Markets & Economy

Happy Spring!

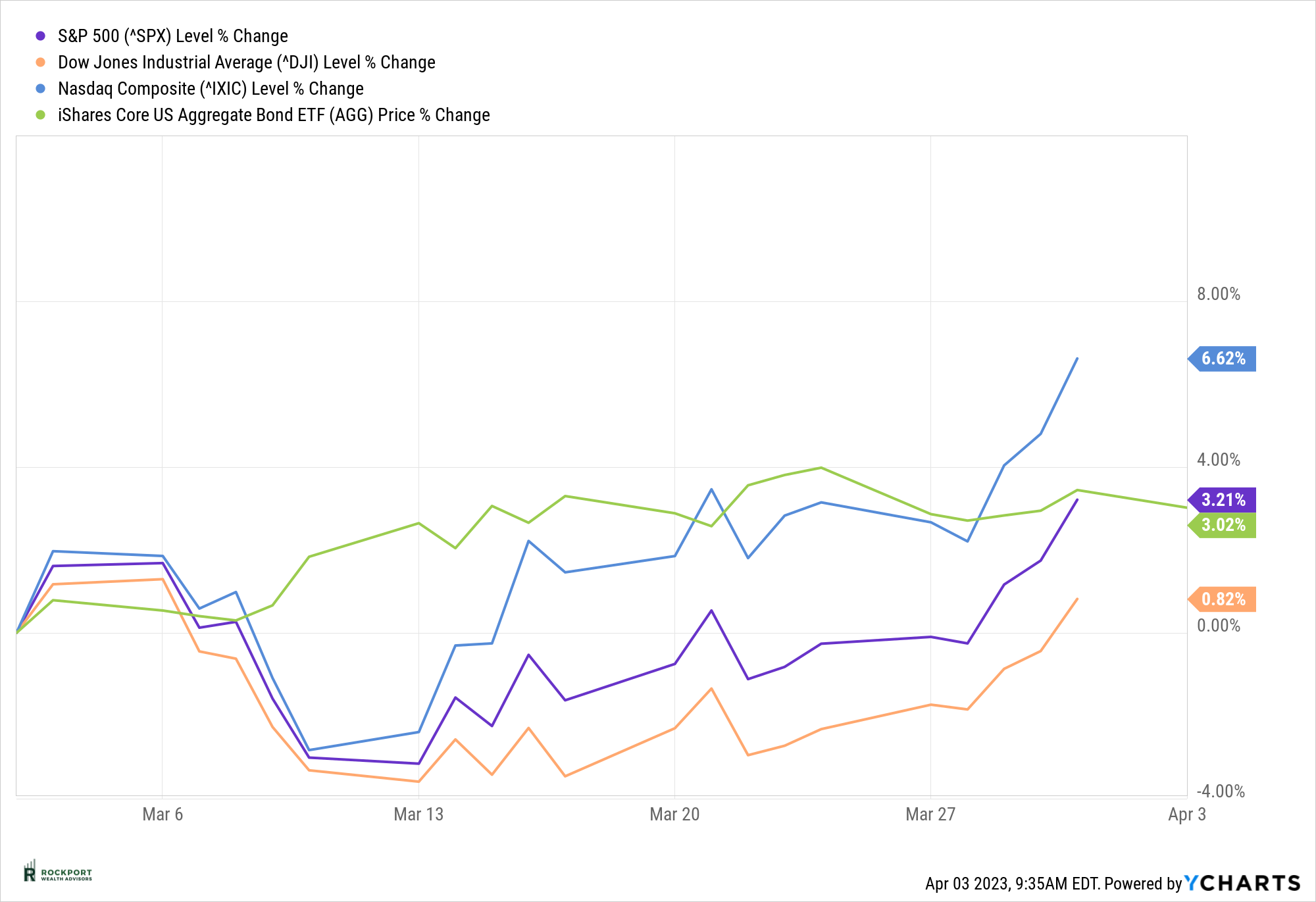

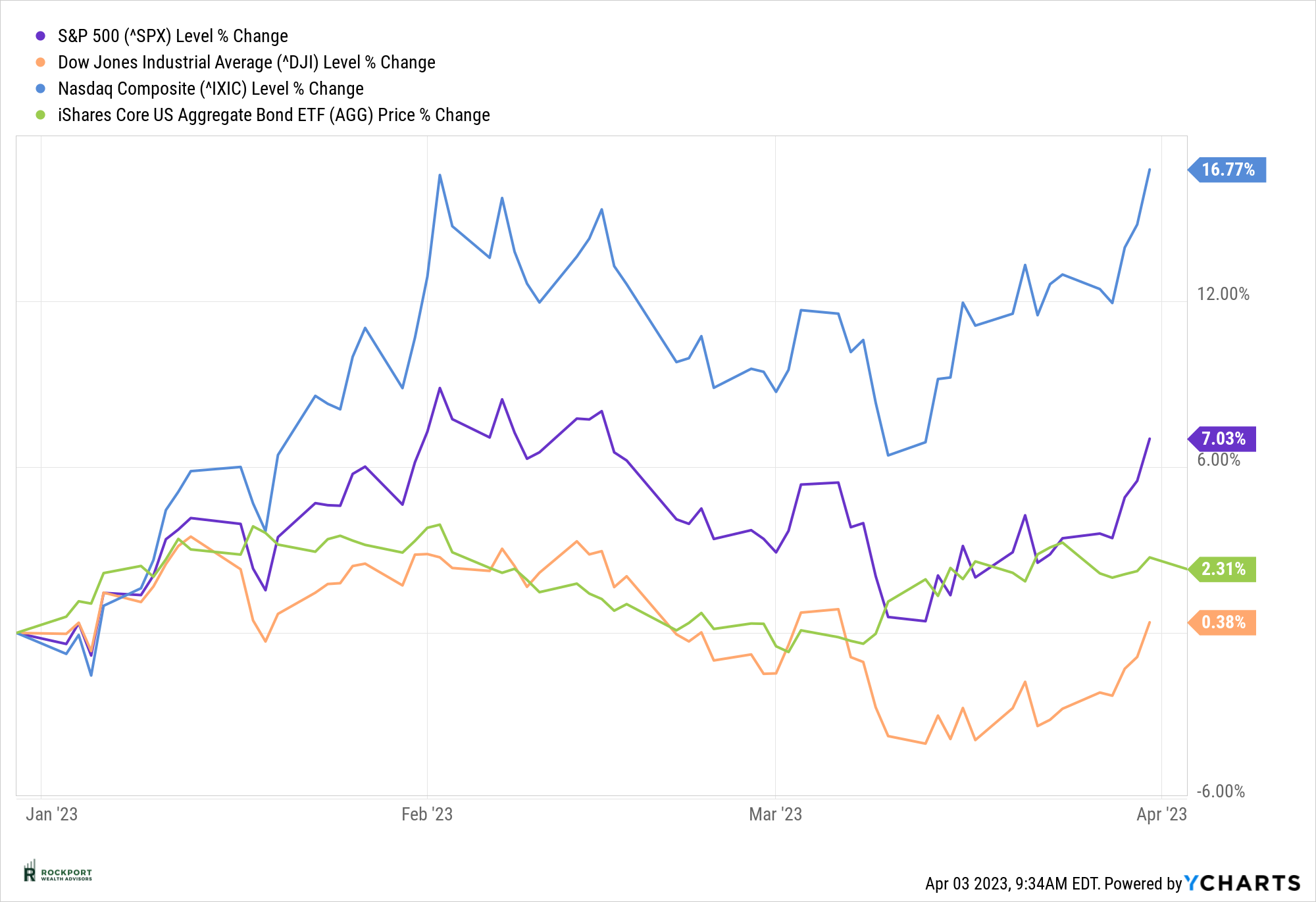

The month of March ultimately turned out to be a very good month for both stocks and bonds. Things started out strong, then disruptive news on the banking industry caused a noticeable mid-month swoon which fortunately recovered strongly by month end. When the final bell rang on March 31st, the S&P 500 index was up 3.21% for the month. Year to date the index is up 7.03%. It is important to note that even though the index had a strong quarter it was largely driven by only a handful of stocks. If you removed the top 10 performing stocks the S&P 500 would not be in positive territory for the year. We call this market breadth and if the market is going to continue its winning ways the breadth will need to improve and more stocks will need to participate in the rally. The first quarter was strong among nearly all asset classes as even bonds as measured by the Aggregate Bond Index were up 2.31%. (See monthly and year to date charts below)

