Happy St. Patrick’s Day and Happy Easter to those of you who celebrate these holidays! The good news with these particular holidays is that they are signs of spring. In the north we are anxiously awaiting longer days and warmer temperatures. If you are in the south please send some warmer weather our way soon!

Markets & Economy

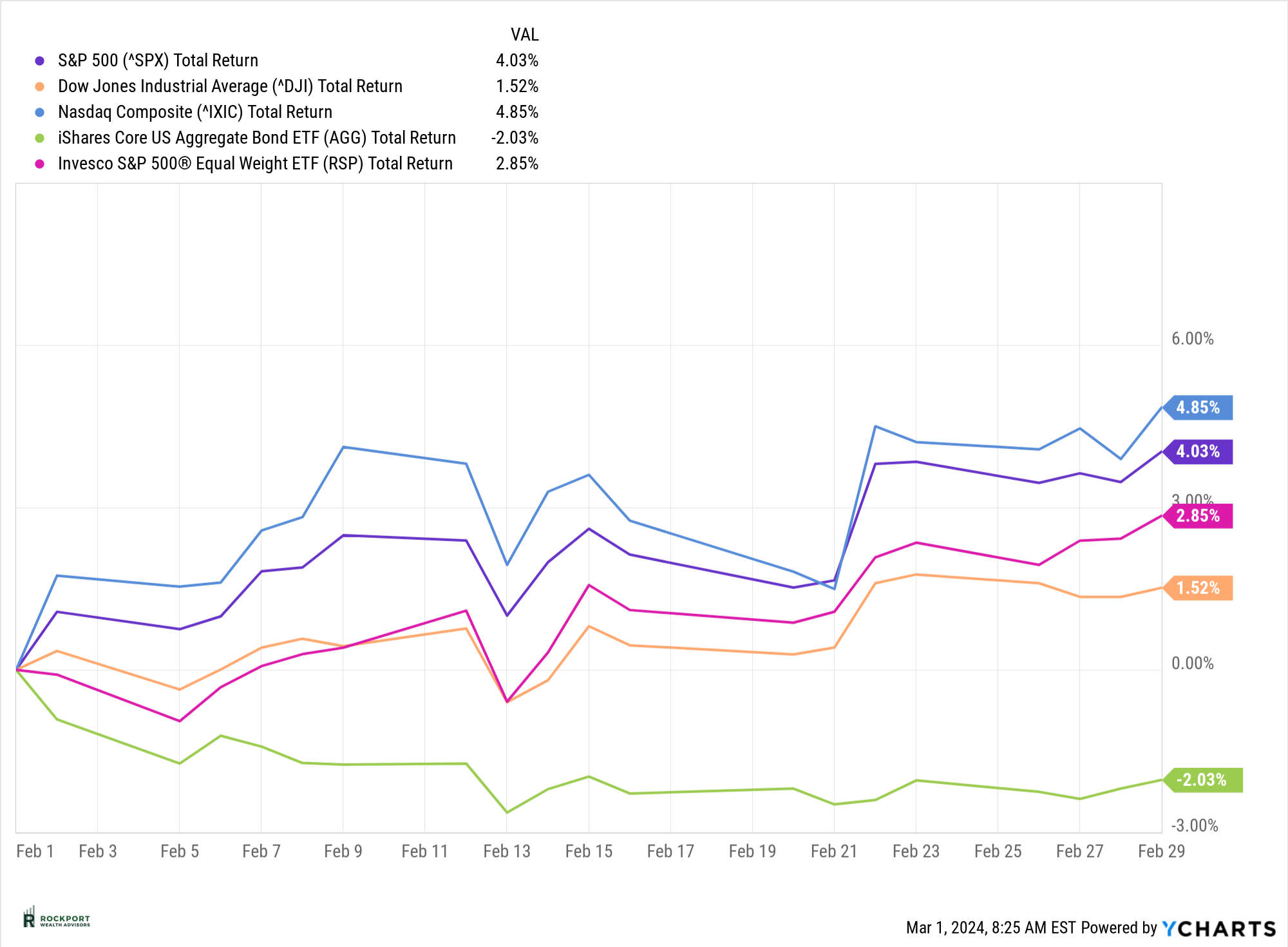

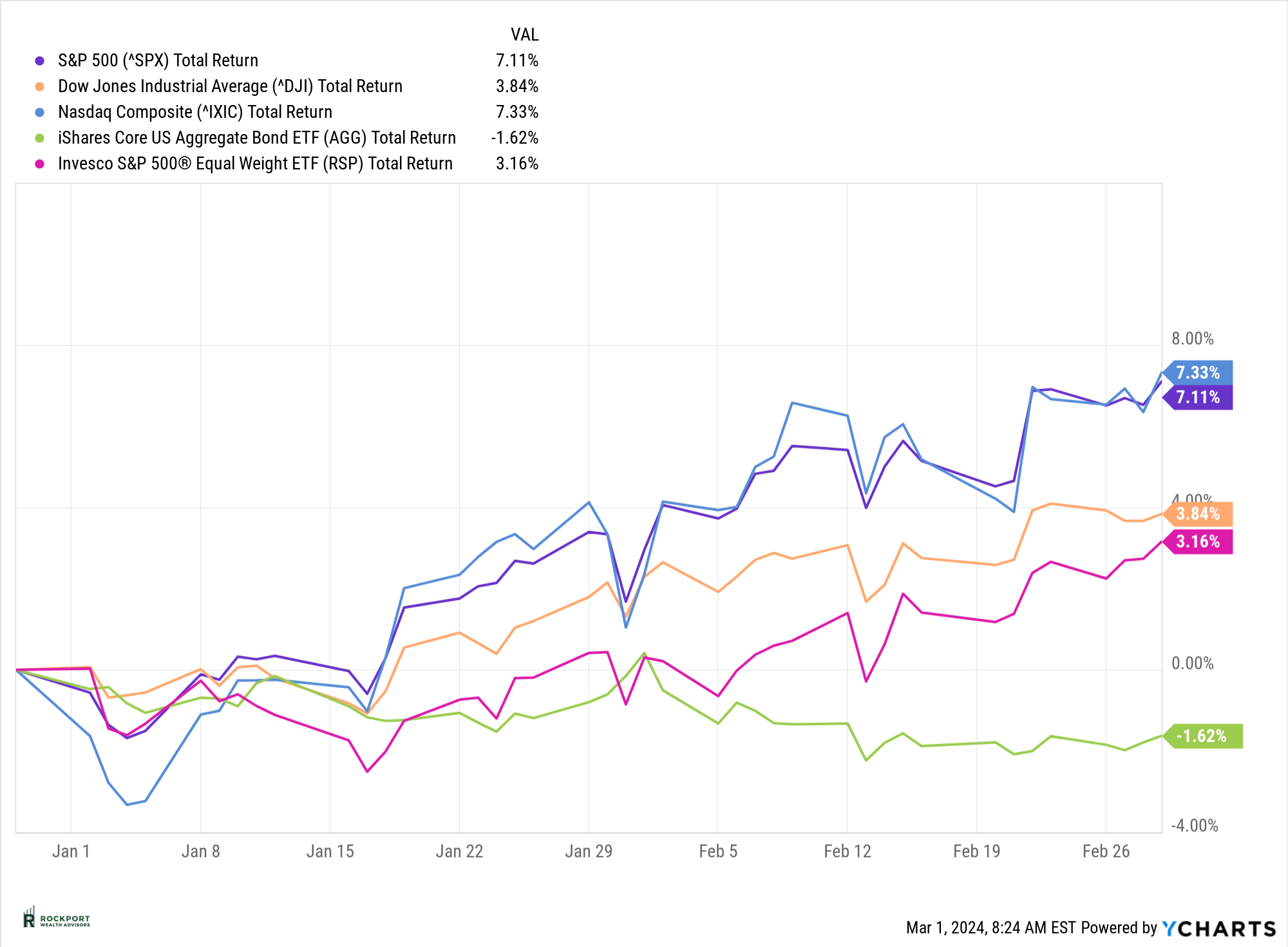

The S&P 500 continues its impressive performance, reaching new highs with only minor setbacks. Despite February being historically weak for the market, the index surged by 4.03%, bringing its year-to-date gain to 7.11%. Other indexes have followed suit, with the S&P 500 Equal Weight Index up 3.16% for the year, and the tech-heavy NASDAQ, which includes the “Magnificent 7,” up 7.33%. Bonds are the only asset class showing negative returns so far this year, down by -1.62%. Money market rates remain strong, with yields hovering around 5%.

