Happy Father’s Day to all the dads out there! Enjoy the day. 😊

Markets & Economy

You may have heard the old market adage, “Sell in May and go away.” This saying reflects the historical trend that stock markets tend to underperform during the summer months—from May through October—compared to the typically stronger performance seen from November through April. While it’s not a hard-and-fast rule, and past performance never guarantees future results, the pattern has prompted some investors to adopt a more cautious approach during the summer season.

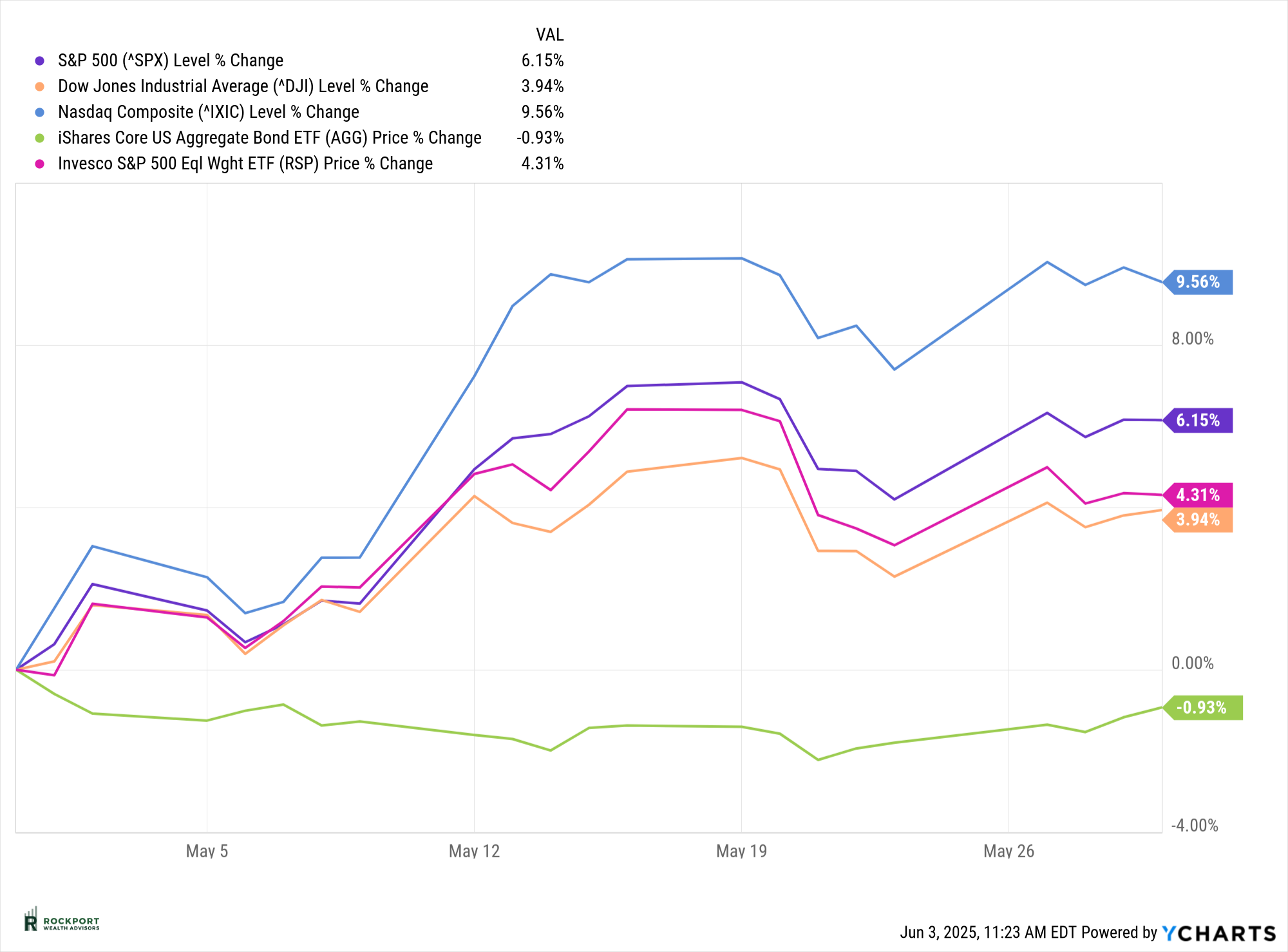

May Defies the “Sell in May” Narrative

Contrary to the old market adage, May was anything but a time to sell. Despite ongoing concerns around tariffs—a topic we’ll address in more detail shortly—the stock market delivered one of its strongest May performances since 1990. The S&P 500 rose by 6.15% during the month, pushing the index back into positive territory for the year with a modest gain of 0.51%. Other major indexes also posted solid gains, led by the NASDAQ, which surged more than 9% in May as technology stocks regained momentum. While the NASDAQ remains slightly negative year-to-date, down just -1.02%, its recent rally has significantly narrowed the gap.

