Belated Halloween wishes and early Thanksgiving greetings to all!

Markets & Economy

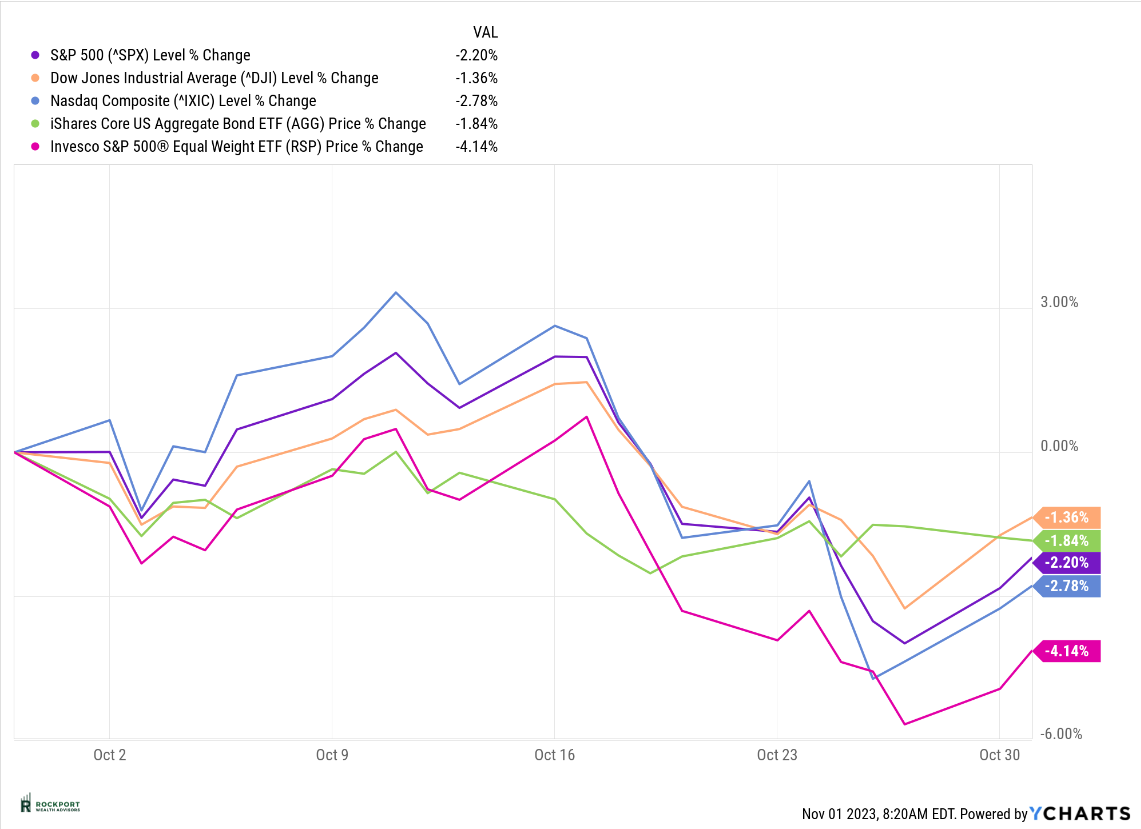

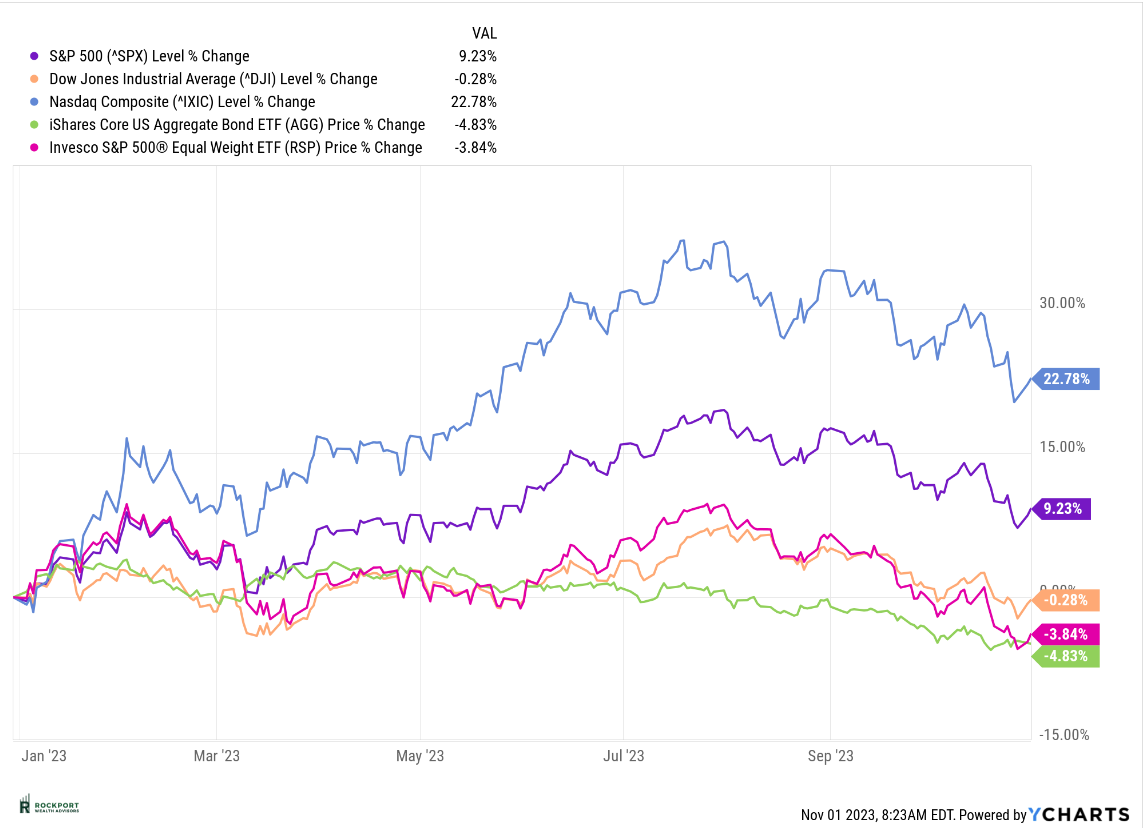

Unfortunately, but not entirely unexpectedly, the stock market extended its decline during the past month. The S&P 500 index fell by 2.2%, marking the third consecutive month with a decline of more than 1%. While not unheard of, such a pattern is relatively uncommon. However, for the year, the index is still showing a gain of 9.23%.