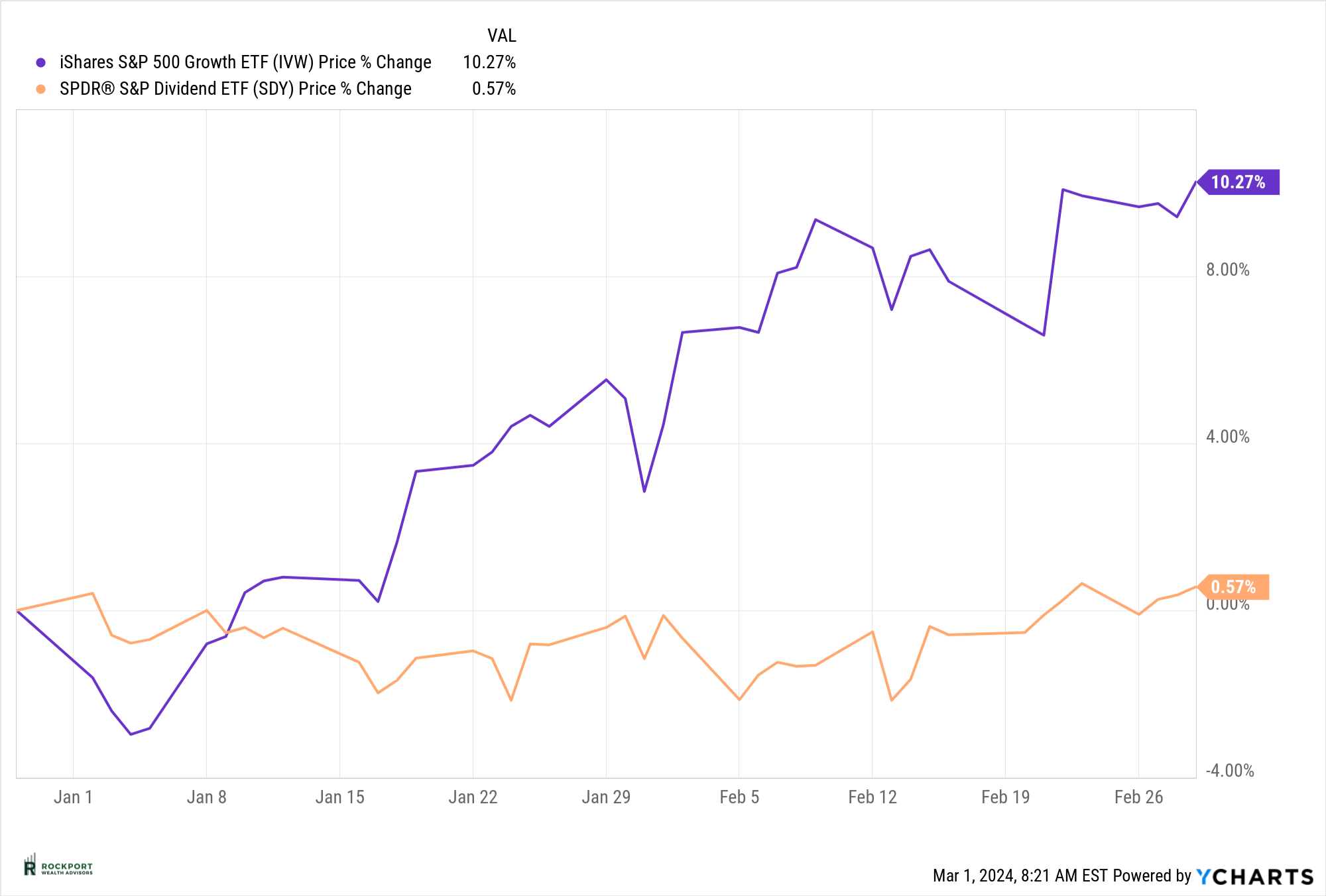

Our stance remains unchanged: we believe the stock market is currently overheated and overvalued by historical standards. The enthusiasm surrounding artificial intelligence (AI) has propelled some stocks to extremely high levels. A pattern reminiscent of the late 1999 and early 2000 period has emerged. While we are not predicting a repeat of the prolonged decline and underperformance seen during that time, the adage “history doesn’t necessarily repeat itself but it sure rhymes” seems relevant. The unfolding of events over the course of the year will provide more clarity.

