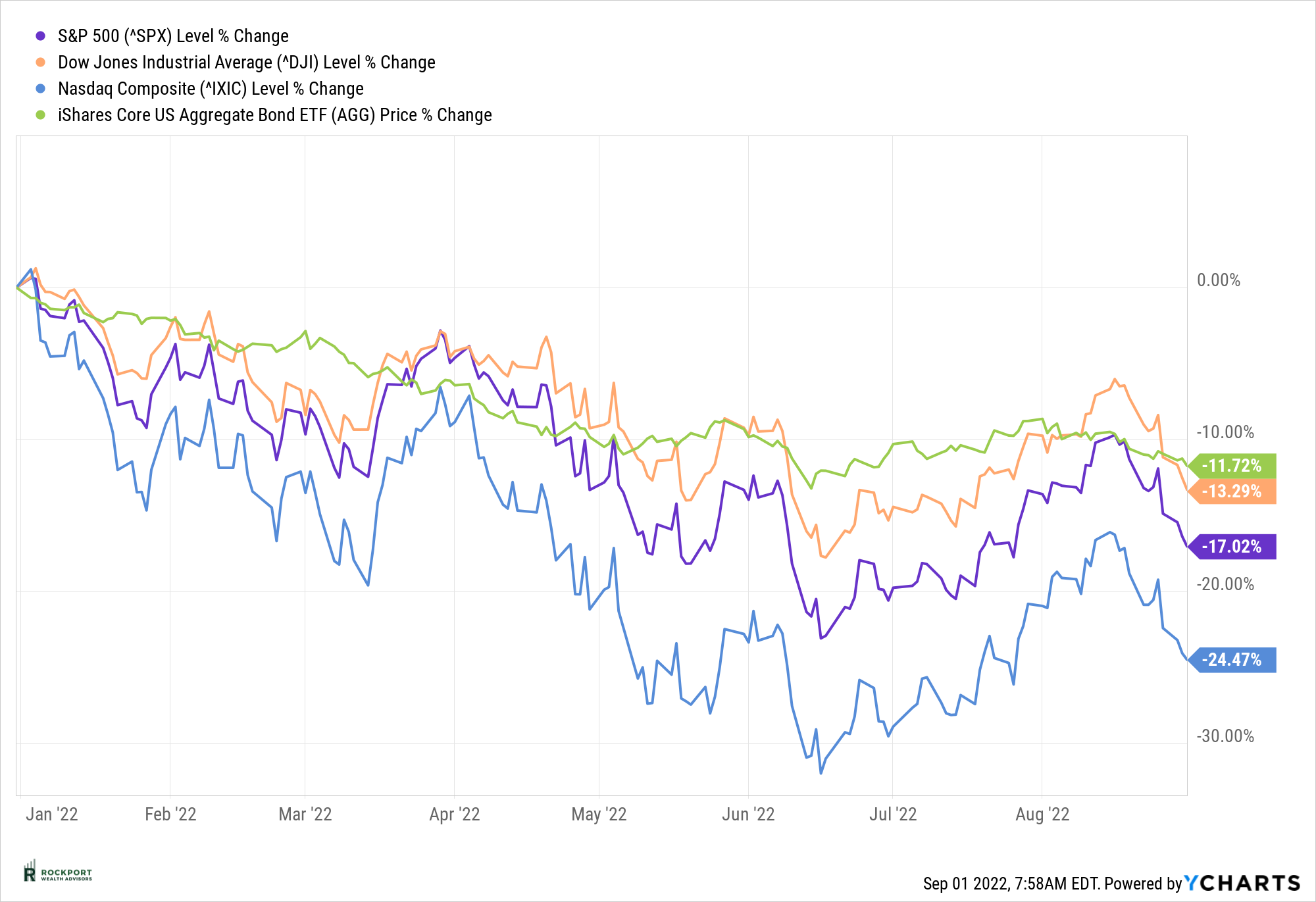

After the best month of the year in July, the markets were in give back mode again during the month of August. For the month, the S & P 500 Index was down nearly 4.25%. This brings the calendar year return for the index to -17%. Even with the rough month it is important to note that we are still well above the market’s worst levels of the year which were hit in mid-June that were nearly 6% lower than we are now:

