Markets & Economy

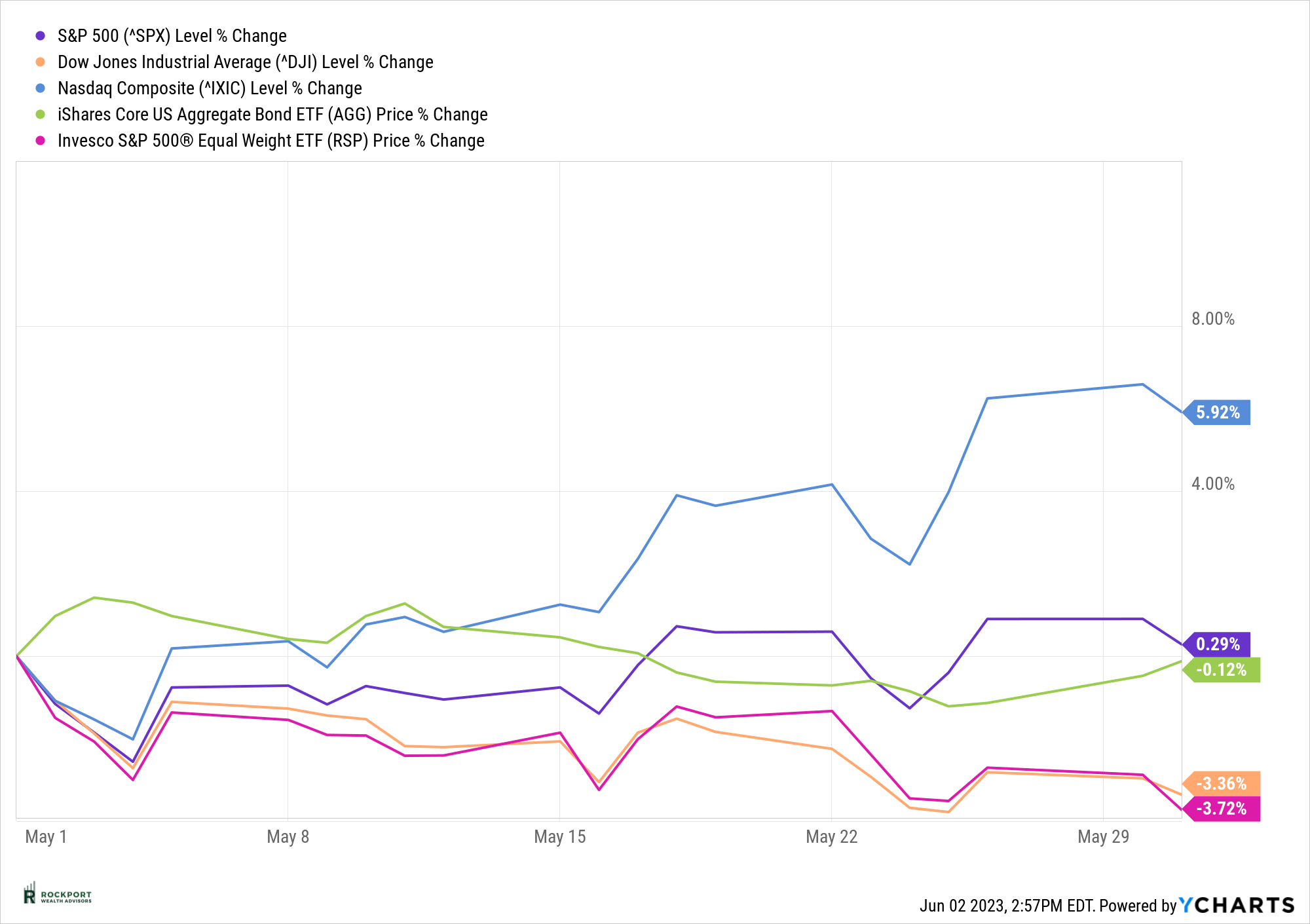

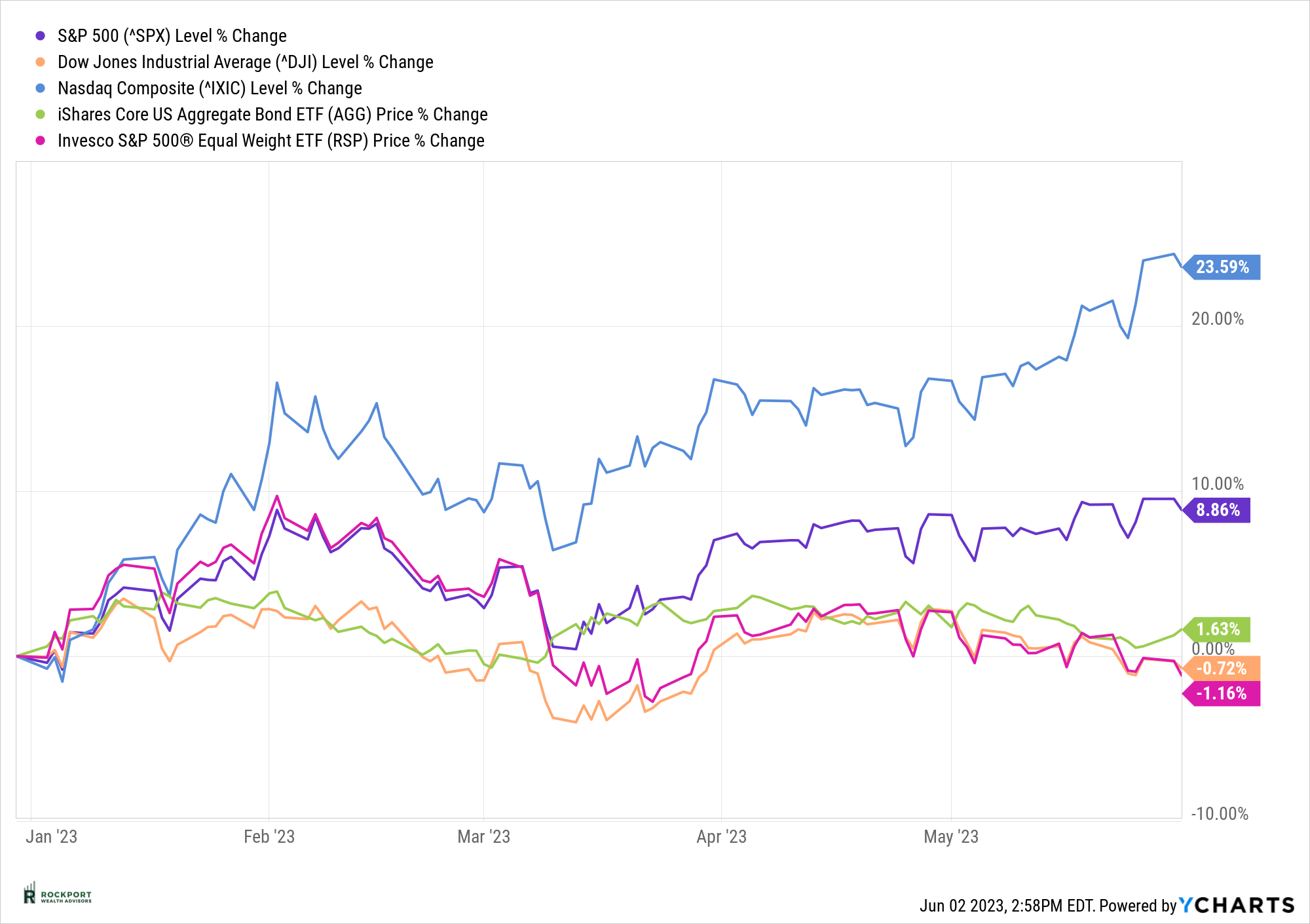

If we really wanted to be lazy, we could almost do a cut and paste from last month’s newsletter as things have not changed very much at all. 😊 For the month of May, the S&P 500 index increased a mere 0.29% which leaves the index up 8.86% YTD. The markets remain very lopsided and are really about a market of a few stocks vs a more broad stock market picture. For example, the Dow Jones Industrial Average is slightly negative for the year while the NASDAQ Composite is up over 23%. The difference? The weighting of 7-10 stocks in the NASDAQ and S&P 500 that have accounted for most of the gains is far more than it is in The Dow Jones. In addition, the Dow Jones does not even contain some of these stocks. As we stated last month, this is not a healthy market environment, and the situation will resolve itself in one of two ways either those 7-10 stocks will give up a majority of their gains or the rest of the stocks in the indexes will play catch up. The latter would be preferable but is not happening yet. We will just need to observe how things play out over the summer months. One thing is for sure, the Herd mentality of piling into a small handful of names, largely based on AI (Artificial Intelligence) optimism has really given a false impression of how the stock market is really doing. “The market is up” is somewhat of a misleading phrase at the moment. (See Charts Below) To help illustrate the above point, we have added a new security to the market returns charts and that is the symbol RSP. This is the S&P 500 equal weight index. In other words, not weighting individual stocks so that one can have a greater influence on the index but instead having each with an identical weight. This is just another measure of market breadth and as you can see the return has been drastically different (less) than the standard weighted S&P 500 index.

