Markets & Economy

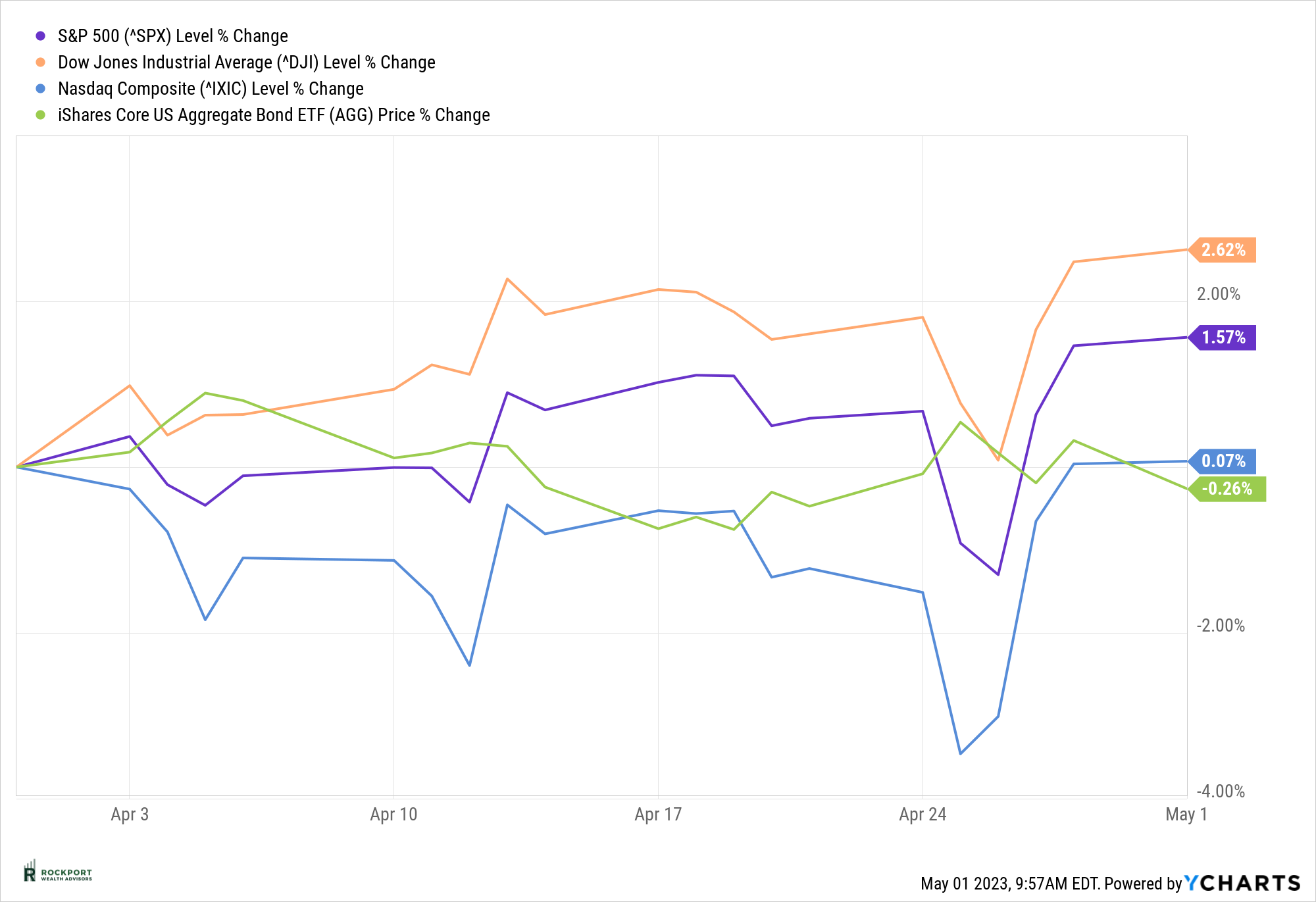

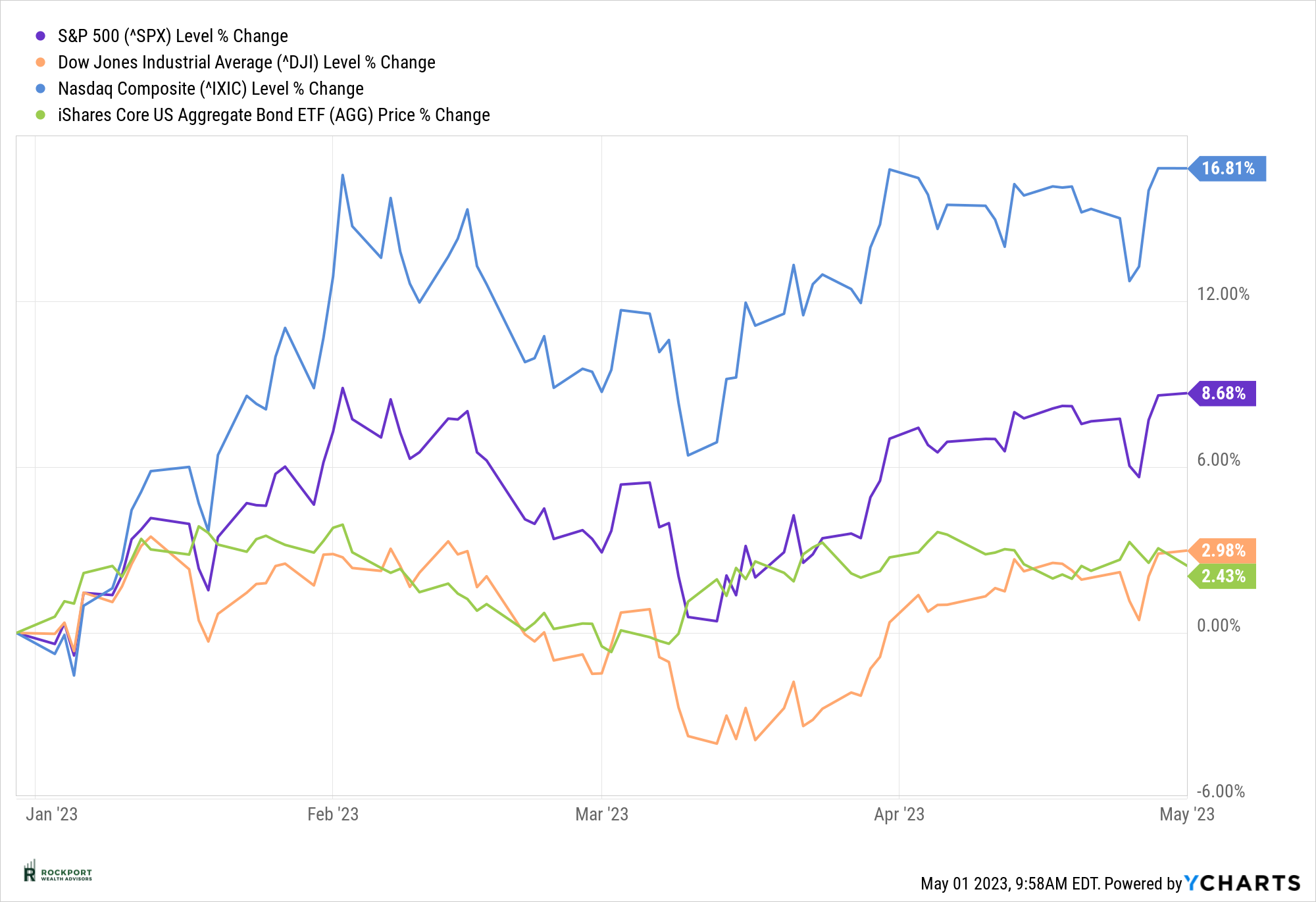

To the surprise of many, the markets had another positive month but there is reason to proceed with a cautious tone. As of the end of April the S&P 500 is up 8.68% for the year. (See charts below) We, like all of you, are thrilled that things have seemingly turned the corner, but the reality of the situation is that while the overall indexes are positive the majority of stocks are not. In fact, if you remove the top 10 performing names from the S&P 500 the index is barely positive for the year. The industry term for this is market breadth and if things are going to stay on track the rest of the stocks will need to begin to participate to the upside. Bonds have also found some solid footing for the time being and are having a positive year as well.

