For those that were in the viewing area, we hope everyone had a chance to view and enjoy the eclipse. It truly was an incredible sight to see.

Markets & Economy

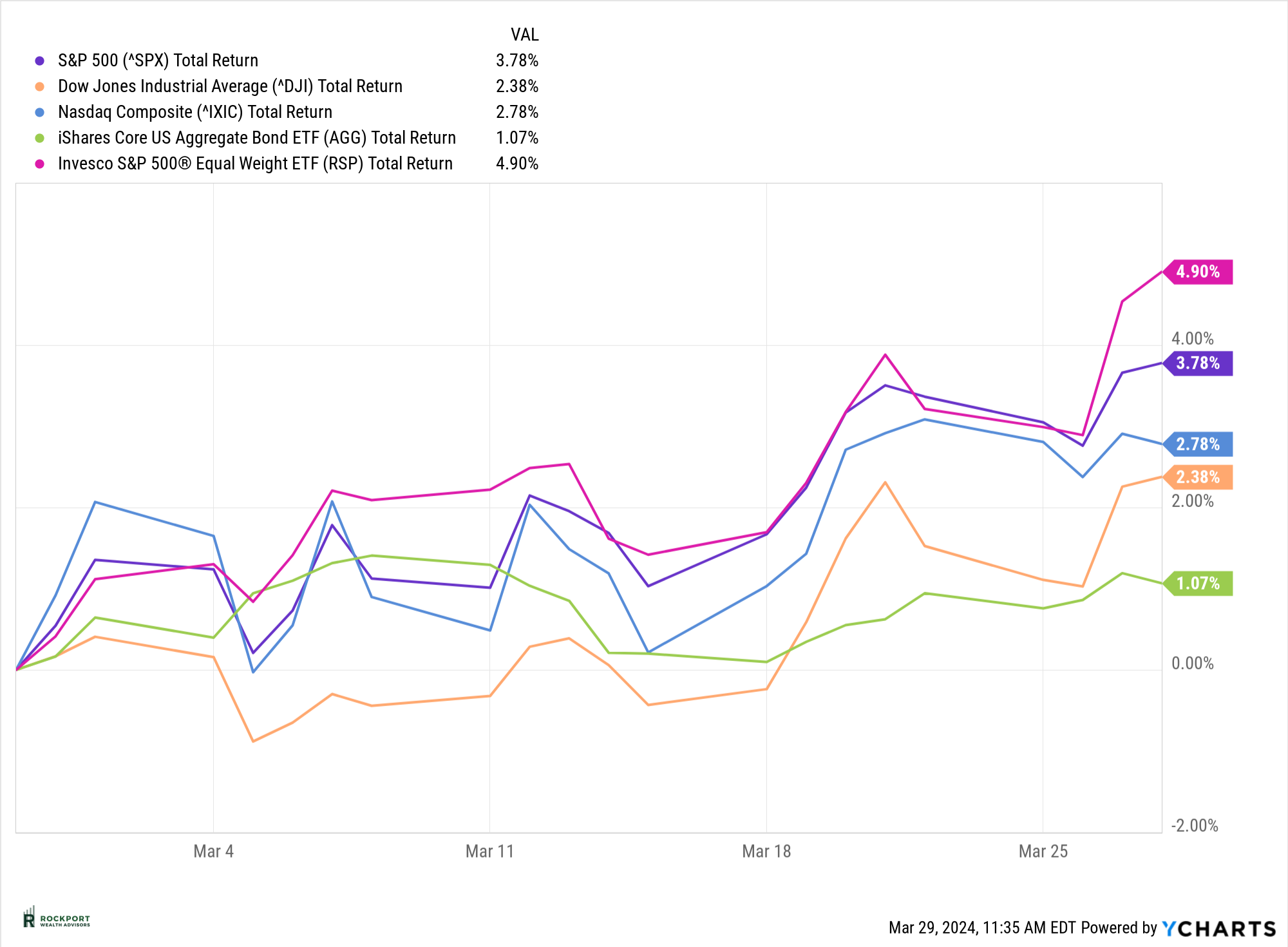

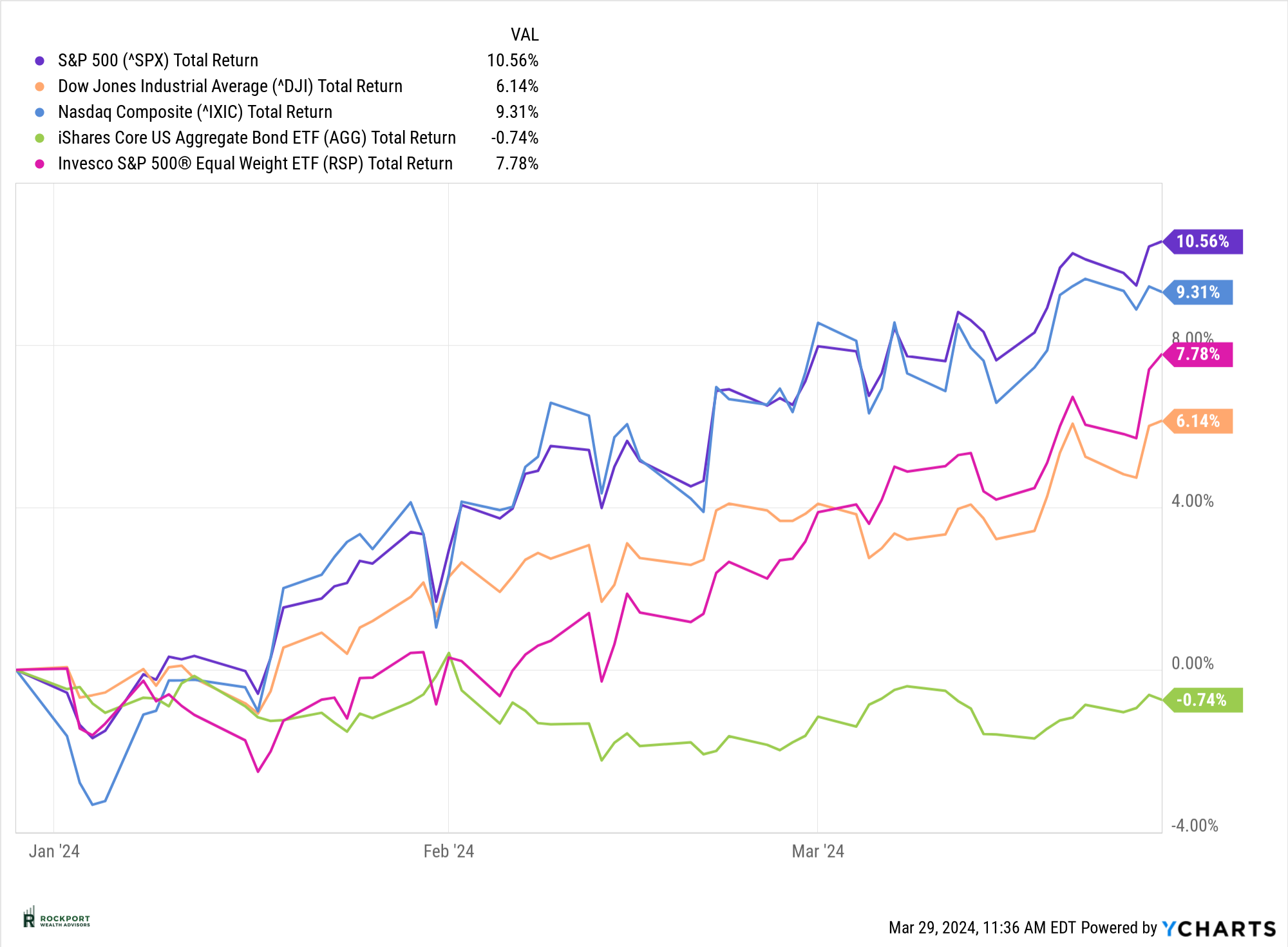

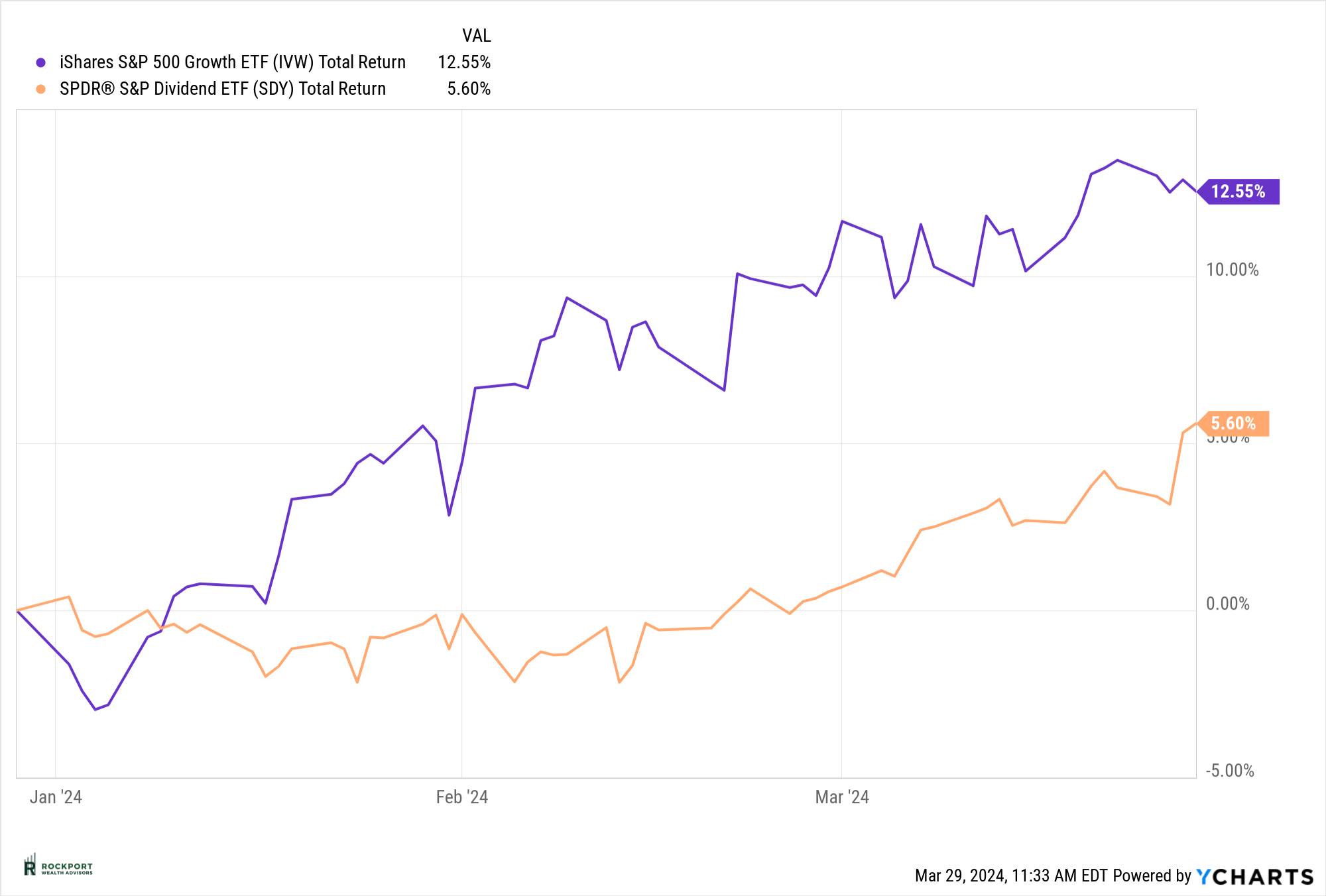

As we wrap up the first quarter of 2024 and enter the second, markets continue to maintain high levels. The S&P 500 rose by 3.78% for the month and is now up by 10.56% for the year. The stock market’s resilience is truly remarkable at this point, surprising not only us but also many Wall Street experts, with five consecutive months of gains. As we mentioned last month, there seems to be a disconnect, as many traditional indicators of both recession and stock market valuation are seemingly being disregarded. Perhaps the takeaway is that stocks often follow their own path, and many economic or market issues, whether real or perceived, don’t become significant until they do. Based on past patterns, at some juncture, the markets will start paying attention to these indicators again, and they will once again become relevant.

One compelling illustration of the stock market’s overvalued state is by observing the actions of major players. Warren Buffett’s Berkshire Hathaway, for instance, currently holds a record $167 billion in cash. This signals their view that stocks are overpriced at these levels. Additionally, several CEOs of major corporations have been selling their company stock to capitalize on the exceptionally high stock prices. These actions speak volumes about the current market conditions.