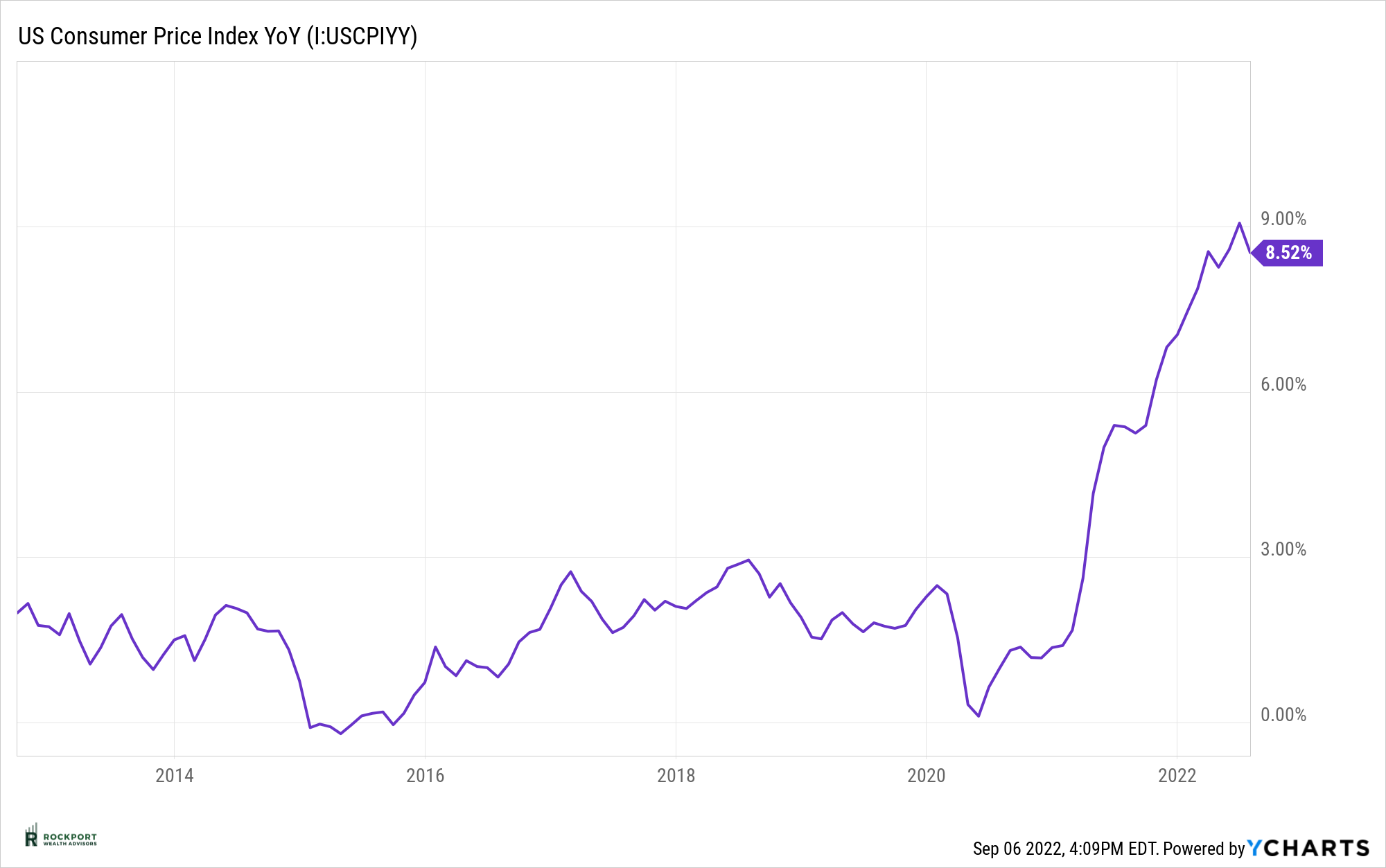

Dad are we there yet? I think we all either remember that question to our parents or have heard that question from our own children when they voice their lack of patience when it comes to getting to the final destination, we are heading to wherever that may have been. This has somewhat been the same for The Federal Reserve and Interest Rate increases this year. We keep waiting for the hint of the last rate increase or at the very least a pause and re-evaluation of interest rate levels but are not getting it. In short, No, we are not there yet. The Consumer Price Index continues to remain at stubbornly high levels (see chart below) and even though it did decline in the month of July (August data won’t be out until September 13th) it remains at multiyear highs by quite a bit. The Federal Reserve’s ultimate goal is to get inflation back to the 2% range, so we have a long way to go on that. The good news is that many commodity components of the CPI have begun to fall off and the two largest components which are both housing related are showing signs of decline as well. This is just going to take more time. The Federal Reserve is in a very difficult position in that if they raise interest rates too much, they risk throwing the economy into a possibly deep recession and if they don’t raise interest rates enough inflation may not come down to the level they want to achieve.

You will notice the addition of the stock markets return chart which is a feature we will be including going forward. We may add additional indexes to be displayed as time goes on. The point to adding this as a visual is to help illustrate a broader picture of stock and bond market performance beyond the S & P 500 index. As you can see and as we have stated there has been no place to hide during the present market downturn. Even bonds are down double digits (as represented by symbol AGG – The aggregate bond index.)

As we move into the fall a quick note on what we call seasonality of the stock market. This means that certain times of the year tend to perform better than others. The August -September time frame is typically one of the weakest of the year for the markets so the softness in August was not terribly surprising. September has historically been one of the worst months of the year on average for returns so we are mentally preparing for what could be an interesting month. The good news in all this is that the negative seasonality turns into some of the most positive seasonality starting in October and going through year end. (Past performance is no guarantee of future returns) As we have stated several times Patience is the key in the current economic and market environment. Major shifts in economic policy like we are experiencing take time to play out.

We hope all is well with you and your families. Enjoy what hopefully turns out to be some nice fall weather.

*The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. Results can be found at slickcharts.com.

*Treasury yields can be found at finance.yahoo.com.

*Charts produced at yCharts.com