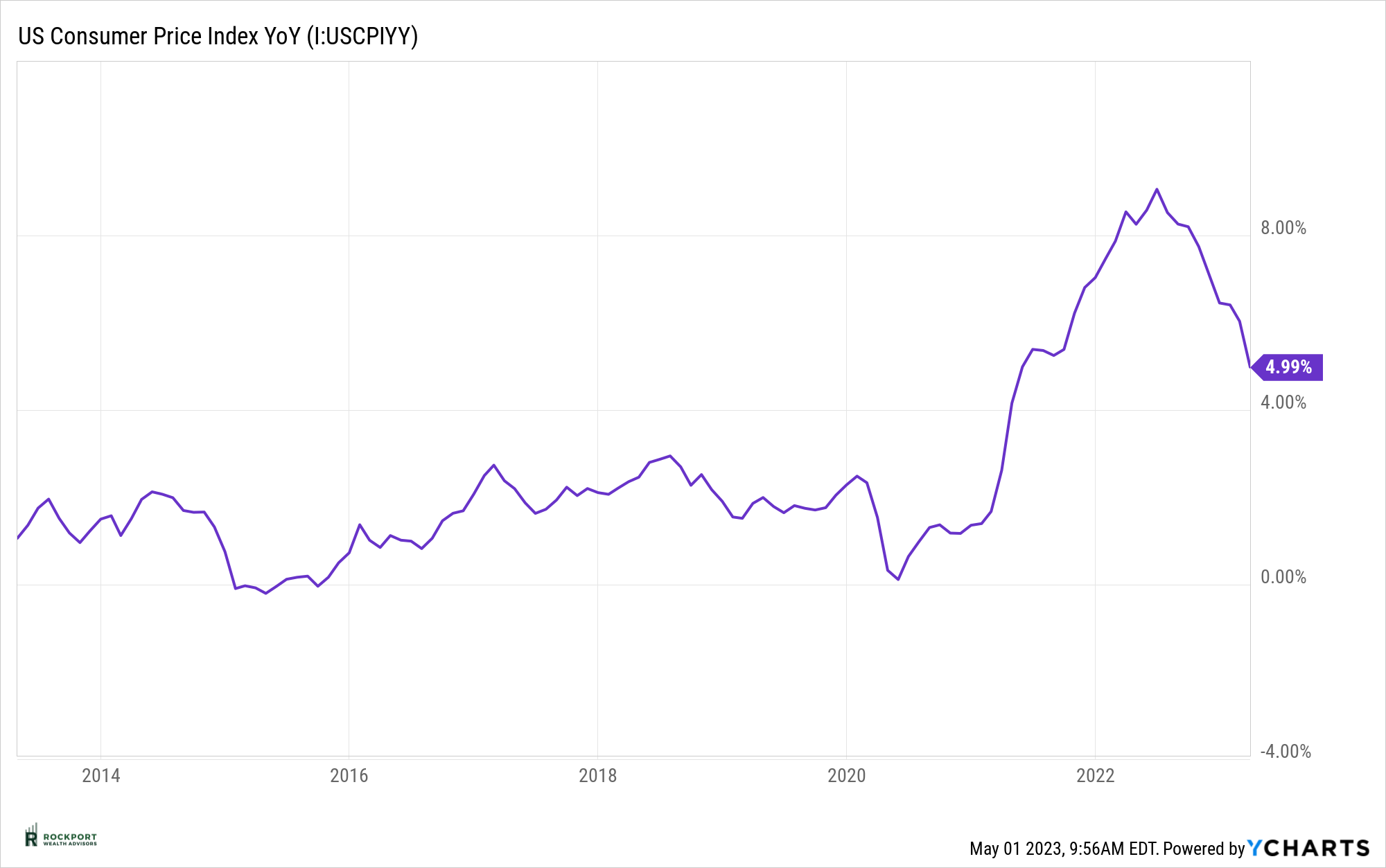

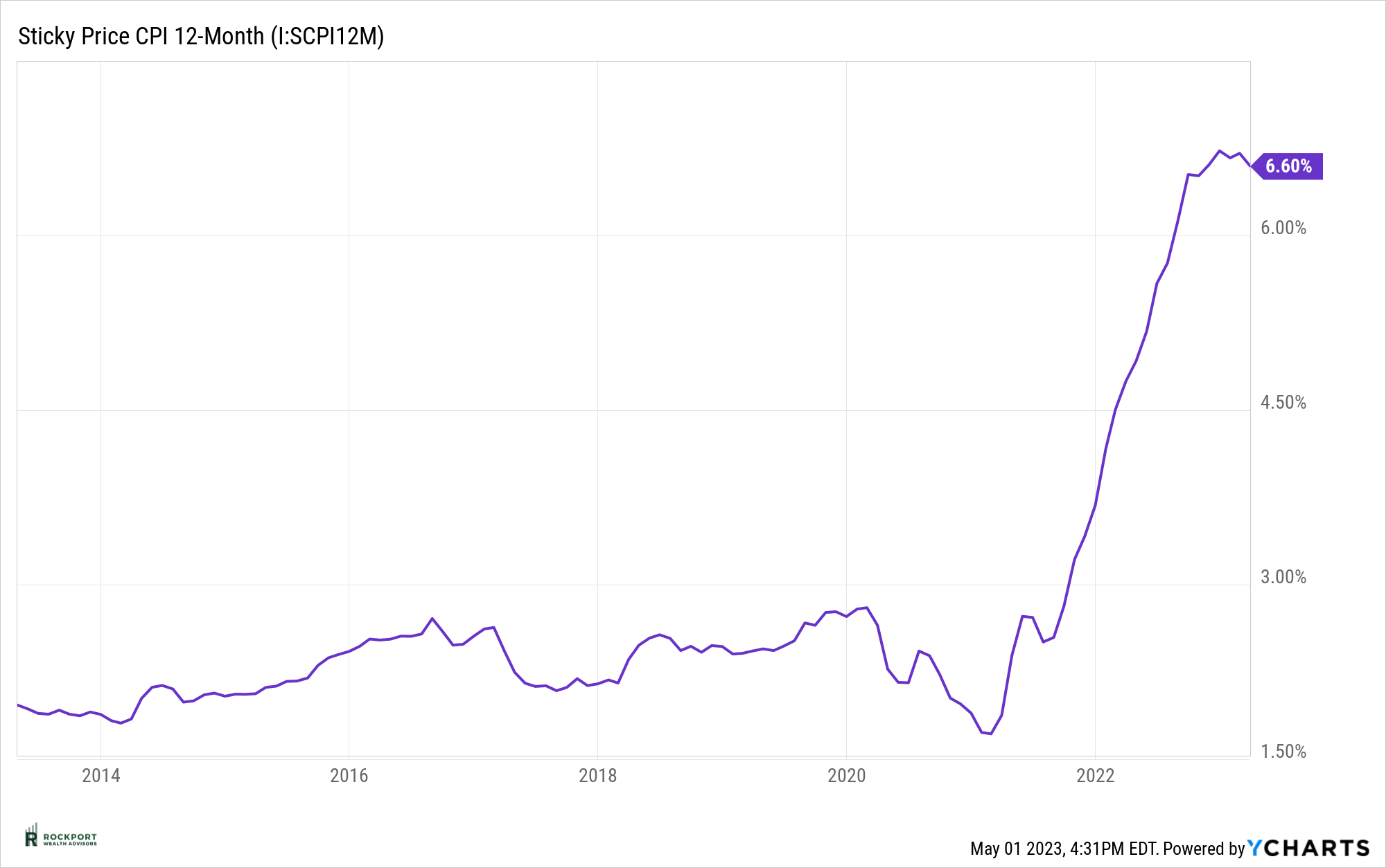

Inflation continues to moderate as the CPI continues to fall, but just like last month the Sticky CPI has barely budged. (See charts below) This likely gives the Federal Reserve all the cover it needs to continue to raise interest rates in the near term. Our view continues to be that they should stop raising rates and let things unfold a bit before deciding on additional hikes. However, at the moment, they seem intent on keeping rates moving higher and holding them higher for some time. For what it’s worth, the stock and bond markets are pricing in interest rate cuts by year end. This has likely contributed to the performance of these asset classes. As we enter the summer months it will be interesting to see who is right, the Federal Reserve or equity and bond markets.