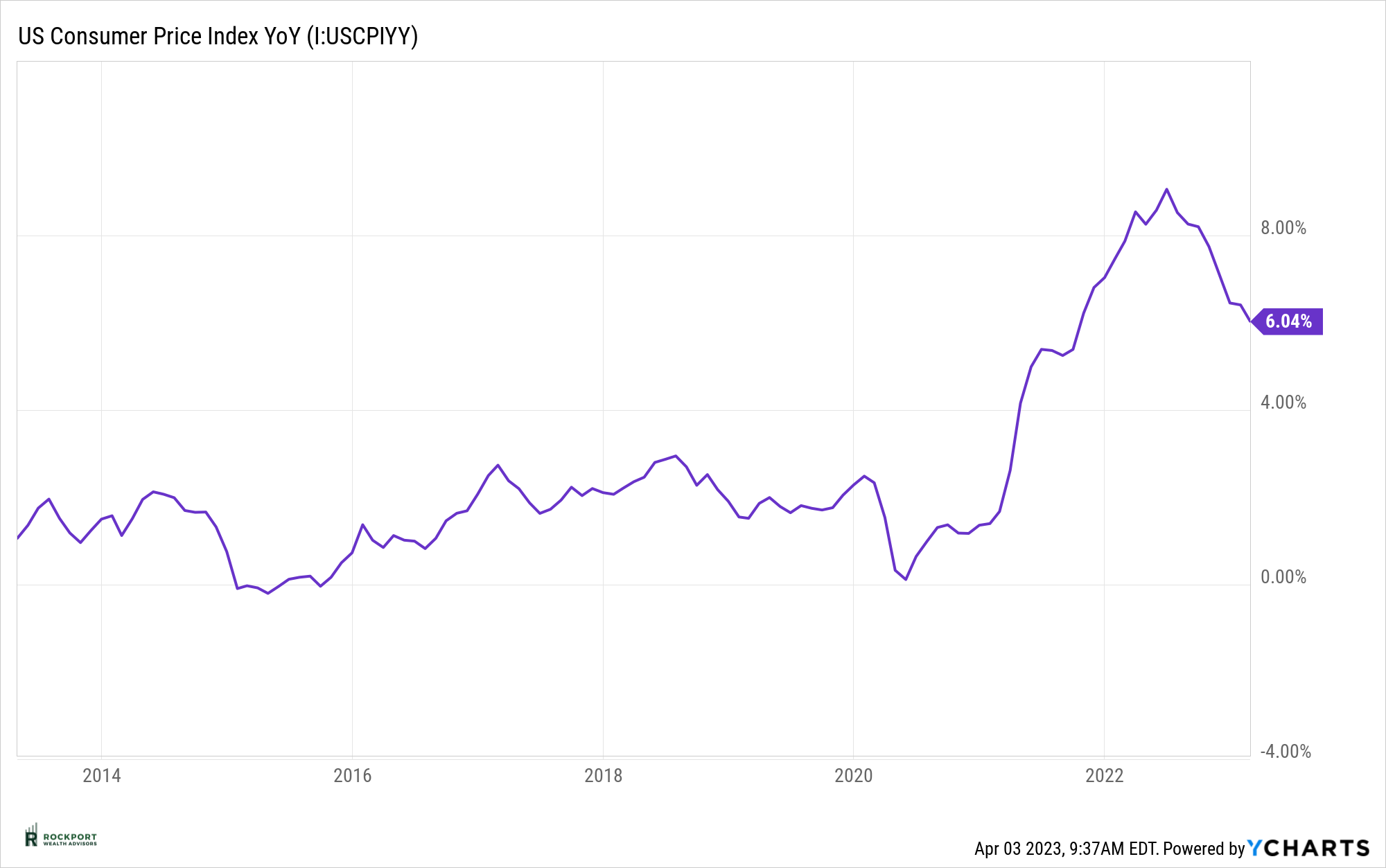

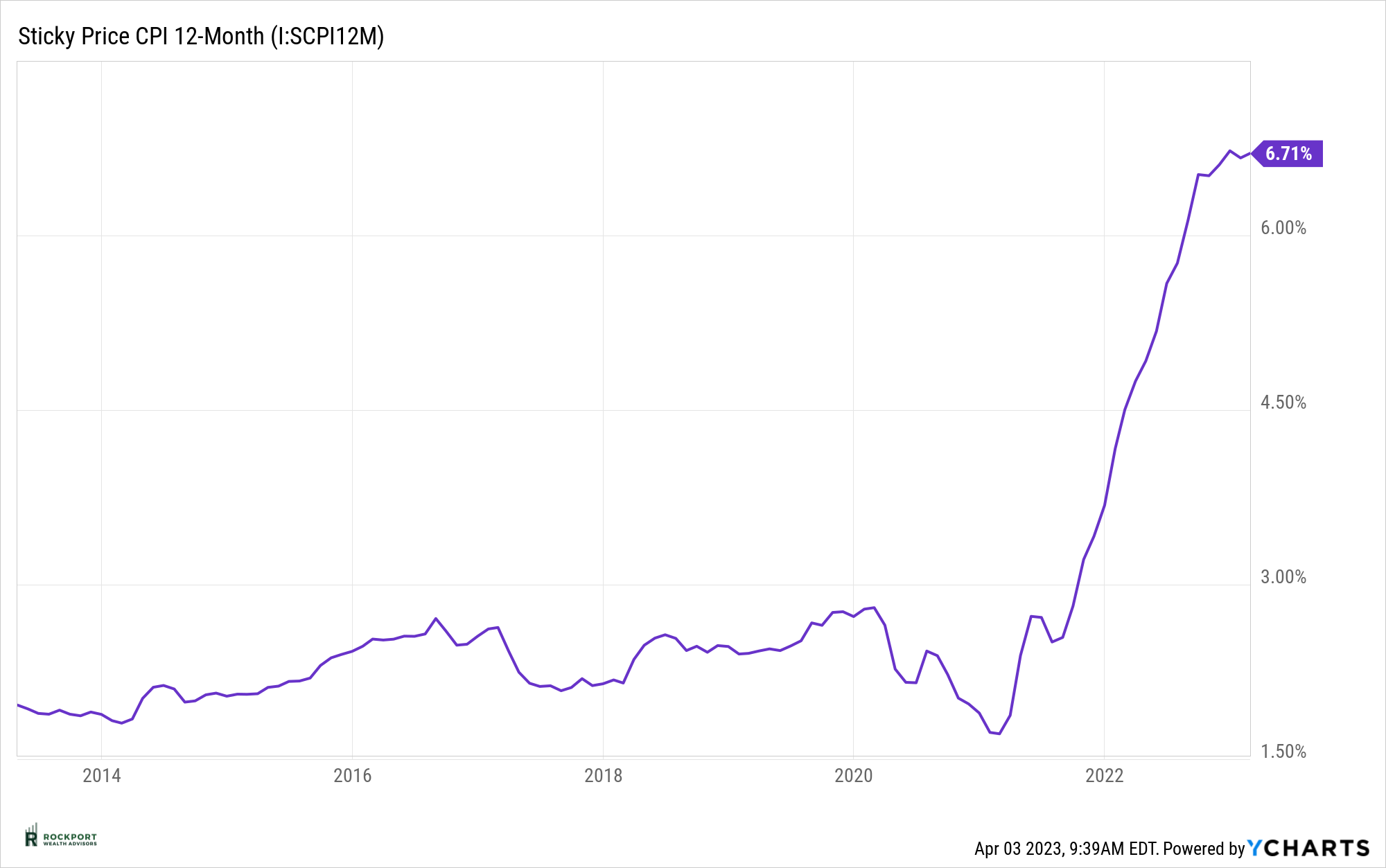

Inflation and recession fears are still present, however both of these fears lessened over the course of the month. The Consumer Price Index moved another notch lower as it came in at 6.04%. (see chart below) Slowly but surely progress is being made. Last month we introduced Sticky CPI and stated that this particular reading had not been showing the same progress as the standard core CPI. This is still true as in March, the sticky CPI (see chart below) moved slightly higher to 6.71%. Clearly rents, housing and medical services are not dropping in price very much, if at all so far. As we had stated, this may be more of what the Federal Reserve is watching when they make their interest rate decisions. As of the writing of this letter, the probability of the Federal Reserve raising interest rates another ¼ point is 57% while the remaining 43% chance lies in no change at all.** It sure seems as if Chairman Powell would like rates higher yet vs lower.