As is often the case when equities perform strongly, bonds saw modest losses in May, reflecting the typical inverse relationship between risk-on equity rallies and fixed income performance.

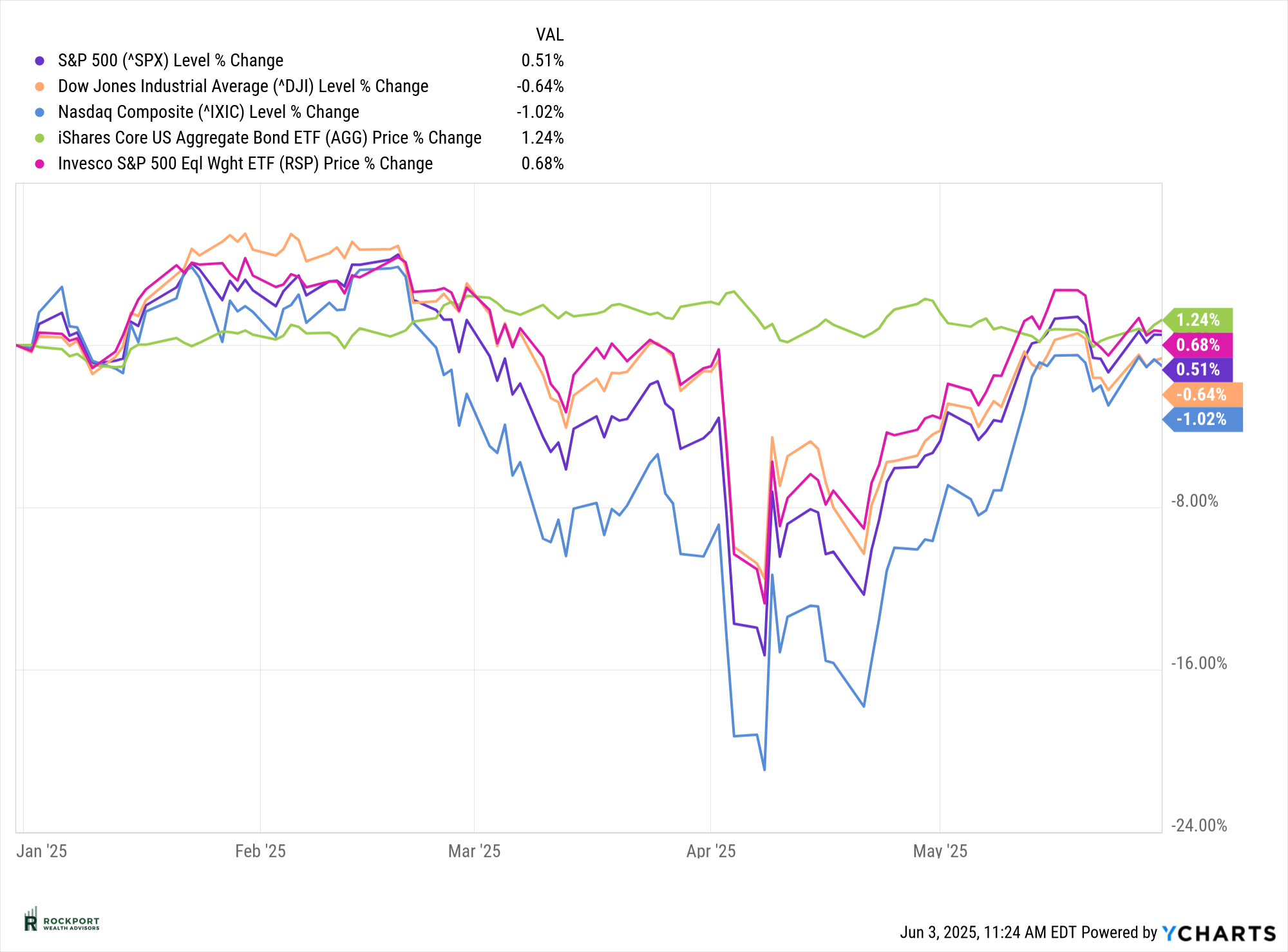

Markets Rebound Despite Headwinds

Stocks have staged a strong rebound from their early April lows, with most major indexes now back in positive territory—or close to it. This resilience has come in the face of several headwinds, including continued uncertainty around U.S. tariff policy, which seems to shift almost daily, and a credit rating downgrade by Moody’s. On May 16th, Moody’s lowered the U.S. credit rating from Aaa to Aa1, a notable change that briefly raised investor concerns.