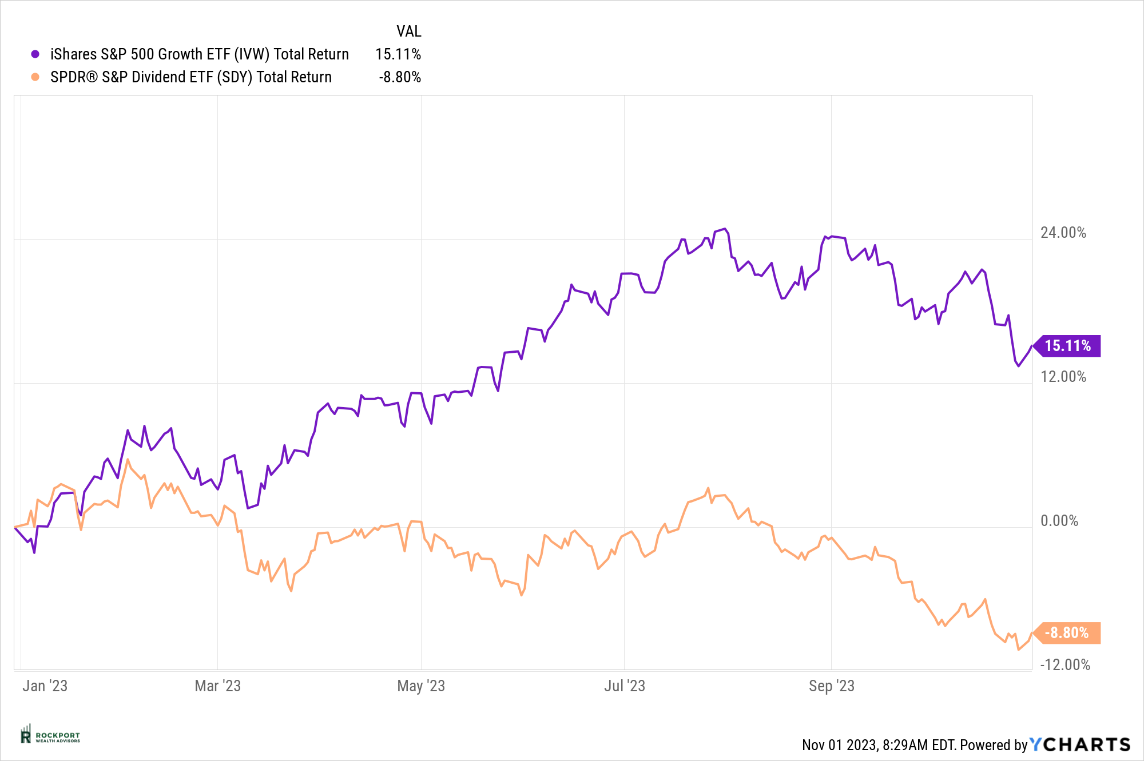

We’ve been closely monitoring the S&P 500 equal weight index throughout the year, as it provides a more accurate representation of overall market performance by leveling out the influence of the dominant 7 stocks. This index also declined by 4.14% for the month and is now down 3.84% year-to-date. In simpler terms, the performance of the 7 prominent stocks is propping up the S&P 500 index, but the broader market is facing challenges. This is also very evident in the Growth vs value Chart we have been showing. At the present time the spread between the two is one of the widest of anytime we can recall.

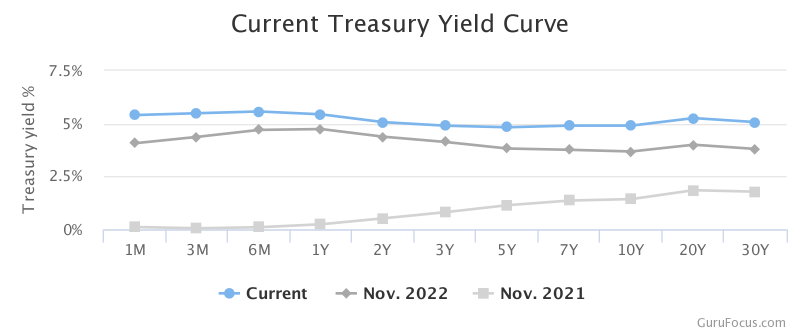

Bonds also continued their underperformance, with the aggregate bond index declining by 1.84% for the month and experiencing a 4.83% drop for the year.

