We hope everyone had a great Halloween! Next up Thanksgiving and then before you know it Christmas will be on our doorstep.

Markets & Economy

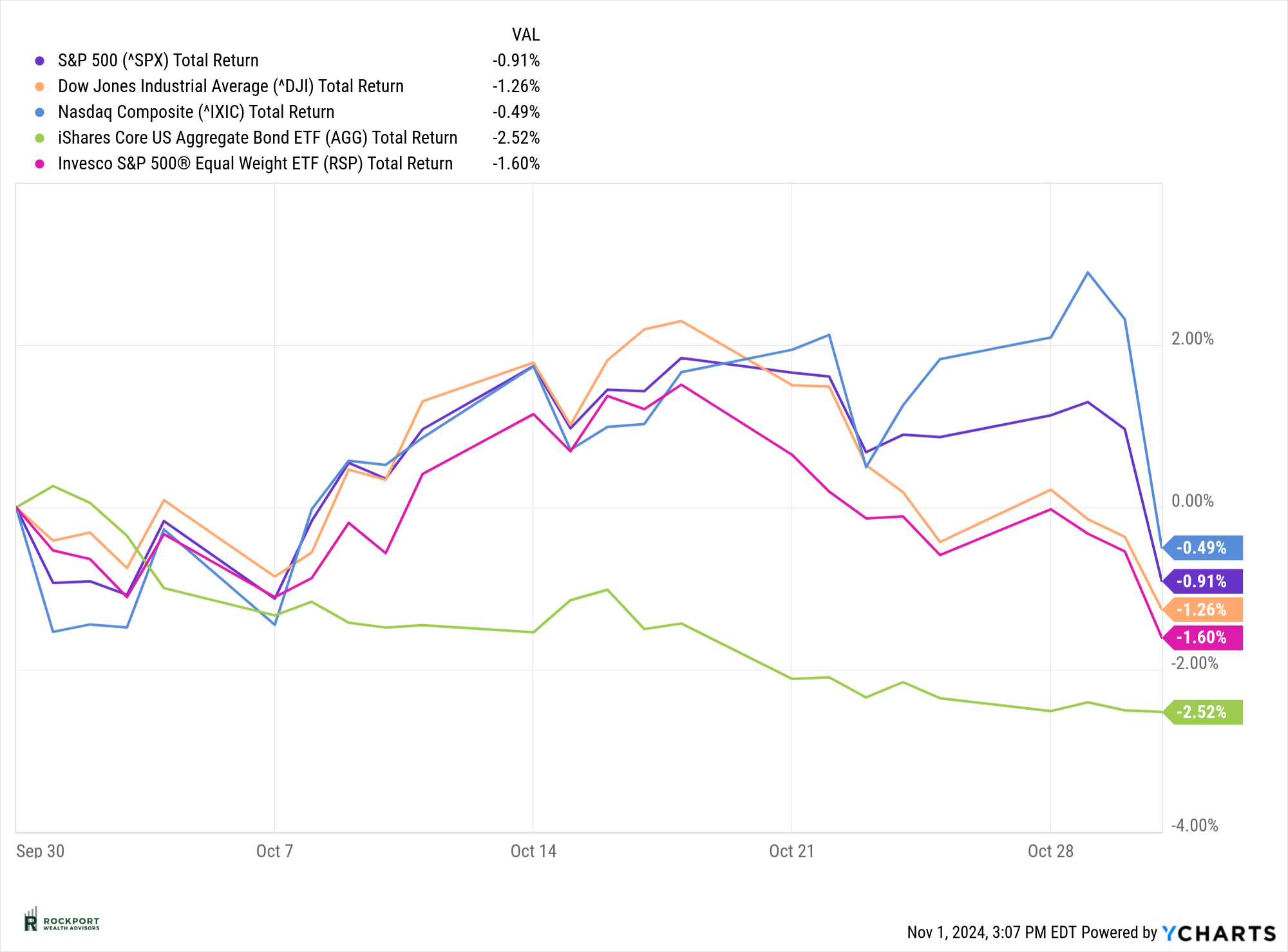

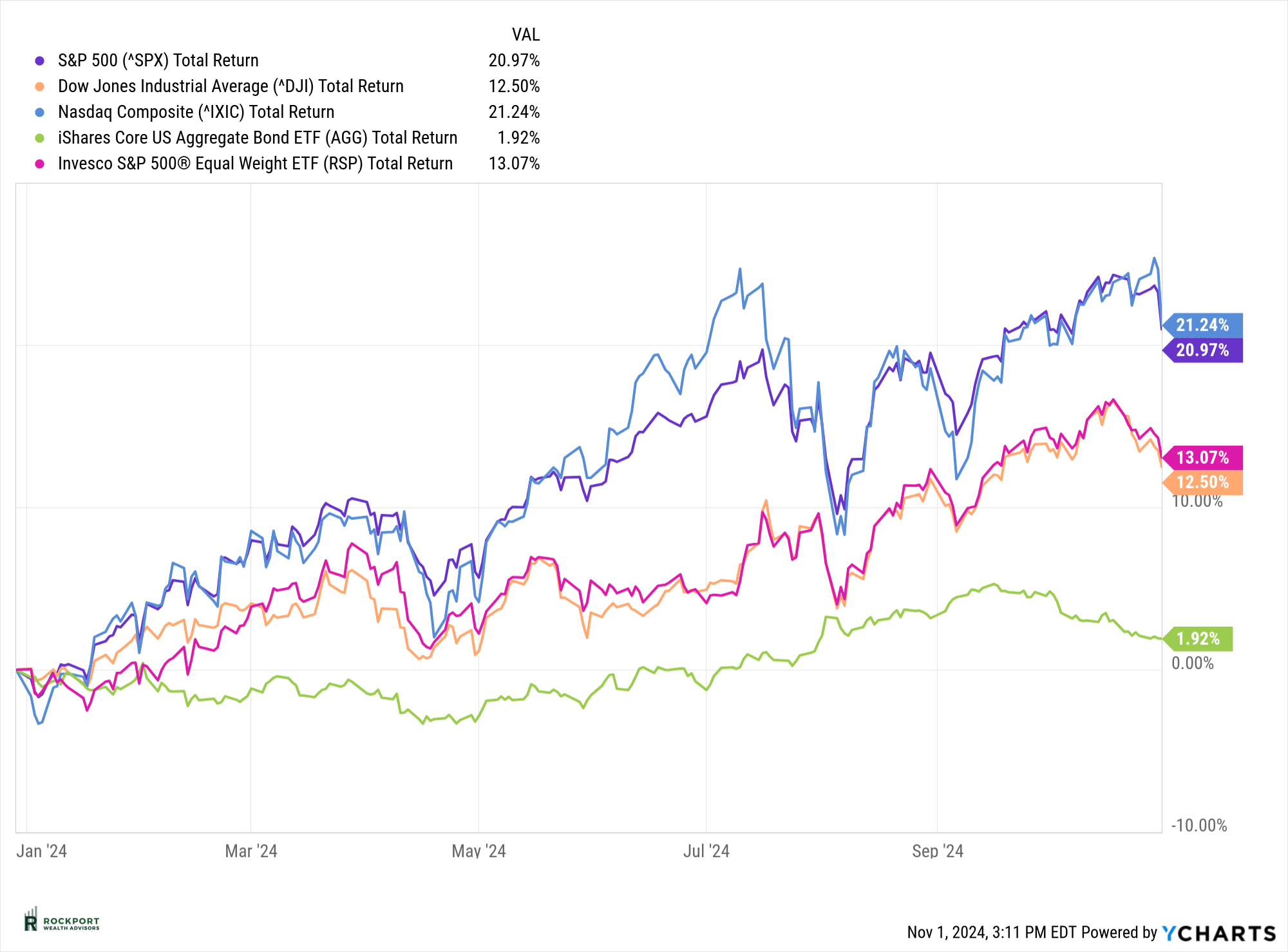

In October, the stock market experienced a modest pause, with the S&P 500 slipping by 0.91% for the month. Despite this slight dip, the index remains up an impressive 20.97% year-to-date. As we approach the final stretch of 2024, it’s clear that this has been an outstanding year for stocks. Even if we see little movement or a minor pullback in the coming months, 2024 will be remembered as a historically strong year for investors.