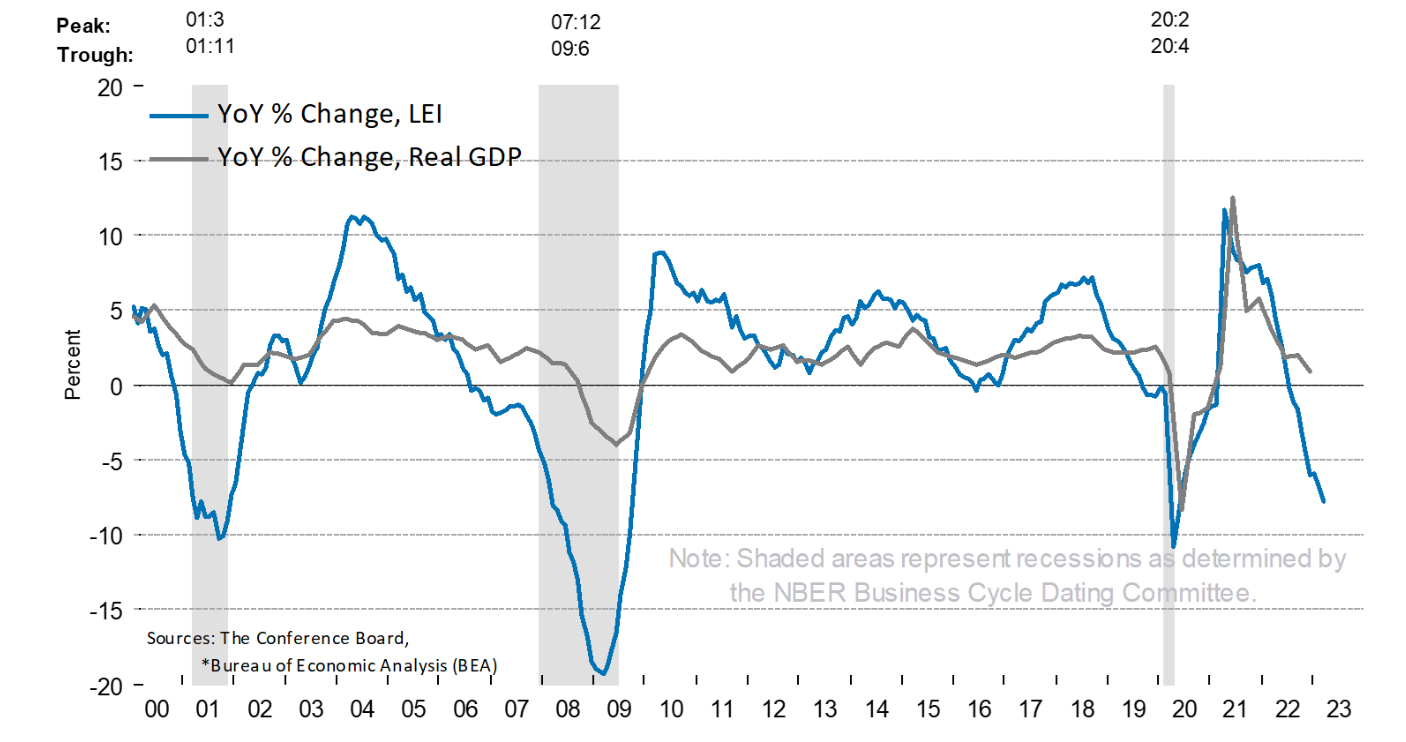

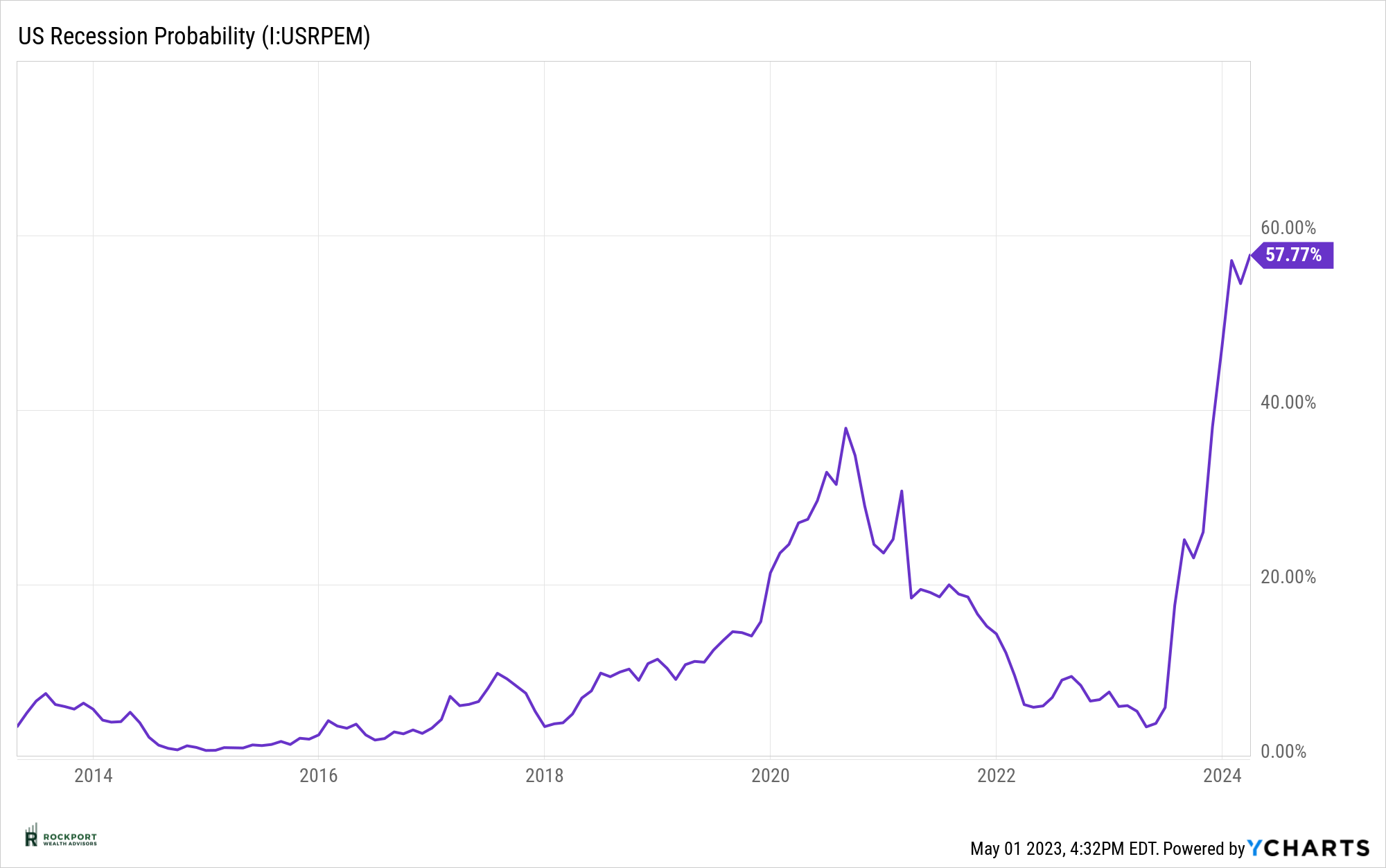

The above contributes to the narrative that a recession is a near certainty. There is no doubt that the economy is slowing, and the odds of an official recession have increased as seen in the Recession Probability Chart below. The Leading Economic Index, which is widely followed, has never had such a steep decline in a short period of time and not signaled a recession. We may in fact look back in 6-12 months and realize we are already in a recession. Time will tell. One reference point we are watching closely is the employment picture. For the moment, even with the headlines about job layoffs, this indicator has held fairly steady. It seems difficult to have a deep recession with employment so strong, so we need to pay close attention to this in the coming months.

With all the above at play we continue to operate on the cautious side of things. If any good news is in the equation, it’s that recessions tend to be deflationary by nature. We have mentioned before, the Federal Reserve in their now 15-month battle against inflation would not mind a recession of some sorts as it would aid them to get inflation back down to the 2.5 to 3% range that they would like to be in. They could then cut interest rates and fuel the economy back up with far less fear of inflation getting out of control.

Rockport Models

There were no changes to the models during the month of April in terms of strategy. We did rebalance the moderate models in mid-April.

Industry Topics

Financial Planning

What is it? Financial planning is the process of creating a roadmap for your financial future. It involves setting financial goals, creating a budget, and developing a plan to achieve those goals. Financial planning is important because it helps you to make informed decisions about your money, reduce financial stress, and achieve financial security.

We offer this service through the use of the financial planning software E-Money. We have yet to embark on this for any client that has not found it to be an extremely eye opening and helpful experience. If this is something you would like to take a closer look at please reach out and we would be happy to educate you about the process.

