Normally as July rolls around we are in the midst of summer doldrums in the markets, and we struggle for topics to talk about in the newsletter. Not so much this year. The end of June marks the end of the 2nd quarter 2022 and as we all know by now the first half of the year has been extremely volatile mostly to the downside.

For the month the markets once again had brief rallies that lasted for several days but unfortunately the momentum continued to the downside a good amount of the time. The S & P 500 closed out the month in official bear market territory down just over 20% for the year, slightly off its worst levels which were over 23%. This has been one of the worst starts to the year in a long time. Let’s hope the second half brings some relief.

The stories have not changed much. The market continues to struggle with the number and amount of interest rate increases that the Federal Reserve will do. Jerome Powell (Fed Chairman) recently stated that a recession is possible and a soft landing, which is essentially the art of raising interest rates without causing a recession, may be very challenging. This is the first time he has made such statements and historically it has been very difficult for the FED to raise interest rates and not cause a recession. It is entirely possible that we are already in one and if not one is becoming increasingly more likely. Such comments can be disturbing to investors but its important to keep in mind that we are not referring to the chaos that ensued in 2008 which, when we say recession is where a lot of minds go. A recession by definition is simply a sustained period of weak or negative growth that is typically accompanied by High unemployment. The part of the definition that is clearly missing right now is the high unemployment. As we all know help wanted signs have become a part of most if not all landscapes around the country at the moment. This will bear watching in the coming months.

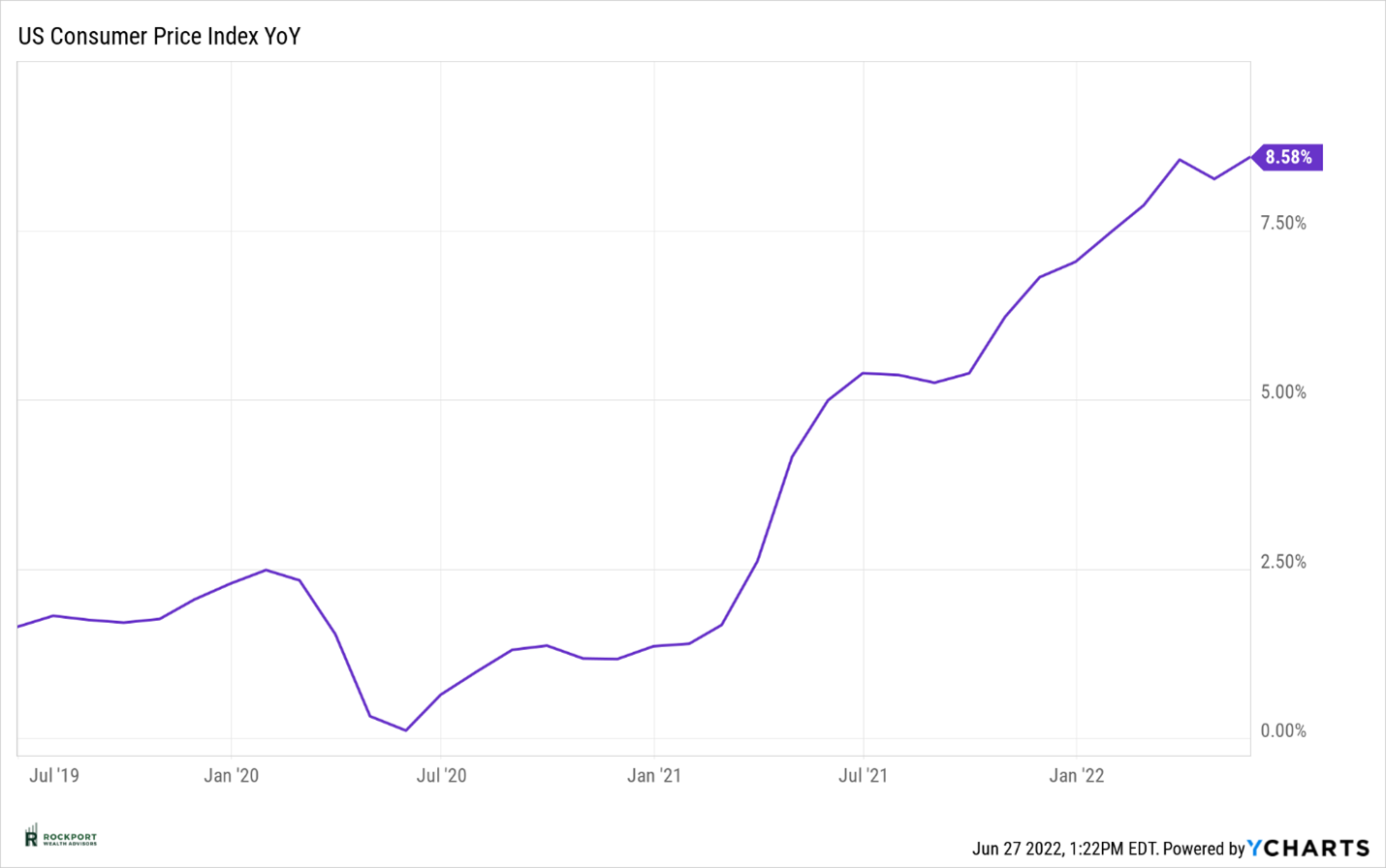

The big question from last month’s newsletter was “have we seen the high in the Consumer Price Index.” This was answered when the CPI hit a new high of 8.58% in May (see chart). This increase prompted the Fed to raise interest rates 3/4 % which was completely unexpected when the month started. The bottom line remains the same here. The need for inflation to level off and eventually decline is imperative to getting stability back in the financial markets as this relates directly to the Fed’s raising of interest rates and the eventual ending of that process.

A few words about Crypto and Housing, both of which were riding high like the stock market as we entered 2022. Crypto prices (ie. Bitcoin) have absolutely fallen off a cliff in recent months and many are at multi year lows. The declines have been staggering and have been way more than stocks or bonds have experienced. There is little doubt that this has contributed to the decline in the stock market as many of the Crypto currencies were bought on margin (borrowed money) and when prices fell sharply those margin loans came due. When a margin loan comes due the investor must put cash into the account to make up the shortfall somehow and often times that cash is raised by selling stocks which are fairly liquid assets. Housing on the other hand appears to just be starting its pricing adjustment that most other asset classes have already experienced. Higher interest rates have driven mortgage rates to levels not seen since the 2008-time frame. That combined with excessive home prices have begun to soften the market. As with any market its impossible to know the severity of price declines but the pieces are clearly in place for a housing market correction. Time will tell.

Lastly with statements coming out at the end of June, sticker shock may be an issue to some who don’t follow their investments as closely as others. Many of our investment partners only send quarterly statements and at the end of Quarter 1 the markets while down were not down that much. Quarter 2 has been exceptionally difficult comparatively. If you would like to take a closer look and review your plan, please reach out to us to schedule a time.

*The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. Results can be found at slickcharts.com.

*Treasury yields can be found at finance.yahoo.com.

*Charts produced at yCharts.com