To help provide context, we’ve included a timeline of key tariff-related announcements. As the timeline shows, the changing tone and content of these headlines have contributed to short-term market volatility, with equity prices often swinging between gains and losses depending on the day’s news.

- May 28: The Court of International Trade issued a permanent injunction against two sets of tariffs: those on Canadian, Chinese, and Mexican-origin goods, and the reciprocal tariffs.

- May 29: The Court of Appeals for the Federal Circuit issued an administrative stay on the injunction, meaning the tariffs remain in effect while the government appeals.

- May 23: The administration sought a pause on the second tariff case after a previous loss in court.

- May 14: China’s country-specific tariff rate was suspended, with imports from China subject to a 10% baseline reciprocal tariff rate.

- May 30: President Trump pledged to double steel tariffs to 50%.

- May 23: US officials pushed countries for their best trade negotiation offers by a deadline.

- April 5: A baseline 10% tariff on nearly all US imports went into effect.

- April 2: President Trump announced “reciprocal tariffs” on all countries not subject to other sanctions.

- March 12: Trump announced plans to increase steel and aluminum tariffs.

- February 13: Trump announced a plan for “reciprocal” tariffs, potentially raising tariffs to match those charged by other countries.

- February 1: Trump signed an executive order to impose tariffs on imports from China, Mexico, and Canada.

Looking Ahead: Tariffs and Market Volatility

While the timeline highlights only the major tariff announcements, there have been numerous sub-headlines in between that have added to the noise. Temporary pauses and reductions in tariffs have helped ease some of the tension, at least for now. However, with the first key deadline approaching in early July, it wouldn’t be surprising to see market volatility pick up again as investors react to unfolding developments.

In this environment, patience remains a critical ingredient for long-term success. Staying focused on your broader investment strategy—rather than the day-to-day headlines—continues to be the most effective approach.