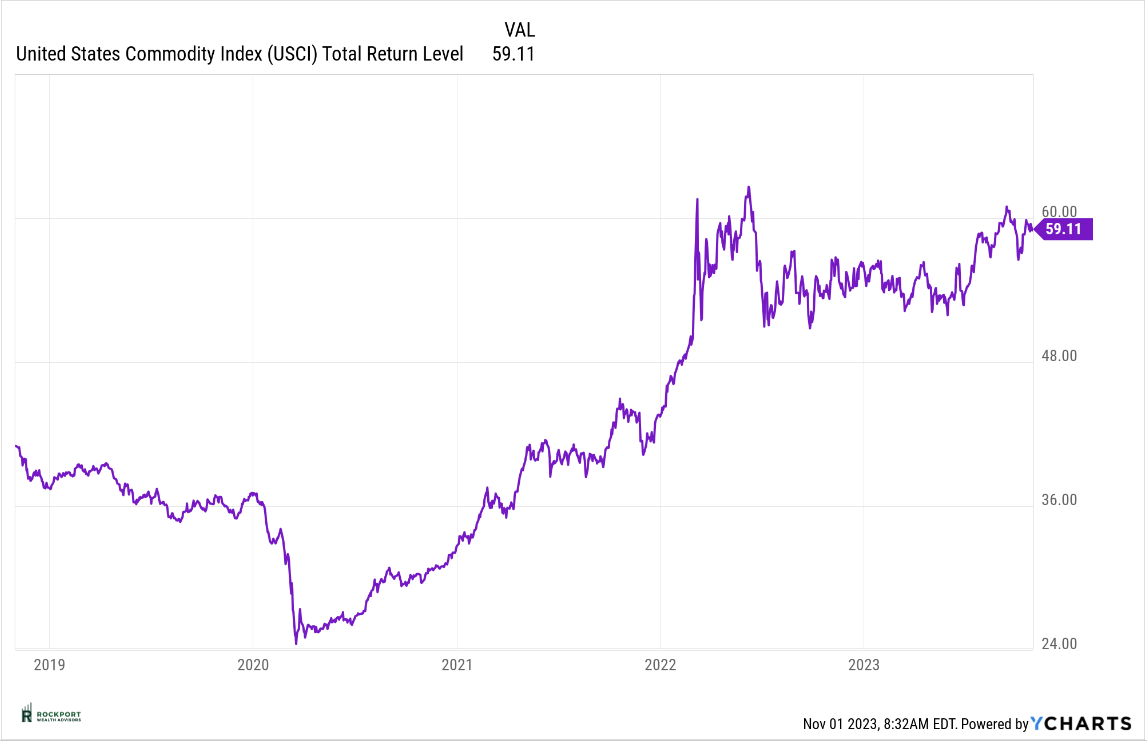

The primary driver behind these market fluctuations remains the Federal Reserve and its decisions regarding interest rates. Of course, there are other significant factors at play, such as the ongoing conflict in Ukraine and the unfortunate developments in the Middle East involving Israel. With regards to the Middle East conflict it is too early to gauge the impact of this event on the global economy, and we must closely observe their unfolding.

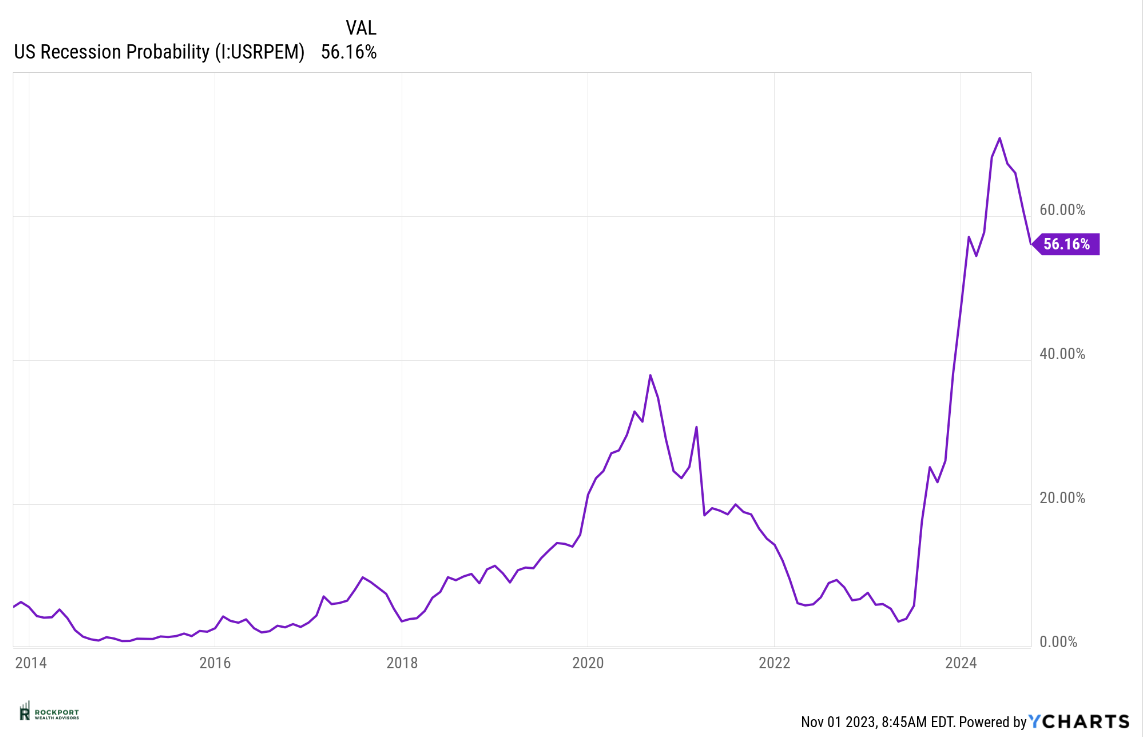

Additionally, the record-high government spending and deficits, along with a slowing economy, add to the complexity of the situation, as we continue to navigate the uncertainty of a potential recession.