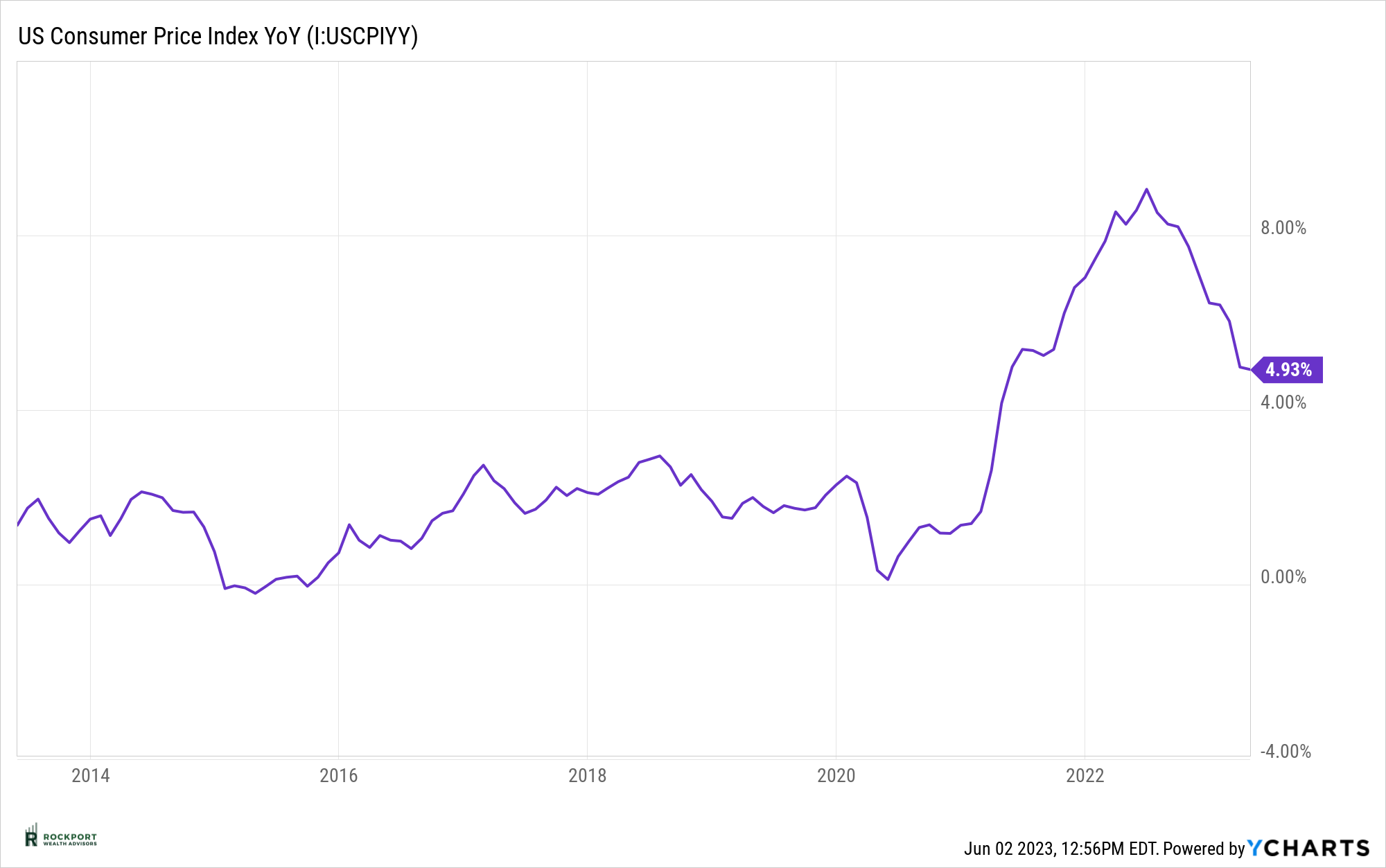

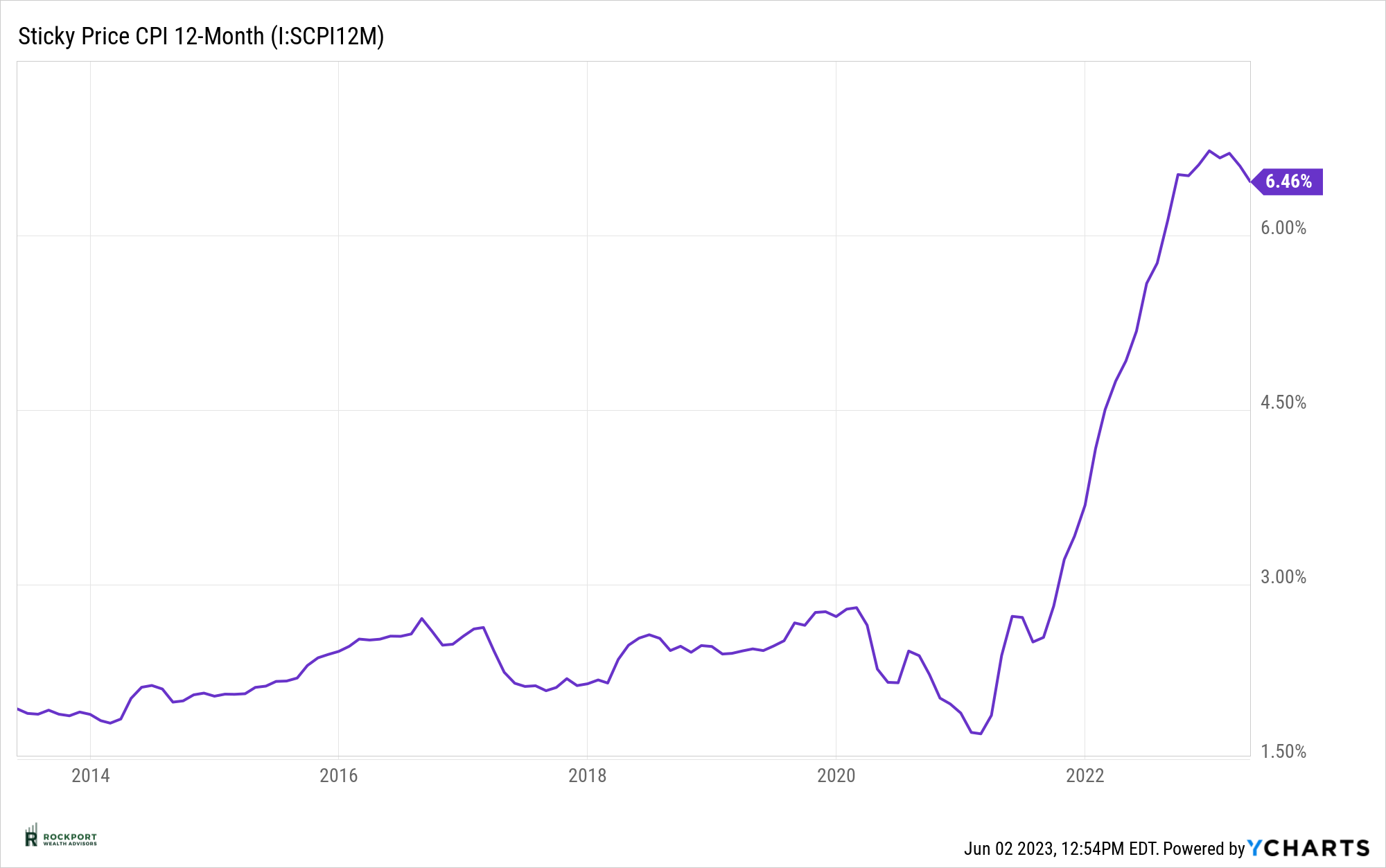

Just a quick review of our favorite hot topics, some of which we have mentioned for months and months. The CPI (Consumer Price Index) continues its slow decline falling 4.93%. This is good but still far away from the Feds target of 2%. Sticky CPI has still barely moved but has nudged slightly lower to 6.46%. As a reminder, this index includes items like housing, medical expenses, and autos all of which tend to move much slower. (See Charts Below)