What a Difference a Month Makes

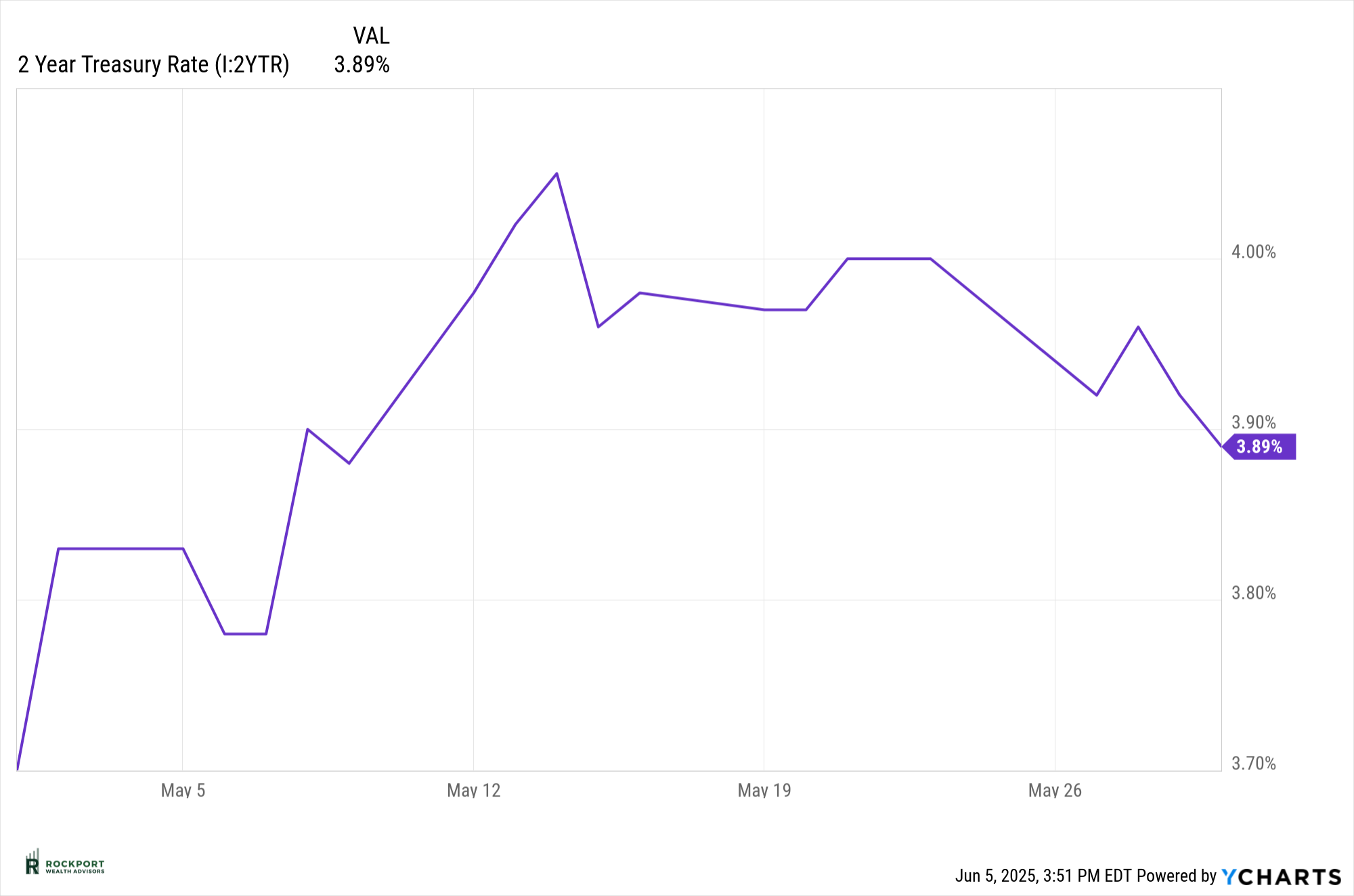

As equity markets moved higher in May, bond yields followed suit. In last month’s newsletter, we noted that the yield on the 2-year Treasury had dropped to 3.6%, creating room for the Federal Reserve to consider cutting interest rates, especially with the Fed funds rate range sitting at 4.25%–4.50%.

However, the story has quickly shifted. The 2-year yield has since climbed to 3.89% and even briefly crossed above 4% during the month. Current market expectations now suggest the Fed may only cut rates twice this year—likely in September and December.

Why does this matter? Historically, equities have tended to perform better during periods when the Fed is cutting rates rather than raising them. Rate cuts can act as a tailwind for the market, making this a key indicator to watch. Moreover, rising bond yields and a more patient Fed suggest continued economic resilience, which reduces the likelihood of a near-term recession.

That said, the outlook remains fluid. As new economic data continues to come in month by month, expectations around interest rates and market direction can shift quickly making it all the more important to stay focused on long-term fundamentals.