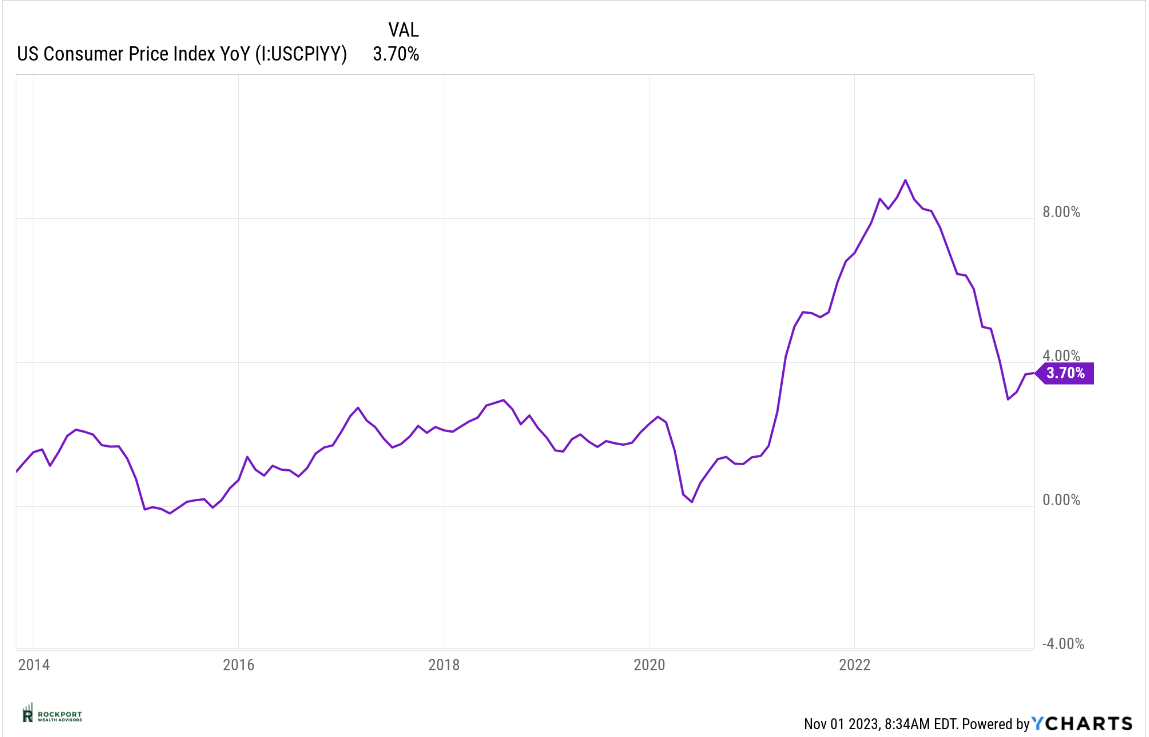

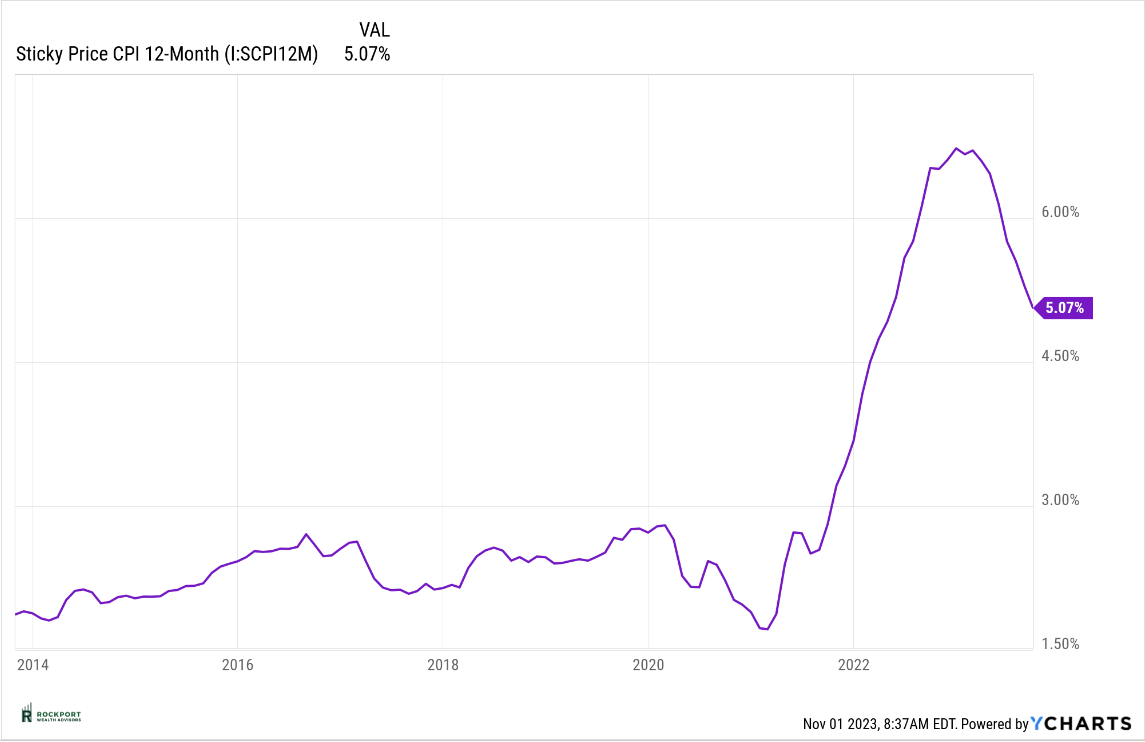

One frequently asked question revolves around the timing of the Federal Reserve’s conclusion of its interest rate hikes. As of the current moment, the Fed has not implemented any interest rate increases in November, and there is a 90% likelihood that no rate hike will occur in December. For those interested in tracking this information, you can easily access these statistics using the CME FedWatch Tool (Click Here). Interestingly, based on the data from that source, there is a suggestion that the Federal Reserve might have completed its rate hikes, and the possibility of rate cuts could emerge in May 2024. It’s essential to bear in mind that these numbers are subject to minute-by-minute changes, so nothing is set in stone. Given that the Federal Reserve is still contending with higher-than-desired inflation, we would not find it terribly surprising if further rate hikes were implemented.

Let’s conclude with a more optimistic note! As we transition into the fourth quarter and approach the year’s end, some encouraging news emerges in the form of favorable seasonal trends. We’ve just embarked on the most favorable period for stock market returns, which extends through the end of April. In fact, November kicks off this period as the strongest month out of the twelve. While this isn’t a guaranteed formula for positive returns, statistically, the odds of success increase. Given this, along with the fact that the markets have experienced three consecutive challenging months, as mentioned earlier, there’s a possibility that Santa may bring his traditional rally. Lastly, bonds appear to be a much better value moving forward after 18 months of underperforming. Hopefully this will help balance and lower risk for investors.

Rockport Models

