Rockport Market Update – August 2025

Key Takeaways

-

GDP bounces back from negative print at the end of Q1

-

Fed does not cut rates in July; September cuts likely

-

Jobs market is showing signs of weakness, with significant downward revisions to the May and June employment figures

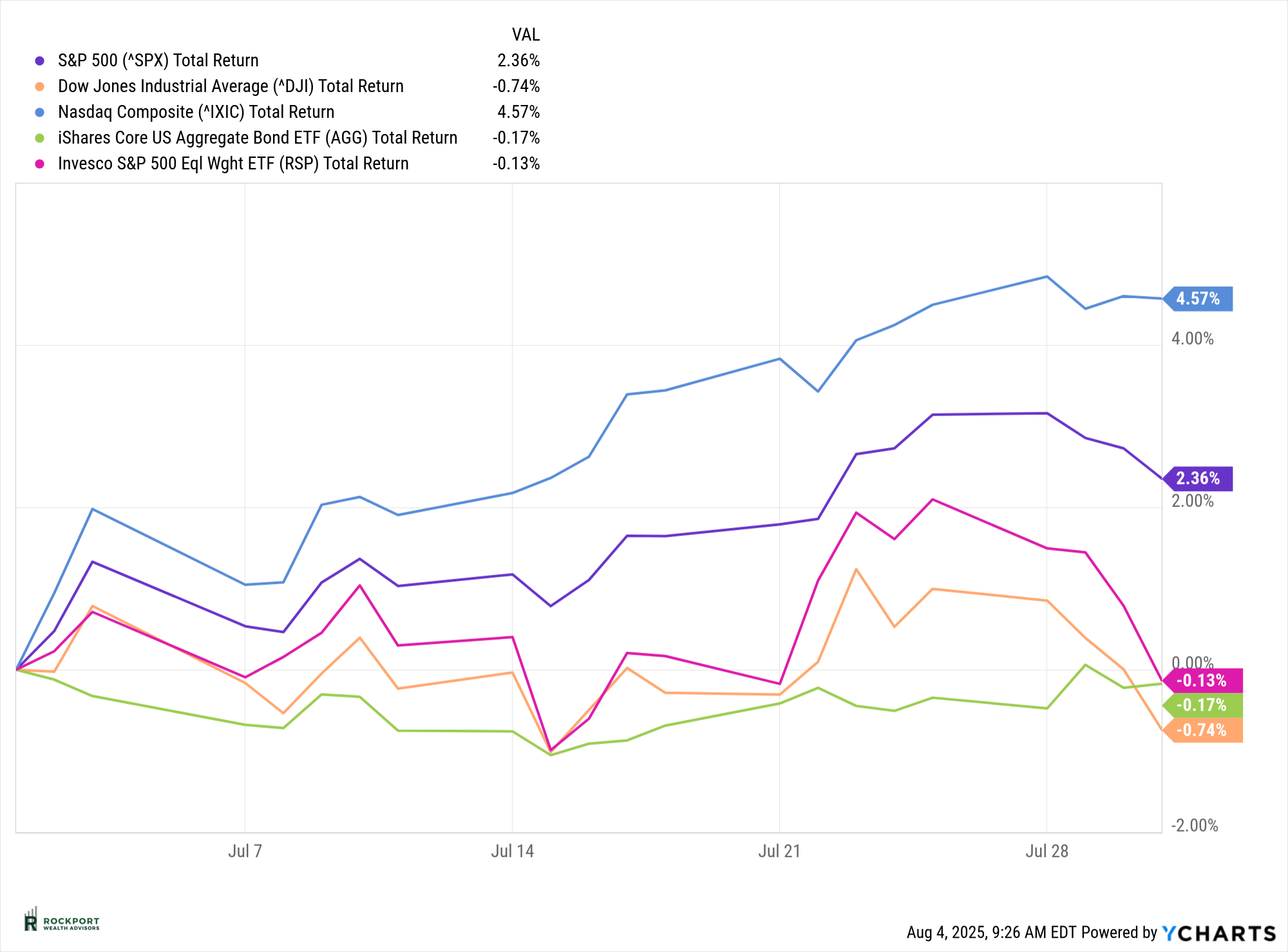

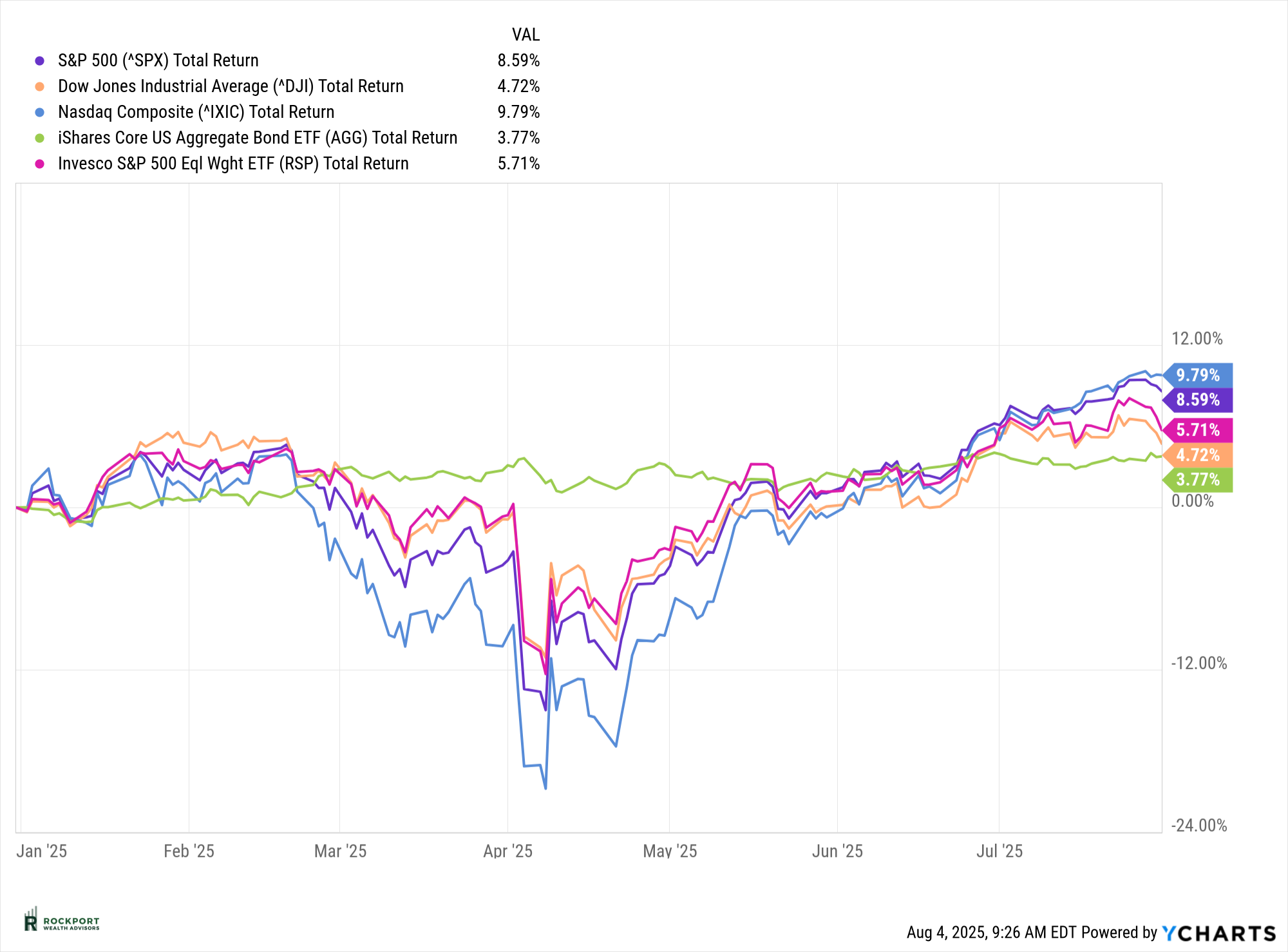

Market Review – July 2025

The stock market delivered another strong performance in July. The S&P 500, including dividends, gained 2.36% for the month, bringing its total return for the year to 8.59%.

Once again, the NASDAQ led the way with an impressive 4.57% return in July, as large-cap tech companies continued to rebound from the pullback seen in March and April.

However, not all segments of the market shared in the gains. The S&P 500 Equal Weight Index slipped slightly by 0.13% for the month. This continues the recent trend of the largest companies driving the majority of the returns in the traditional, market-cap-weighted S&P 500 index.

Despite ongoing headlines around tariffs– still one of the most talked-about topics in 2025– the market has remained resilient. While the full economic impact of these policies may take time to materialize, investor sentiment appears largely unfazed for now.