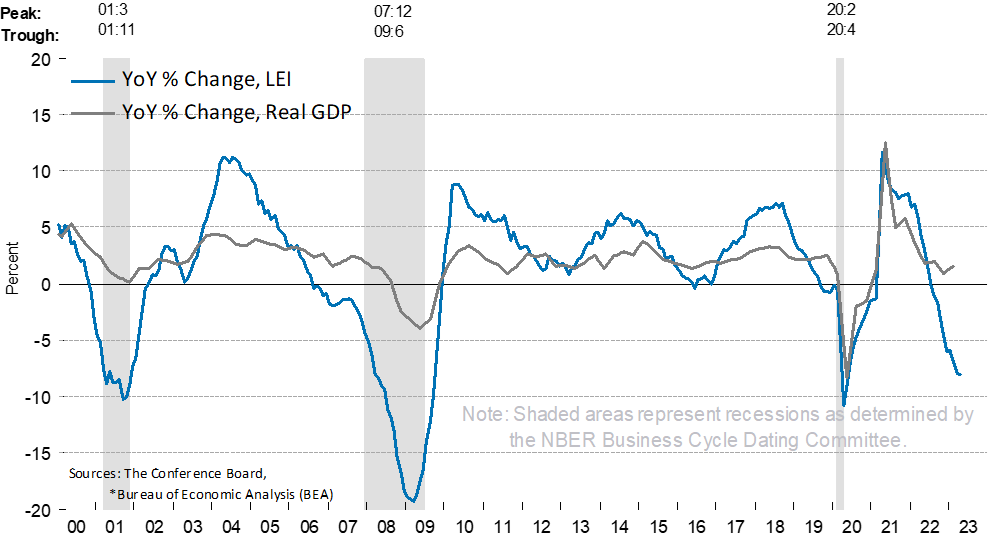

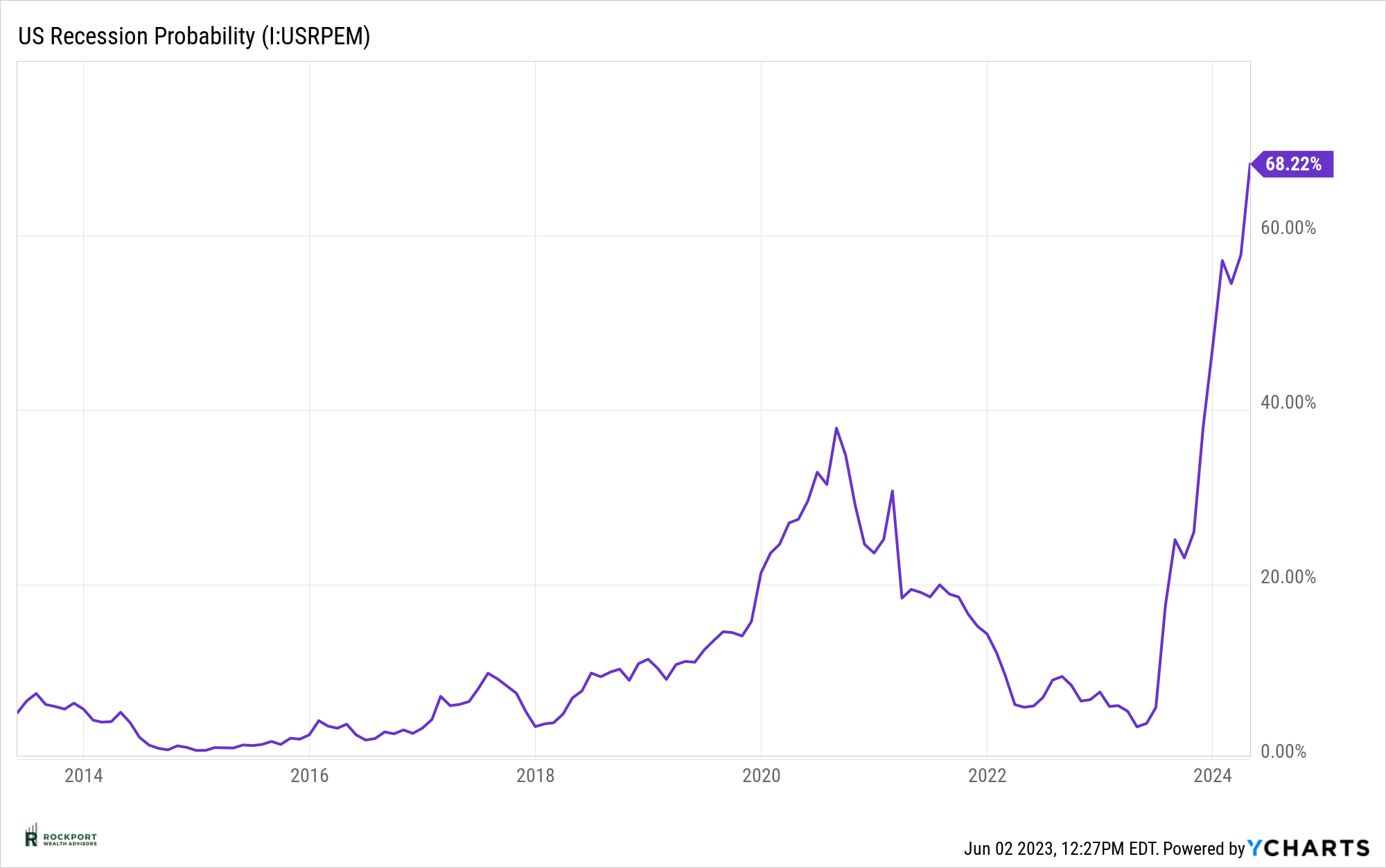

Both of the above seem to signal that the Fed is not done raising interest rates yet although we would not be surprised to see a pause in the raises at some point in the near future. The New York Feds Recession Probability model has increased to 68.22%. This is the highest number recorded for this indicator since the 1980’s. Lastly the LEI (Leading Economic Index) has made consistent new lows since early 2022. It would be extraordinarily rare for this indicator to be down as much as it has been for the past 18 months and us not have or already be in a recession. (See Charts Below)

Rockport Models

There were no changes to the Rockport Model Portfolios during the month of May.

Industry Topics

529 Plan Conversions

Did you know that unused 529 plan funds can be converted to a Roth IRA for the beneficiary/student. Most people know that 529 plan funds can be withdrawn tax free when used for qualified tuition and college expenses. What happens if college funds are still left in the account post-graduation? Of course, they can be used for Graduate school expenses but thanks to Secure Act 2.0 if that is not an option, those remaining funds can now be converted to a Roth IRA without triggering any penalties. Several conditions must be met to achieve this. If you have questions or would like to find out more, please let us know.

Rockport News

We are growing!