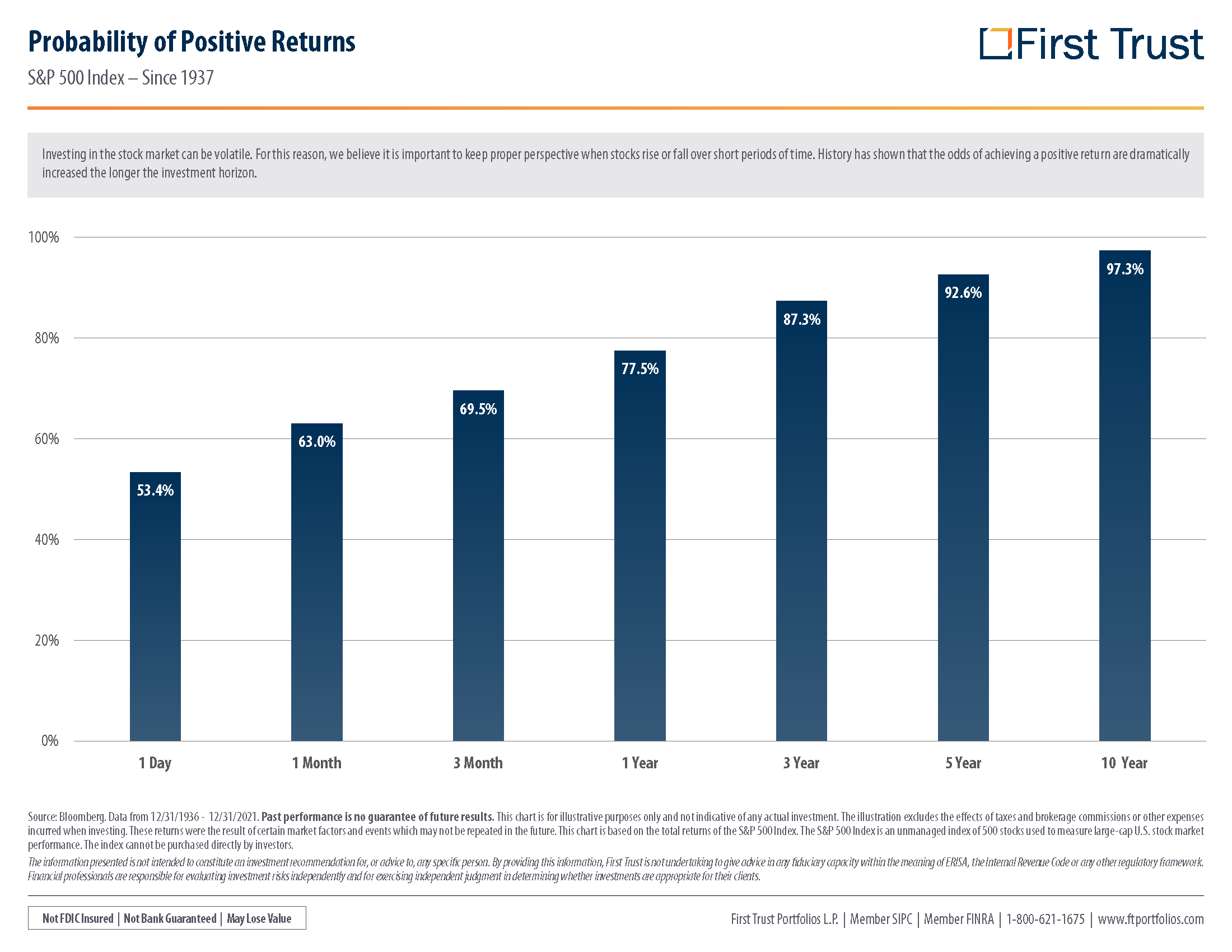

There has been a growing trend in recent years where investors are fixated on short-term market fluctuations and neglecting the importance of long-term investment planning. This trend seems to have peaked with the negative returns for stocks and bonds last year. The constant media reporting on daily, weekly, and monthly market movements without considering multi-year periods is believed to be contributing to this trend. As a result, investors are developing bad investing habits. It is important to note that investing is not always a positive experience, with approximately one out of every four years experiencing a downturn. (See chart below) This emphasizes the importance of having a long-term financial plan and managing one’s life around that plan rather than making investments the primary focus.

Rockport News

We have gotten several questions on the timing of systematic payments going to bank accounts. Just a quick operational reminder: If you are getting a systematic payout from an account on a monthly basis, please keep in mind that if the date you are supposed to receive your payment is on a weekend that those payments do not go out until the following Monday or the next business day if Monday is a Holiday.

Mark Your Calendars! Our 3rd Annual Salute to Service Golf Outing which benefits several Veteran Organizations is scheduled for Monday August 14th. Once again it will be held at Red Tail Golf Club in the Cleveland Area. Details on participating or donating can be found at Salutetoservicegolf.com. It would be great to see as many clients and friends of Rockport attend as possible.

As always, if you have any questions on anything we have talked about here or anything else that is on your mind, please feel free to reach out.

*The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. Results can be found at slickcharts.com.

*Treasury yields can be found at finance.yahoo.com.

*Charts produced at yCharts.com

*Bonds can be found at bloomberg.com/markets/rates-bonds

*Fed Rate Probability Chart can be found at cmegroup.com/markets/interest-rates/cme-fedwatch-too

*The LEI can be found at conference-board.org/topics/us-leading-indicators