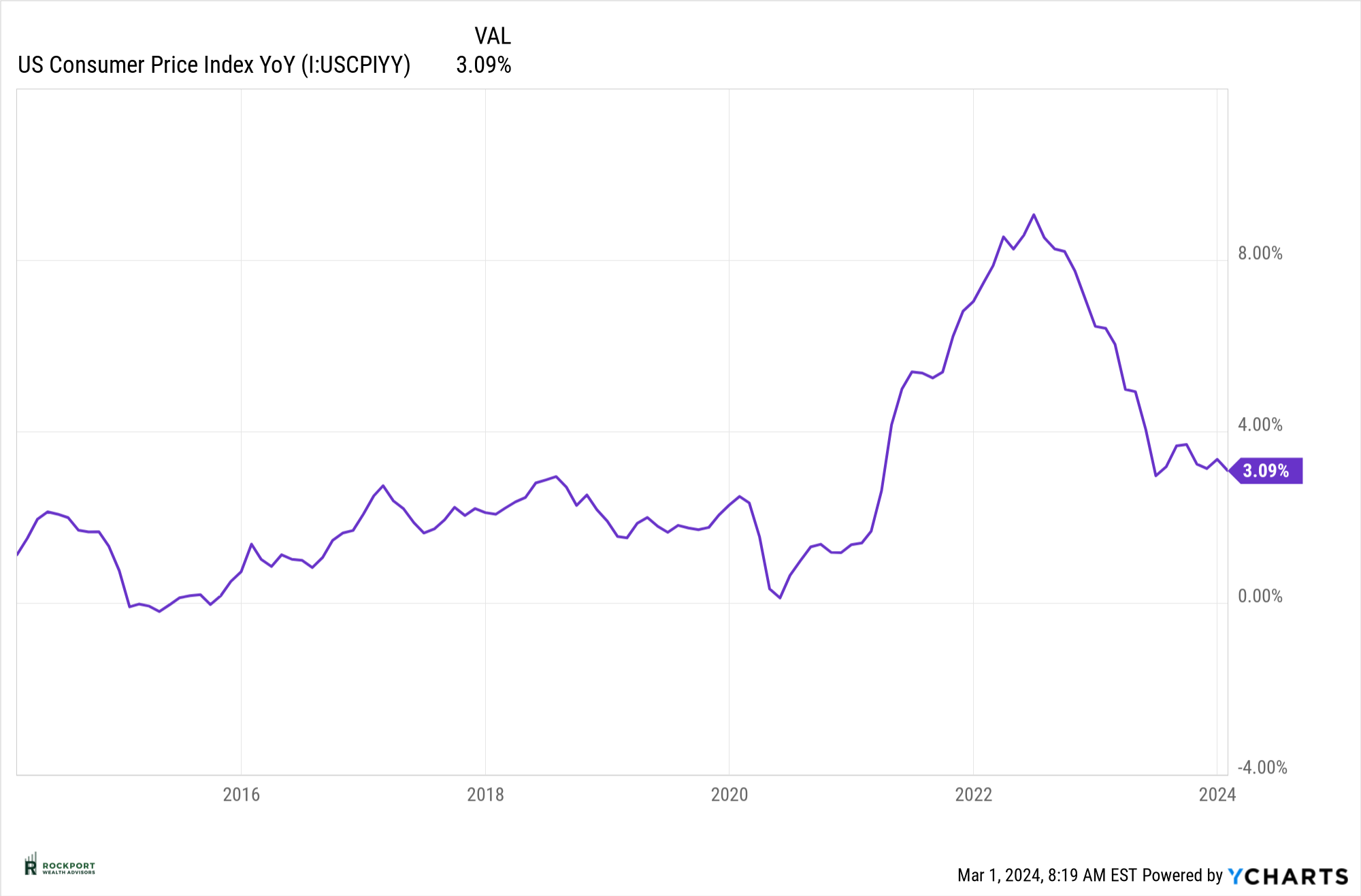

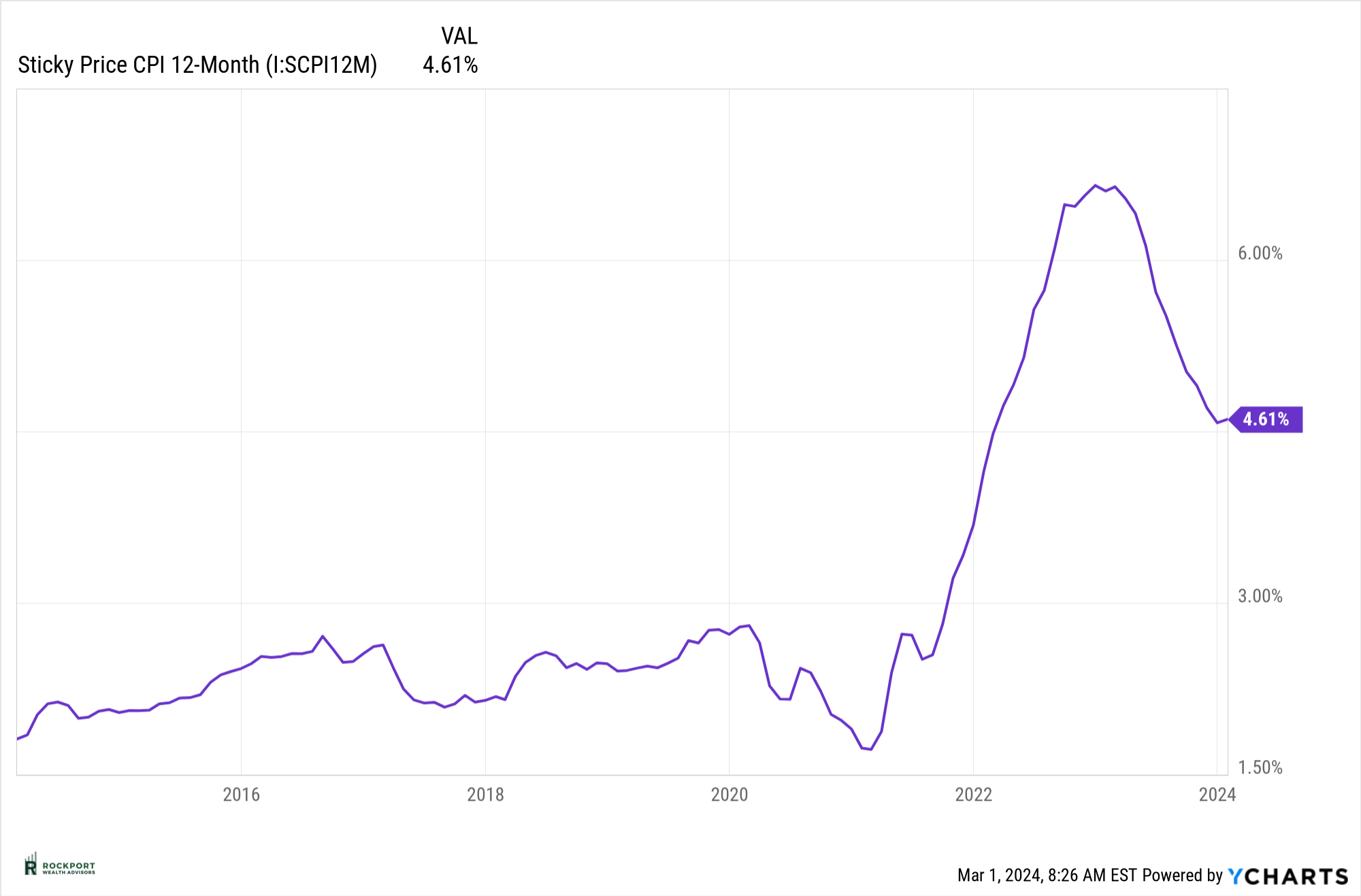

The Federal Reserve maintains its stance that it will not consider interest rate cuts until inflation reaches or nears its target of 2%. It is remarkable, to say the least, how the market has reacted to this, considering that much of the upward momentum has been based on the expectation of interest rate cuts this year. The Consumer Price Index (CPI) remains in the 3-3.5% range, showing no significant improvement over the past six months. The Sticky CPI actually increased this past month to 4.61%. It is evident that the Fed still has work to do, and interest rate cuts at this time would not facilitate their efforts to lower inflation. The stock market’s prevailing expectation is that the Fed will make noticeable interest rate cuts in 2024.

