This is your captain speaking, please fasten your seat belts we may encounter some turbulence. Most of us have heard something similar to this at some point while taking an airline flight. In Investing terms, it sums up the month of January very well as we closed out a volatile (turbulent) month.

After an extremely quiet 2021 the market has started off 2022 with a month that was nothing like what we had seen at any point in the past year. If you will recall in our last newsletter, we alluded to the market becoming much choppier for 2022. That certainly was the case in January. The move down is not terribly surprising to us however the timing was. We certainly did not expect the market to start off the calendar year in such a bad mood. For the month the S&P 500 index was down just over 5%. This would have been noticeably worse had the last two days of the month not seen such significant rallies.

After an extremely quiet 2021 the market has started off 2022 with a month that was nothing like what we had seen at any point in the past year. If you will recall in our last newsletter, we alluded to the market becoming much choppier for 2022. That certainly was the case in January. The move down is not terribly surprising to us however the timing was. We certainly did not expect the market to start off the calendar year in such a bad mood. For the month the S&P 500 index was down just over 5%. This would have been noticeably worse had the last two days of the month not seen such significant rallies.

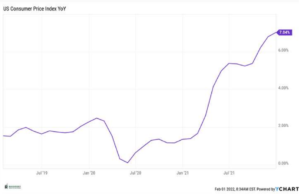

So, what’s up? Global markets are reacting to the growing likelihood of higher interest rates. If you go back to a year ago the Federal Reserve was steadfastly stating that they were not going to entertain the thought of raising interest rates until sometime in 2023. However, it appears as if the Fed did not correctly assess the rapidness of the rise in inflation as well how high prices have gotten. The chart at the center of the page is the CPI (Consumer Price Index.) You can easily see the rise in prices since July 2020. As a result, the Federal reserve in an attempt to keep inflation from rising more and getting out of control is being forced to move up their schedule for interest rate hikes and at present time it is widely expected that they will begin raising interest rates in March of this year. This is one of their primary tools to fight rising prices.

From an investment standpoint, we are moving from an environment where the Fed has been your friend for the better part of the past 10-12 years. We have all enjoyed interest rates hovering near zero and the economic stimulus that goes along with that. It has been a spectacular environment to borrow money as rates have been extraordinarily low and Stock and bond markets particularly in the United States have responded with record high gains on a fairly regular basis.

Now, we are about to embark on a period of time where the complete opposite in terms of monetary policy is going to be happening. The Fed will likely be increasing interest rates instead of cutting them or keeping them near zero and will be withdrawing stimulus instead of putting it into the system. Look at it in terms of sailing a boat. When you have the wind at your back the boat is fairly easy to move forward and when you have the wind in your face the boat advances a lot slower. This is what we would expect to happen with the economy, stocks and bonds.

We still expect a fair amount of market volatility for the foreseeable future and in conjunction with that the potential of lesser returns than we have experienced over the past several years. Patience will be a key attribute for investors in 2022.

As we stated in the previous Newsletter the models were rebalanced on January 31 and we have added sleeves of investments to hopefully help in a lower return environment.

Please stay safe and healthy and as always, we welcome any comments or questions.

*The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. Results can be found at slickcharts.com.

*Treasury yields can be found at finance.yahoo.com.

*Charts produced at yCharts.com