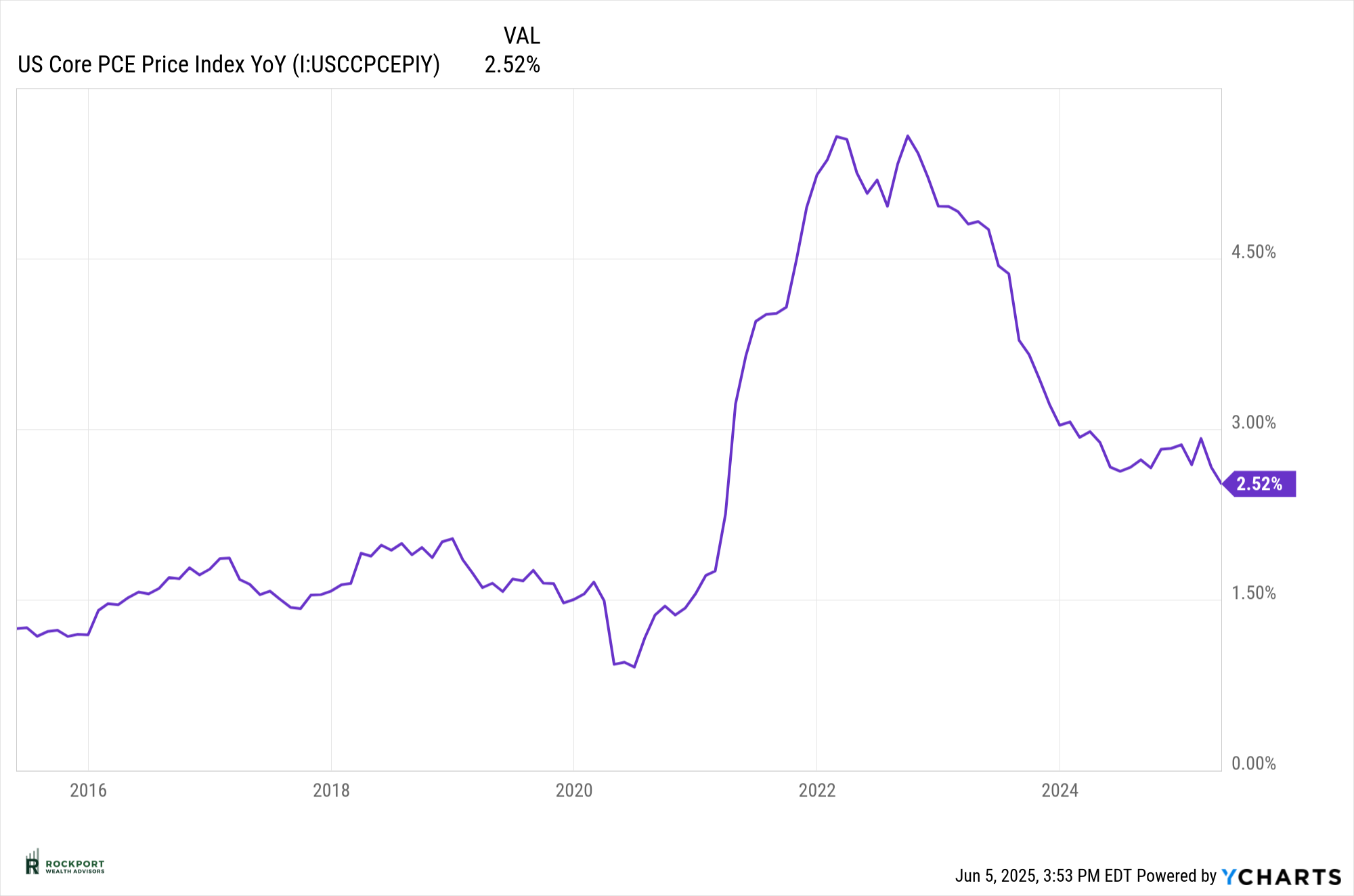

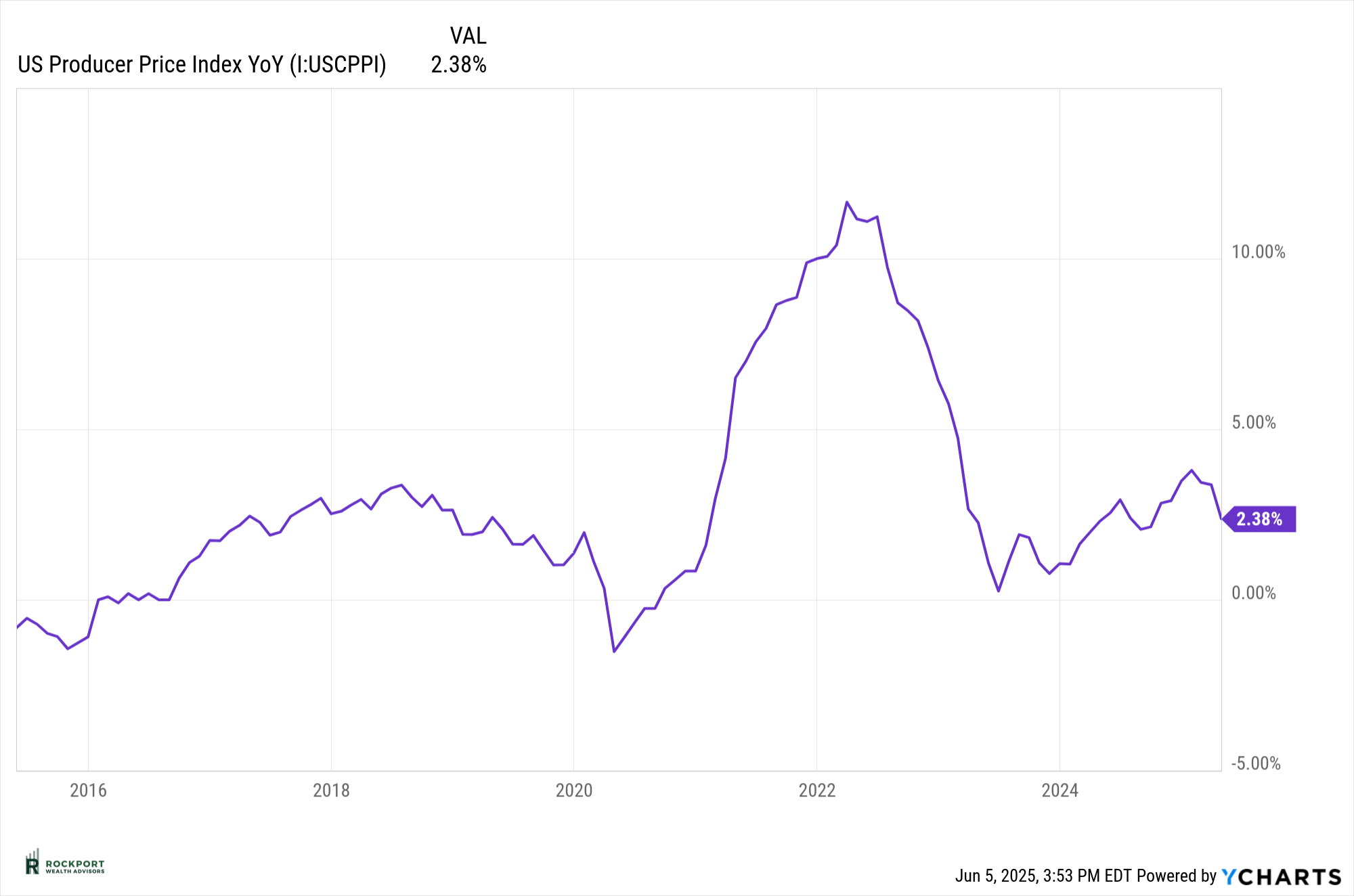

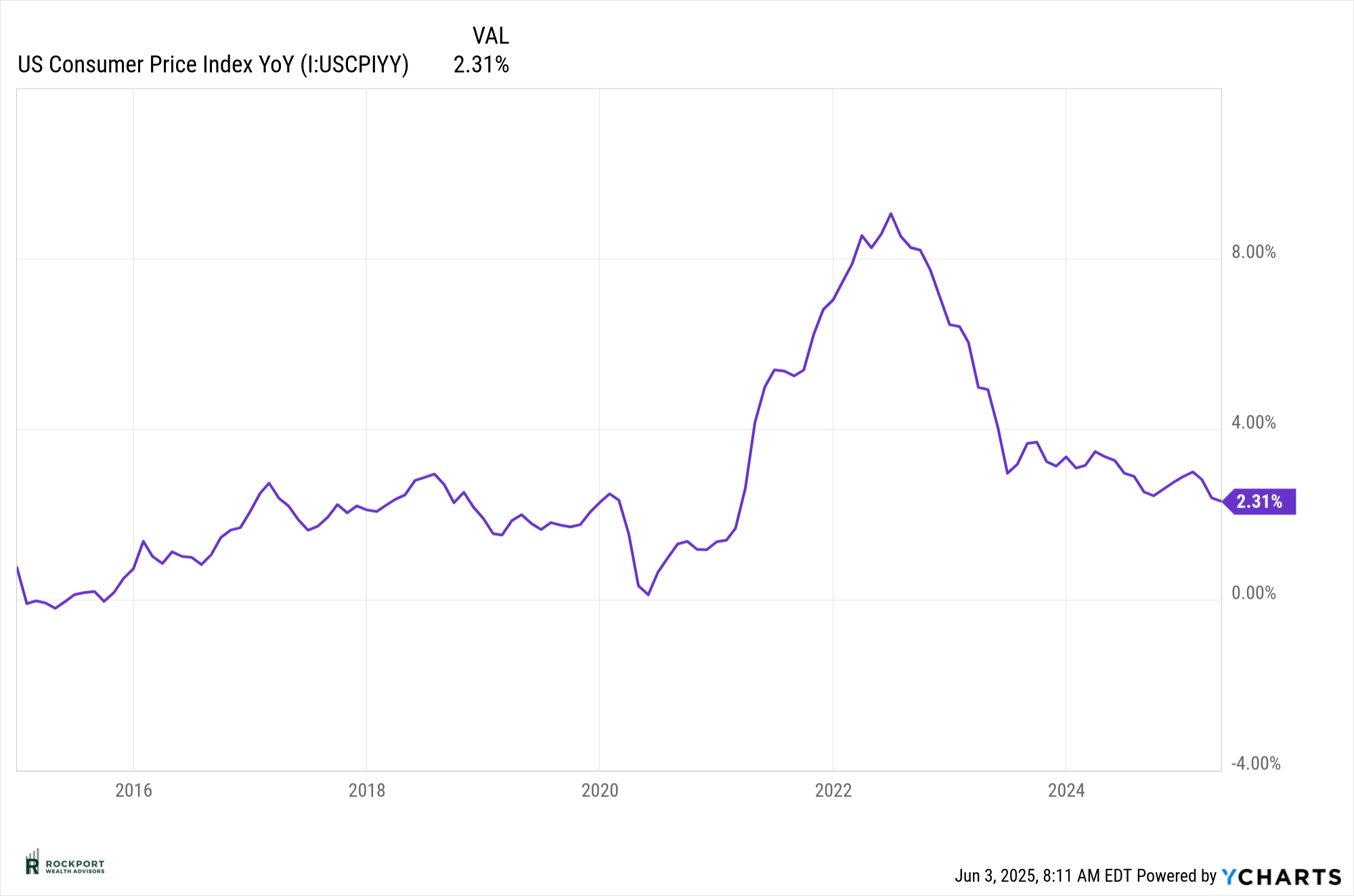

Inflation Eases—for Now

Inflation continued to moderate in May, offering a welcome sign for both consumers and markets. Many key inflation indicators have now retreated to their lowest levels since 2021, providing some short-term relief and supporting the case for a more patient Federal Reserve.

That said, we continue to believe inflation may reaccelerate in the second half of the year. One factor contributing to that outlook is oil, which found support after hitting lows earlier in the month and has since begun to climb again. Energy prices are a key input in inflation readings, and any sustained move higher in oil prices could push inflation metrics back up.