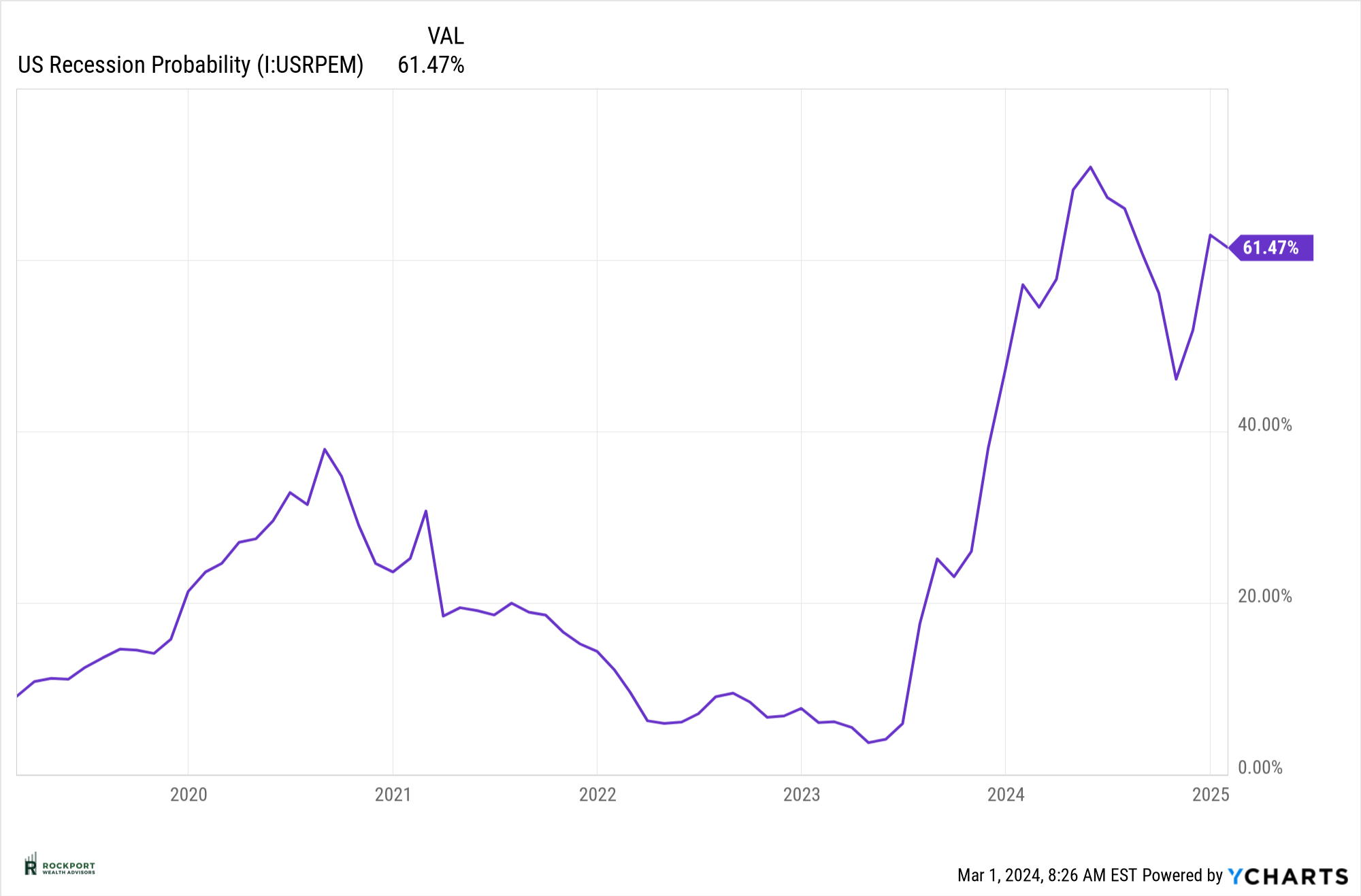

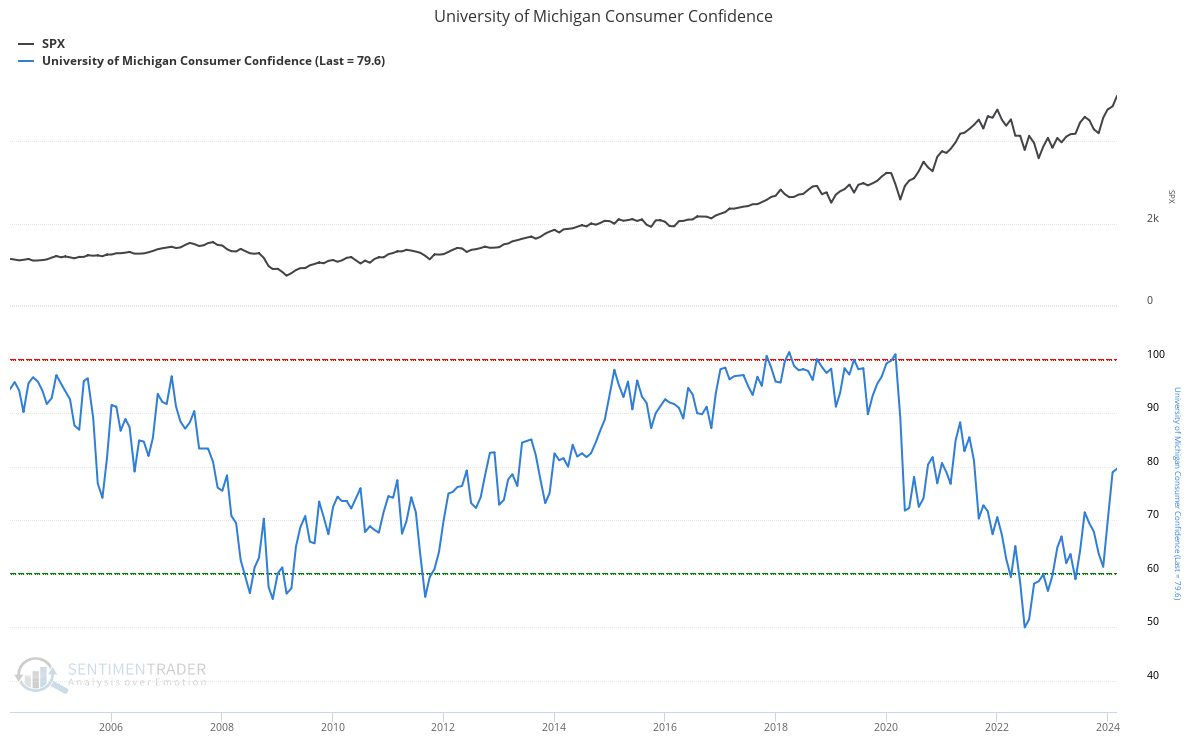

The likelihood of a recession remains elevated, although there are indications that the Fed may be able to achieve a soft landing, avoiding a recession. Consumer confidence has noticeably improved since the middle of 2023, a crucial factor in assessing potential recessions, as a significant decline in confidence often precedes a recession. Additionally, if inflation can remain subdued and decrease from current levels, it would further bolster consumer confidence. However, the issue with inflation is that it impacts everyone’s daily activities and expenses, which can erode confidence, unless one avoids activities like eating, drinking, driving, or living in a home—all of which have seen increased costs compared to a year ago. At the time of this writing, commodities are up 7% for the year, global shipping rates have doubled, housing prices have risen, and oil prices are up 10%, all suggesting a potential increase in inflation going forward. As mentioned earlier, the Fed has its work cut out for them.