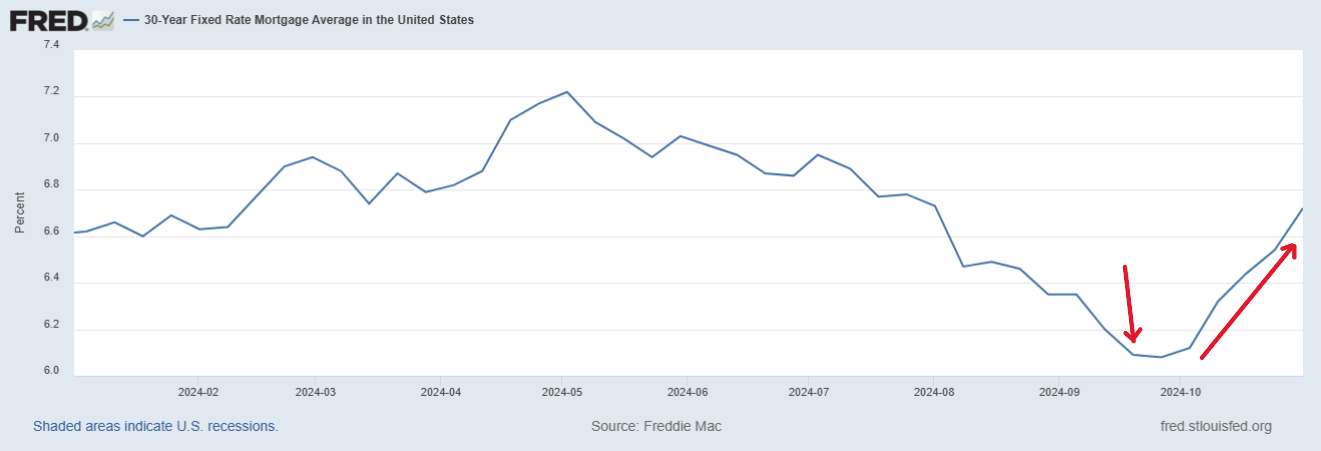

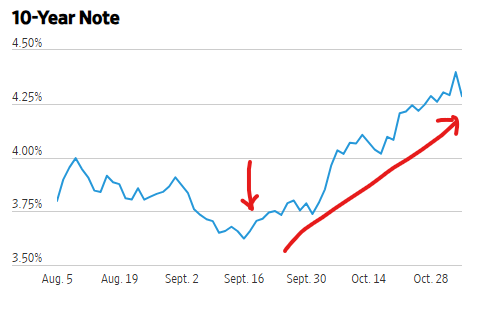

In October, bonds were the weakest-performing asset class, with the aggregate bond index posting a decline of 2.25%. Despite this setback, the index remains in positive territory for the year, up 1.92%. Interestingly, bond yields were significantly lower when the Federal Reserve announced an interest rate cut on September 18th. In the charts below, you can see the rate movements on the 30-year mortgage and the yield on the 10-year Treasury; the downward arrow marks the time of the cut, followed by notable increases in yield. This outcome is counter to the Fed’s objective, which was to lower yields and borrowing costs through the rate cut. Could this be the bond market’s signal that inflation may resurface in the coming months? This is a notable development worth monitoring closely.

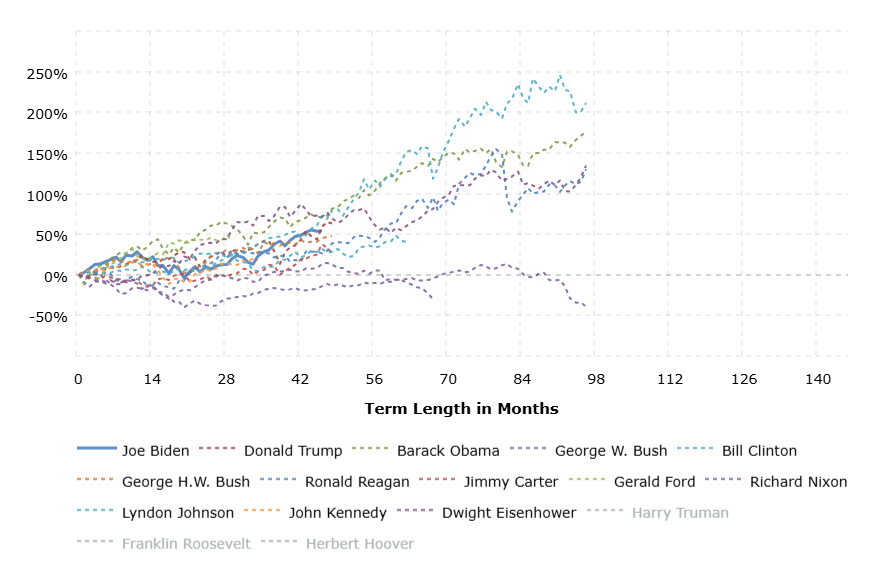

As you read this, Election Day will have passed, and hopefully, so has any uncertainty, with results that were clear and uncontested. Many investors understandably worry about the potential impact of elections on their finances. However, as the chart below illustrates, history shows that stock market performance tends to be positive over a president’s term, regardless of the party in office. In fact, only George W. Bush and Richard Nixon saw negative market returns during their terms. Historically, who holds office has had less impact on the market than factors like interest rates, inflation, and, most importantly, the long-term growth of the economy.