This will be an important dynamic to watch as we head into the second half of the year and could influence both monetary policy and market behavior going forward.

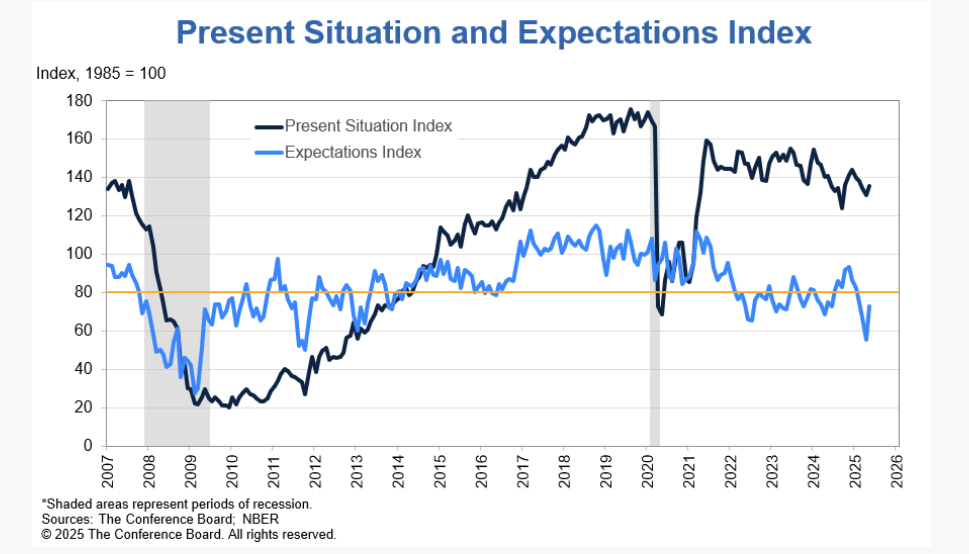

Consumer Confidence Rebounds

Consumer confidence rose in May, with improvements seen in both the Present Situation and Future Expectations components of the index. This uptick is not entirely surprising, as rising stock prices often correlate with improved consumer sentiment.

This is an encouraging development, particularly for those concerned about a potential recession. Historically, improving consumer confidence is not something we typically see in the lead-up to an economic downturn. As such, this trend offers a reassuring signal about the current health and trajectory of the economy. We’ll continue to monitor this closely, as consumer confidence remains a key indicator of economic momentum and future growth potential.

Looking Ahead: GDP Update Coming in July

We’ll get our next official look at economic growth when the updated GDP report is released in July. As noted earlier, we do not expect a negative print at this time, which would be required to signal the start of a technical recession. Should the data confirm continued growth, it would be another reassuring sign that the economy remains on solid footing—despite ongoing headlines and short-term volatility. We’ll provide a full update and analysis once the numbers are released.