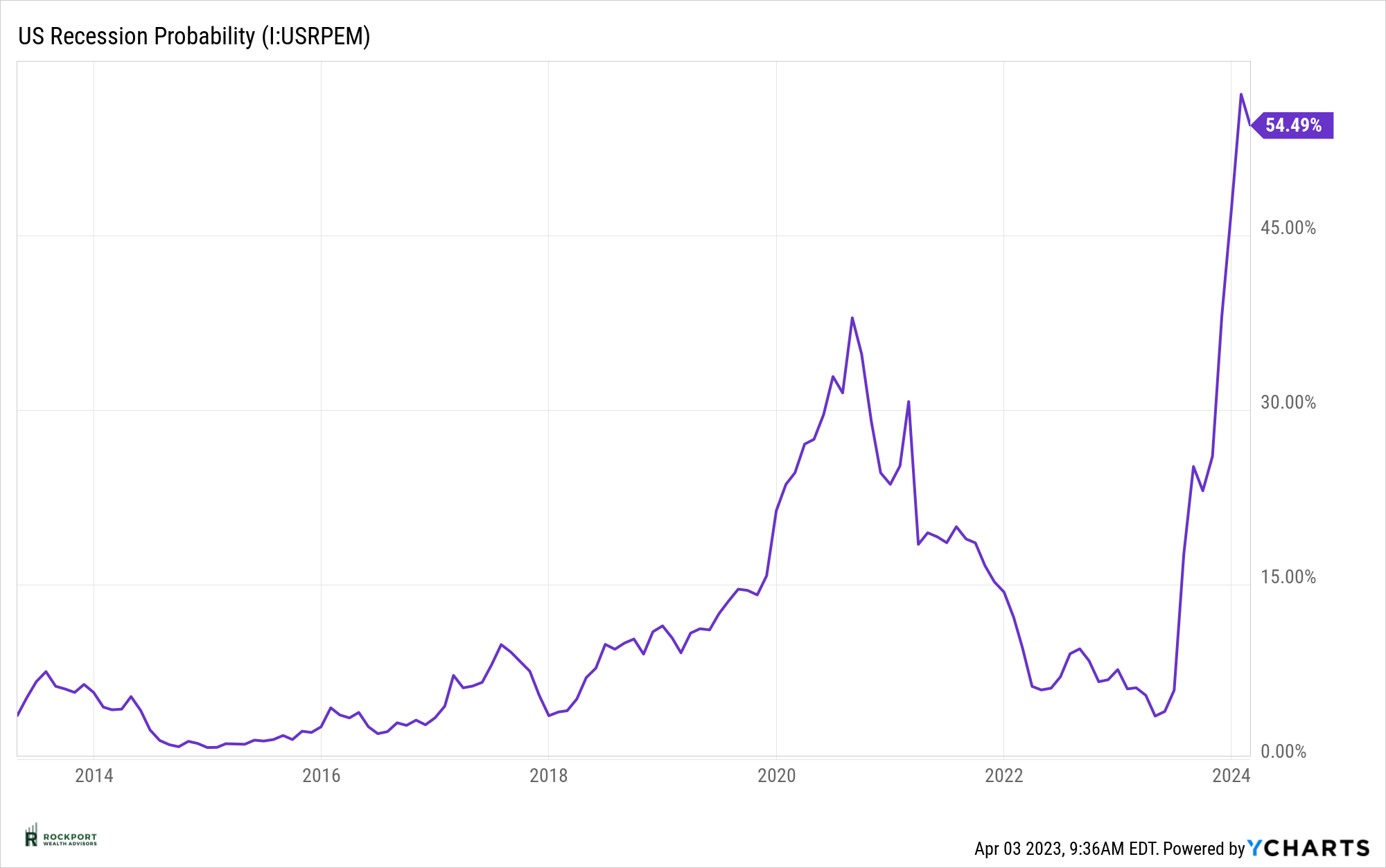

Our list of unsettled events actually grew during the month of March and to be quite frank we are surprised to see the stock market’s resilience given the continued stubborn sticky inflation, increasing international tensions and now the indefinite nature of what the media is calling a banking crisis. We hardly think it is a crisis at this point given only a handful of banks have had issues due to poor management but it bears watching to see if this becomes more widespread. All of the above play a roll in what ultimately the Federal Reserve will do with interest rates which is the true driving factor in what takes place. They still have inferred that they would like to keep pressing rates higher, however, given the newest addition to the list of the banking issue, will they really be able to do so? For what it’s worth, the New York Feds recession probability model actually declined slightly in March (see chart). It’s noteworthy to keep an eye on the employment picture during times of potential recession. Currently, while a number of layoffs have been announced they have not had a material impact on the overall employment picture. This is something we will be watching closely in the months ahead.

Rockport Models

Cautious Change

Our models continue to run a bit more on the cautious side as we enter the second quarter of 2023. We stand ready to make changes at any point in time but at a minimum you may see an additional rebalance or two during the course of the year just to keep the stocks, bonds and alternative investments in line with our model allocations.