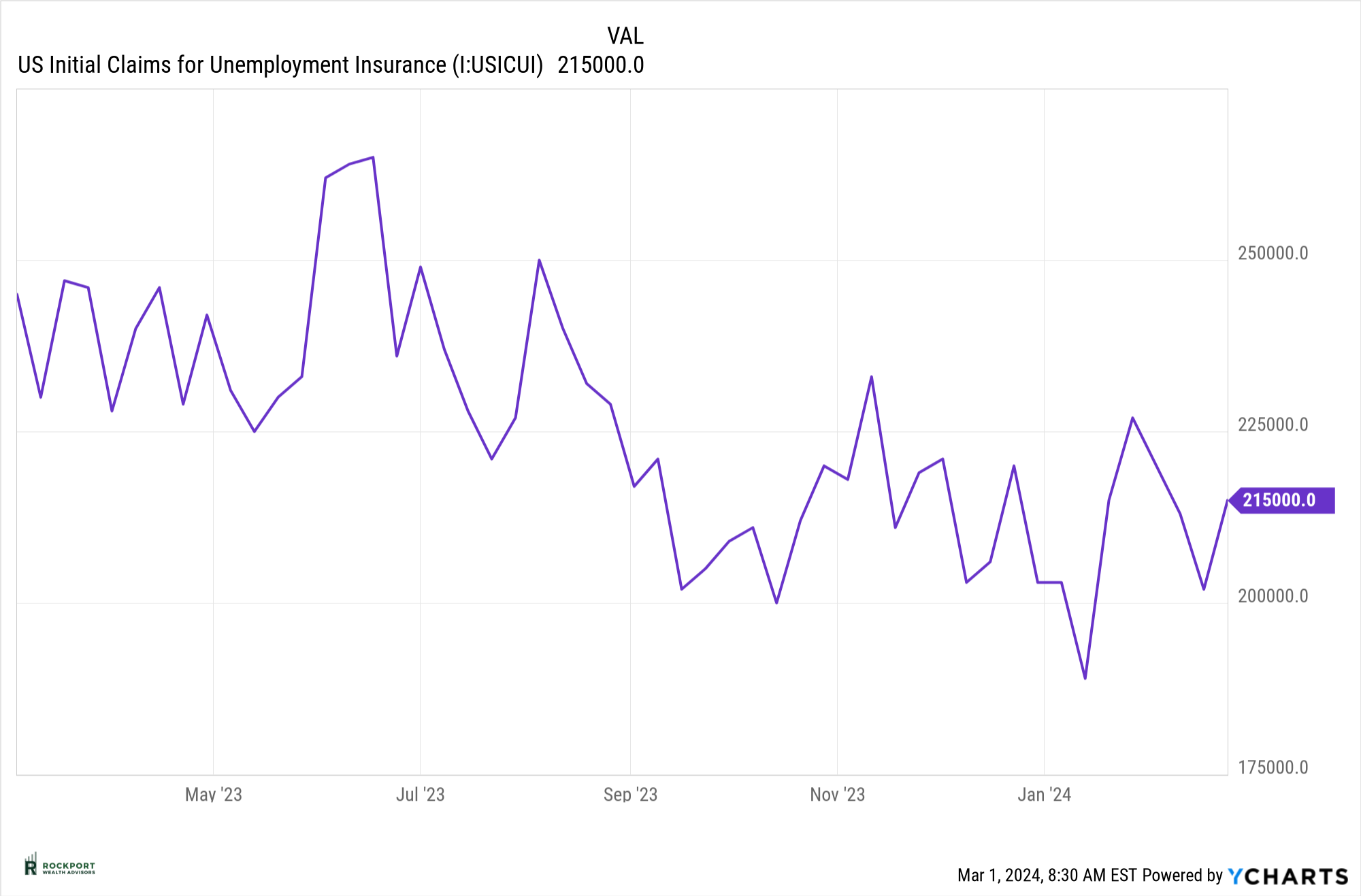

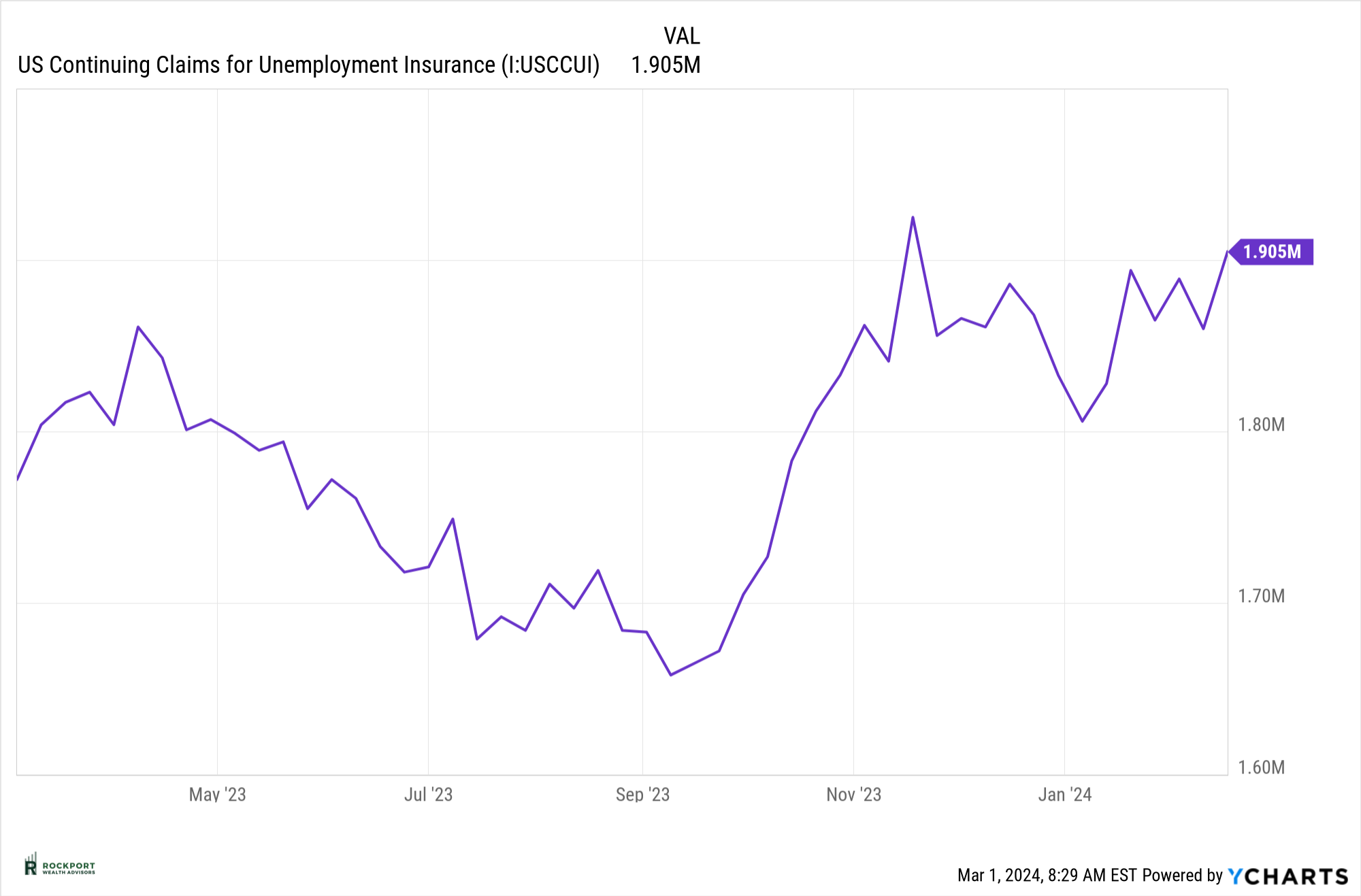

Finally, we are closely monitoring the employment situation. Both initial and continuing claims for unemployment have risen since the beginning of the year. This is a trend we hope will not persist, and we are confident that the Fed is closely monitoring this situation as well.

Let’s close out with a few housekeeping items:

Taxes

A friendly reminder that the Tax filing deadline is April 15th. If you need any assistance from us in terms of locating possible tax forms or verifying that you have the correct forms, please reach out. In addition, if you would like us to review your return from a financial planning perspective, we are happy to do so. Just reach out and we can send a secure link for you to forward by email.

Cetera Advisors Fair Fund Claim

Many have received or will soon receive documentation from our previous Broker Dealer about a Cetera Advisors Fair Fund claim. This claim dates back to 2019. Questions have come up as to if this is a legitimate claim. The short answer is yes, it is and if you so choose you may complete the back pages of this document and submit to claim your fee reimbursement. The amounts per client vary from a few dollars up to several hundred in some cases. If you have any questions on this feel free to give our office a call.

Beneficiary Updates

Thank you for your prompt responses to our beneficiary update campaign. We greatly appreciate your cooperation in getting their information back to us. If you have not, please do so as soon as possible. This is an extremely important piece of information to have up to date and can save your loved ones and heirs a great deal of headache and possibly tax savings if addressed now.

As always, if you have any questions on anything we have talked about here or anything else that is on your mind, please feel free to reach out.

*The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. Results can be found at slickcharts.com.

*Treasury yields can be found at finance.yahoo.com.

*Charts produced at yCharts.com

*Bonds can be found at bloomberg.com/markets/rates-bonds

*Fed Rate Probability Chart can be found at cmegroup.com/markets/interest-rates/cme-fedwatch-too

*The LEI can be found at conference-board.org/topics/us-leading-indicators

*Treasury Yield Curve can be found at Gurufocus.com

*University of Michigan Consumer Confidence produced at SentimenTrader

*Rockport Models – Please remember we are referencing our model portfolios, and your portfolio may differ from the models mentioned depending on your individual needs and circumstance.