Tax Update

Many clients now take advantage of Qualified Charitable Distribution which is a way to take money directly from IRA accounts to a charity. One common dissatisfaction has been that the custodians (Shcwab and Axos for example) have not been required to report the distribution and the burden of proof has fallen on the tax payer. Finally action steps have been taken to address this situation. Following is a quick recap on QCD’s and the new legislation around them.

The IRS has introduced a new code for the reporting of qualified charitable distributions (QCDs) by IRA custodians on Form 1099-R. Previously QCD’s were not reported on Form 1099-R and it was the responsibility of the taxpayer to make sure they were accounted for properly.

How QCDs Work

QCDs first became available in 2006, and they were made permanent in 2015. The strategy has become increasingly popular among IRA owners who are charitably inclined. With a QCD, IRA owners or beneficiaries who are at least age 70½ make a tax-free donation to charity directly from their IRA. An important benefit of a QCD is that it can be used to satisfy a required minimum distribution (RMD).

The 2025 annual limit is $108,000, and it is indexed for inflation. A one-time QCD of $54,000 can go to a split-interest entity, such as a charitable remainder annuity trust, charitable remainder unitrust or a charitable gift annuity.

QCDs can only be made through a direct transfer of IRA funds to charities that qualify under the tax code. Gifts made to donor-advised funds or private foundations do not qualify. In addition, the client cannot receive anything of value from the charity in exchange for making a QCD, and that must be documented in writing.

New Code Y

Historically, IRA custodians have not been required to report a QCD differently than any other IRA distribution. There has never been any special code on Form 1099-R to identify the QCD. Instead, the QCD was coded like any other IRA distribution, and it was up to the taxpayer to let the IRS know about the QCD on the tax return.

For 2025 QCDs, the IRS appears to have changed its approach. In April 2025, the IRS released draft Instructions for the 2025 Form 1099-R. These draft Instructions introduced a new Code Y for QCDs. While these are only “draft” instructions, the IRS has also released the final version of the actual 2025 Form 1099-R with Code Y included.

Code Y would seem to be welcome news for both IRA owners and their tax preparers to help ensure that the QCD tax break is not missed. However, as before, IRA owners will need to be careful to make sure that their donation satisfies all of the QCD rules. Simply receiving a 1099-R with Code Y from the custodian does not necessarily guarantee that the donation qualifies for tax-free treatment.

Rockport News

Axos Change

For those of you that have brokerage accounts at AXOS, we will be terminating our relationship with them by year end. We will be in contact with you mid-year to arrange for a transfer of accounts to our other clearing firm Charles Schwab. We plan to start this process in July time permitting.

Salute to Service Golf Outing

Our 5th Annual Salute to Service Golf outing is taking place August 11, 2025 at Red Tail Golf Club in Avon.

Rockport Wealth Advisors honors the service and sacrifice of America’s veterans by providing free financial education and tools to those who serve. We team up with established veteran support nonprofits such as the National Veterans Memorial and Museum and GallantFew that share the same vision to ensure military heroes excel once they return home. The Salute to Service Golf Outing is an extension of our philanthropic efforts for veterans.

Since 2021 the Salute to Service Golf Outing has raised more than $65,000 for our military veterans! If you are a golfer and want to join this years fun, use the link below to learn more and register. Donations are also greatly appreciated and can be made through the link. All are welcome!

Salute to Service Golf Registration

As always, if you have any questions on anything we have talked about here or anything else that is on your mind, please feel free to reach out.

*Treasury yields can be found at finance.yahoo.com.

*Charts produced at yCharts.com

*The LEI can be found at Conference-board.org

*Bonds can be found at https://www.bloomberg.com/markets/rates-bonds

*CME FedWatch Tool – CME Group

*University of Michigan Consumer Confidence found at SentimentTrader.com

*FRED Charts produced by Federal Reserve Bank St. Louis

*PMI Manufacturing and Services Indexes, and Consumer Confidence and Future Expectations at Conference-board.org

*Buffett Indicator produced at currentmarketvaluation.com

*Distribution of S&P 500 Returns found at Macrotrends.net

*S&P 500 forward P/E ratios can be found atBusinessinsider.com

*The Asset Managers Positioning Chart found at The Daily Shot

* Rockport Models – Please remember we are referencing our model portfolios, and your portfolio may differ from the models mentioned depending on your individual needs and circumstances.