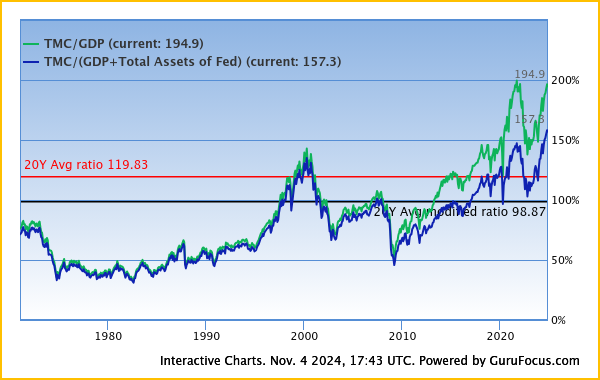

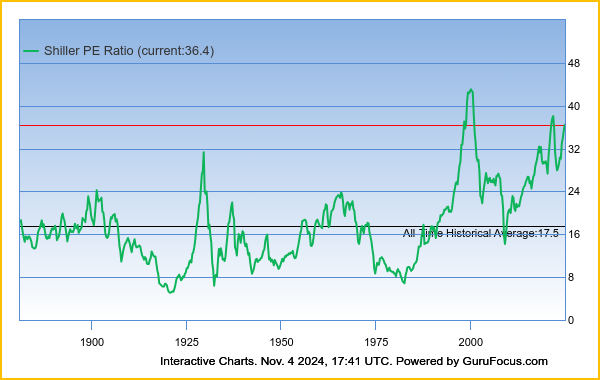

As we assess the current landscape, the winner of this election will face an expensive stock market, ongoing global conflicts, and a Federal Reserve still grappling with inflation, potentially exacerbating it with recent rate cuts. Below, you’ll find charts of two widely monitored stock market valuation metrics: the Buffett Indicator and the Shiller Price-to-Earnings ratio. The Buffett Indicator is nearing an all-time high, well above its peak in March 2000, while the Shiller P/E ratio is also approaching levels last seen in 2000. Given these elevated valuations, we wouldn’t be surprised to see more subdued stock market returns in the coming years. Remember, while high valuations don’t directly cause market declines, they can amplify the severity of a downturn when one occurs.

Next month we will go back to updating our relevant data points. With the election being top of mind for most, we felt a little focus on an event that occurs only once every 4 years was warranted.

Rockport News

Investment Model Update

We did make a change to the Income model during the month. We sold out of Blackrock Multi Asset Income and replaced it with MDIV (First Trust Multi Asset Income). Symbol MDIV has a slightly higher dividend and lower costs internally. We also replaced SCHD (Shwab US Dividend Equity) with WBIY (WBI Power Factors High Dividend ETF). WBIY has a higher dividend. This particular model continues to be managed for a nice income stream with a moderate amount of risk. If you have any questions please feel free to reach out.

Be Aware, Be Diligent…..Scams to avoid

We will take a break from Tax talk for a few months and focus on some things that EVERYONE should be aware of. How to be aware of and hopefully avoid the different types of scams out there. We will start with Phishing.

Phishing is a scam in which the scammer poses as a legitimate, trusted source, in order to trick you into providing sensitive data such as your username, password, banking details or social security number. The scammer then uses the information to steal money or commit identity theft. Phishing attacks can also give scammers access to your computer or network to install malware or ransomware.

Phishing scams most commonly start with a fake email that appears to come from the trusted source but can also start with a text message (also called “smishing”) or telephone call (also called “vishing”) or a social media message.

If someone contacts you asking for your personal information — e.g., social security number, credit card number, bank account info — do not give it. And be careful of clicking on suspicious links in email messages.

If you are asked to log in after clicking a link in an email, be careful. You may want to verify that you have reached the real login site by instead logging into the website separately outside of the email.

As always, if you have any questions on anything we have talked about here or anything else that is on your mind, please feel free to reach out.

*The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. Results can be found at slickcharts.com.

*Treasury yields can be found at finance.yahoo.com.

*Charts produced at yCharts.com

*The LEI can be found at Conference-board.org

*Bonds can be found at https://www.bloomberg.com/markets/rates-bonds

*CME FedWatch Tool – CME Group

*University of Michigan Consumer Confidence found at SentimentTrader.com

*FRED Charts produced by Federal Reserve Bank St. Louis

*PMI Manufacturing and Services Indexes, and Consumer Confidence and Future Expectations at Conference-board.org

*Buffett Indicator & Shiller PE Ratio produced at gurufocus.com

* Rockport Models – Please remember we are referencing our model portfolios, and your portfolio may differ from the models mentioned depending on your individual needs and circumstances.