have talked about here or anything else that is on your mind, please feel free to reach out.

*Treasury yields can be found at finance.yahoo.com.

*Charts produced at yCharts.com

*The LEI can be found at Conference-board.org

*Bonds can be found at https://www.bloomberg.com/markets/rates-bonds

*CME FedWatch Tool – CME Group

*University of Michigan Consumer Confidence found at SentimentTrader.com

*FRED Charts produced by Federal Reserve Bank St. Louis

*PMI Manufacturing and Services Indexes, and Consumer Confidence and Future Expectations at Conference-board.org

*Buffett Indicator produced at currentmarketvaluation.com

*Shiller PE produced by www.gurufocus.com

*Distribution of S&P 500 Returns found at Macrotrends.net

*S&P 500 forward P/E ratios can be found atBusinessinsider.com

*The Asset Managers Positioning Chart found at The Daily Shot

* Rockport Models – Please remember we are referencing our model portfolios, and your portfolio may differ from the models mentioned depending on your individual needs and circumstances.