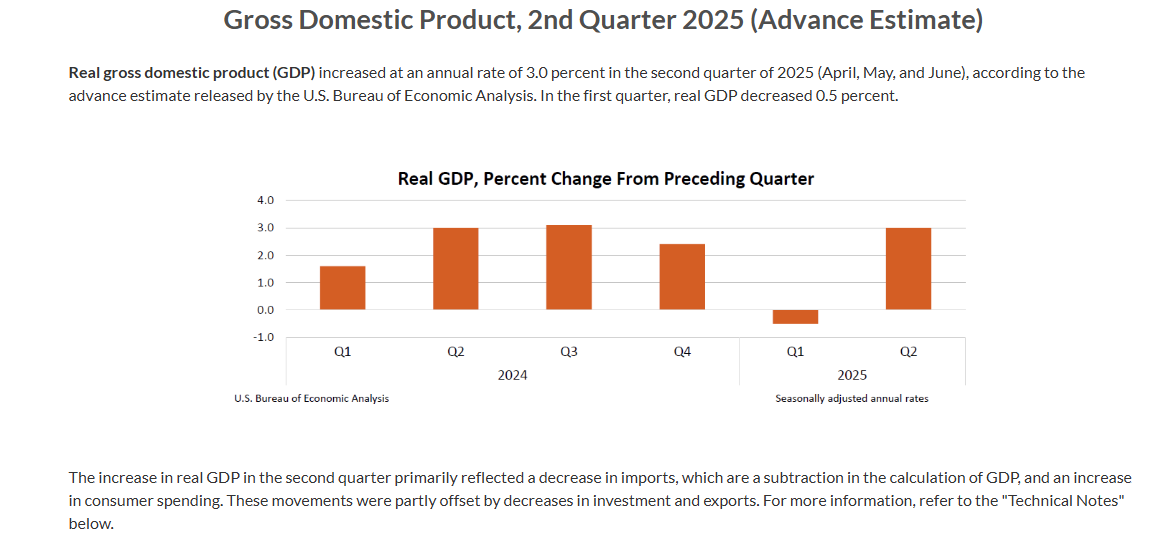

GDP Confirms Continued Growth

Gross Domestic Product (GDP) grew at an annualized rate of 3.0% in the second quarter, a solid indicator that the economy remains on stable footing. We’ve been closely watching this report, especially following the negative reading in the first quarter, as it helps confirm that the U.S. has avoided a technical recession.

We will continue to monitor GDP data each quarter and keep you updated as new reports are released.

Source: Bureau of Economic Analysis

Federal Reserve Update

As expected, the Federal Reserve held interest rates steady in July. With no FOMC (Federal Open Market Committee) meeting scheduled in August, the next opportunity for a rate decision will come in September.

Currently, markets are pricing in a 92% probability of a rate cut at that meeting. However, it’s important to remember that these projections can shift quickly as new data emerges. For now, we’ll continue to focus on the current economic landscape and adjust as needed once concrete information becomes available.

Employment Trends Worth Watching

Getting a clear picture of the current job market has become more challenging. Recent revisions to the May and June employment reports revealed that significantly fewer jobs were created than initially reported. These downward revisions are noteworthy.

Historically, declines in employment often precede broader economic slowdowns and can influence the Federal Reserve’s decisions on interest rates. For this reason, upcoming job reports will be especially important to watch. A weakening labor market typically increases the likelihood of the Fed moving toward rate cuts.

To help illustrate the scale of the recent changes, we’ve included an excerpt below from the Bureau of Labor Statistics highlighting the revisions.

Direct from the BLS:

Revisions for May and June were larger than normal. The change in total nonfarm payroll employment for May was revised down by 125,000, from +144,000 to +19,000 and the change for June was revised down by 133,000, from +147,000 to +14,000. With these revisions, employment in May and June combined is 258,000 lower than previously reported.

Overall, the markets are not in a bad place right now as inflation is still fairly tame and economic growth is good but not great. Seasonality is in play for the next two months as August and September historically have been two of the lower performing months. This has played out in the last several years as we have experienced modest declines. It would not shock us to see some type of pullback once again but these things are nearly impossible to predict.

Information as of 8.12.25

Securities offered by Registered Representatives through Private Client Services, Member FINRA/SIPC. Advisory products and services offered by Investment Advisory Representatives through Rockport Wealth LLC, a Registered Investment Advisor. Private Client Services and Rockport Wealth LLC are unaffiliated entities. The opinions contained herein are that of the authors not necessarily that of Private Client Services LLC and there should not be any guarantees assumed from the information presented.

Investments in securities do not offer a fixed rate of return. Principal yield and/or share price will fluctuate with changes in market conditions, and when sold or rendered, you may receive more or less than originally invested. No system of financial planning strategy can guarantee future results. Investors cannot directly invest in indices. Past performance does not guarantee future results. The performance numbers we mention are indexes. If you’re a client, we manage a custom portfolio for your particular situation and the performance will be different.

*Charts produced at yCharts.com

*GDP Estimate – Bureau of Economic Analysis

*CME FedWatch Tool – CME Group

* Rockport Models – Please remember we are referencing our model portfolios, and your portfolio may differ from the models mentioned depending on your individual needs and circumstances.

Rockport Wealth Advisors and J Arnold Wealth Management are DBAs of Rockport Wealth, LLC, a fee-based Registered Investment Adviser (RIA) registered with the Securities and Exchange Commission and offering a full range of professional services. The scope of any financial planning and/or consulting services to be provided depends upon the needs of the client and the terms of the engagement. Please see our CRS & ADV disclosure documents for more information about our business.