The only change to any of the Rockport Models was once again in the Sector model where we reduced equity exposure slightly from 55% to 52%. Keep in mind this is our most active strategy by far.

Industry Topics

Qualified Charitable Distributions

Qualified Charitable Distributions offer a convenient method for donating funds directly from your IRA to a charitable organization. The concept behind this is quite straightforward. To be eligible, you must be at least 70 ½ years old, not in the year you reach that age, but actually at age 70 ½. Secondly, you can arrange for a direct transfer from your IRA to your chosen charitable organization(s). Lastly, the maximum contribution limit is set at $100,000. Therefore, if you have a charitable inclination, this method is far more advantageous than withdrawing the funds, incurring taxes, and then attempting to claim a deduction. It’s worth noting that with the significant increase in the Standard deduction, many individuals no longer meet the criteria for itemizing and claiming deductions. If you would like more information please reach out.

As always, if you have any questions on anything we have talked about here or anything else that is on your mind, please feel free to reach out.

*The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. Results can be found at slickcharts.com.

*Treasury yields can be found at finance.yahoo.com.

*Charts produced at yCharts.com

*Bonds can be found at bloomberg.com/markets/rates-bonds

*Fed Rate Probability Chart can be found at cmegroup.com/markets/interest-rates/cme-fedwatch-too

*The LEI can be found at conference-board.org/topics/us-leading-indicators

*Treasury Yield Curve can be found at Gurufocus.com

*Rockport Models – Please remember we are referencing our model portfolios, and your portfolio may differ from the models mentioned depending on your individual needs and circumstance.