Welcome to our newest employee Meaghan Grant whose first day will be June 12th. Meaghan just graduated from Centre College in Danville Kentucky with a degree in Economics and Finance. She is an accomplished golfer, playing all four years for her alma mater which competed in the NCAA Division III Championships for three consecutive years finishing 7th, 11th and 10th in the nation. Meaghan was captain of the team for three years. Her primary responsibility will be working with clients on the eMoney financial planning software. If you are currently enrolled in that system don’t be surprised if she contacts you in the future. Welcome Meaghan!

Mark your calendars!

Our 3rd Annual Salute to Service Golf Outing which benefits several Veteran Organizations is scheduled for Monday August 14th. Once again it will be held at Red Tail Golf Club in the Cleveland Area. Details on participating or donating can be found at Salutetoservicegolf.com. It would be great to see as many clients and friends of Rockport attend as possible.

As always, if you have any questions on anything we have talked about here or anything else that is on your mind, please feel free to reach out.

*The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. Results can be found at slickcharts.com.

*Treasury yields can be found at finance.yahoo.com.

*Charts produced at yCharts.com

*Bonds can be found at bloomberg.com/markets/rates-bonds

*Fed Rate Probability Chart can be found at cmegroup.com/markets/interest-rates/cme-fedwatch-too

*The LEI can be found at conference-board.org/topics/us-leading-indicators