Industry Topics

Roth Conversion

It is no secret that IRA withdrawals which are taxable as ordinary income add to the tax bill overtime. They also have an effect on things such as Medicare premiums. One possible way to control this situation is by exploring a Roth Conversion. In short, you pay taxes now on changing (converting) IRA money to a Roth in exchange for tax free withdrawals later on (Including for your beneficiaries!) We now have software that allows us to run custom scenarios for each client. Where it makes sense we will be approaching clients that may benefit from this but if you would like to explore further please reach out.

Rockport News

Mark Your Calendars!

Our 3rd Annual Salute to Service Golf Outing which benefits several Veteran Organizations is scheduled for Monday August 14th. Once again it will be held at Red Tail Golf Club in the Cleveland Area. Details on participating or donating can be found at Salutetoservicegolf.com. It would be great to see as many clients and friends of Rockport attend as possible.

As always, if you have any questions on anything we have talked about here or anything else that is on your mind, please feel free to reach out.

*The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. Results can be found at slickcharts.com.

*Treasury yields can be found at finance.yahoo.com.

*Charts produced at yCharts.com

*Bonds can be found at bloomberg.com/markets/rates-bonds

**Fed Rate Probability Chart can be found at cmegroup.com/markets/interest-rates/cme-fedwatch-tool