As April comes to a close, so does the most historically positive seasonality period for stocks, spanning from November through April. There’s a well-known adage on Wall Street: “Sell in May and go away.” This doesn’t necessarily mean that stocks will decline during this period, but historical data shows that returns have typically slowed down. If a market pullback were to occur, the summer or early fall would be the logical time. It’s important to remember that the market tends to experience at least one decline of 10% or more per year, regardless of whether the overall year ends positively or negatively. Recall the period from August to October last year for an example.

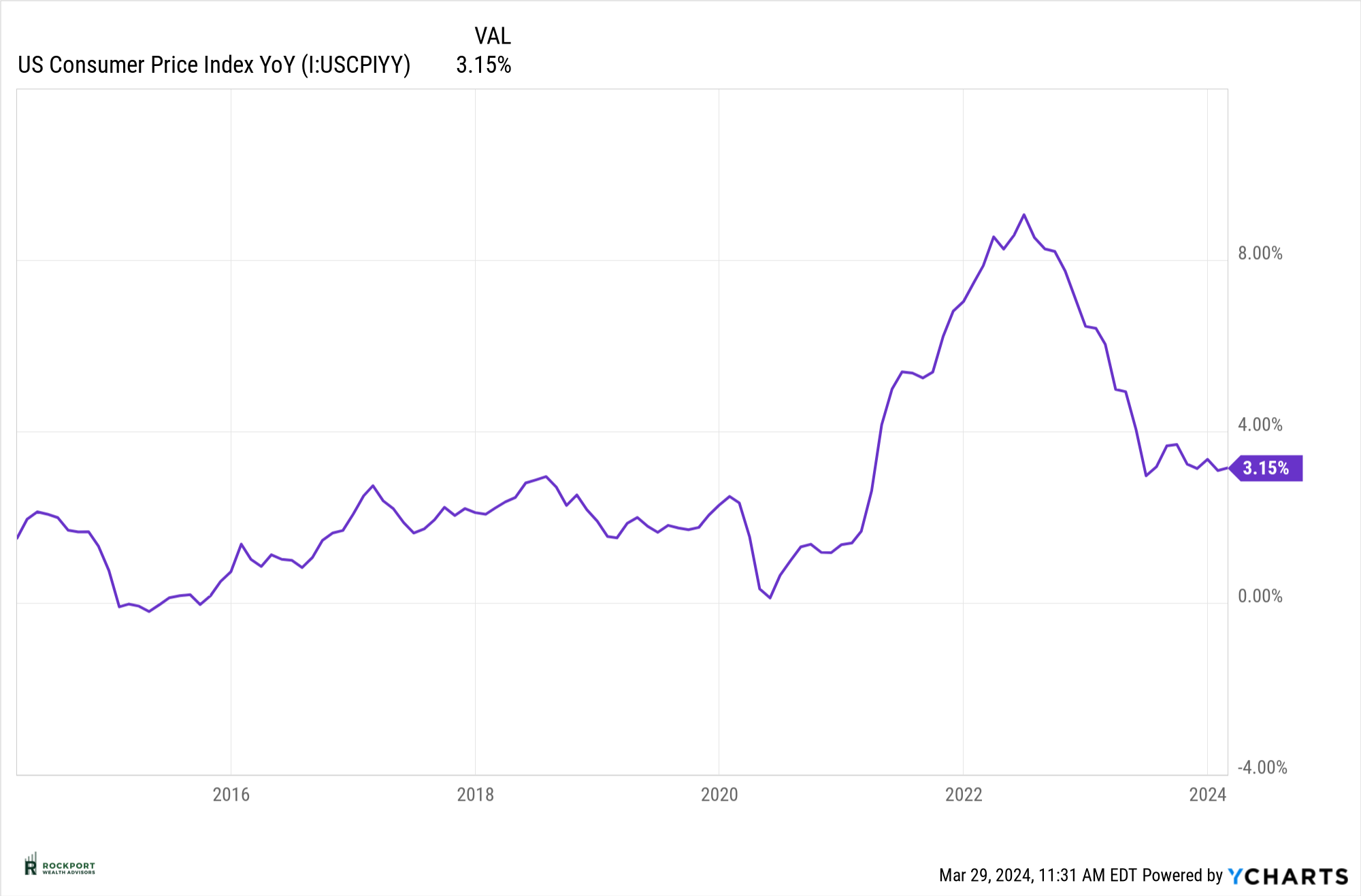

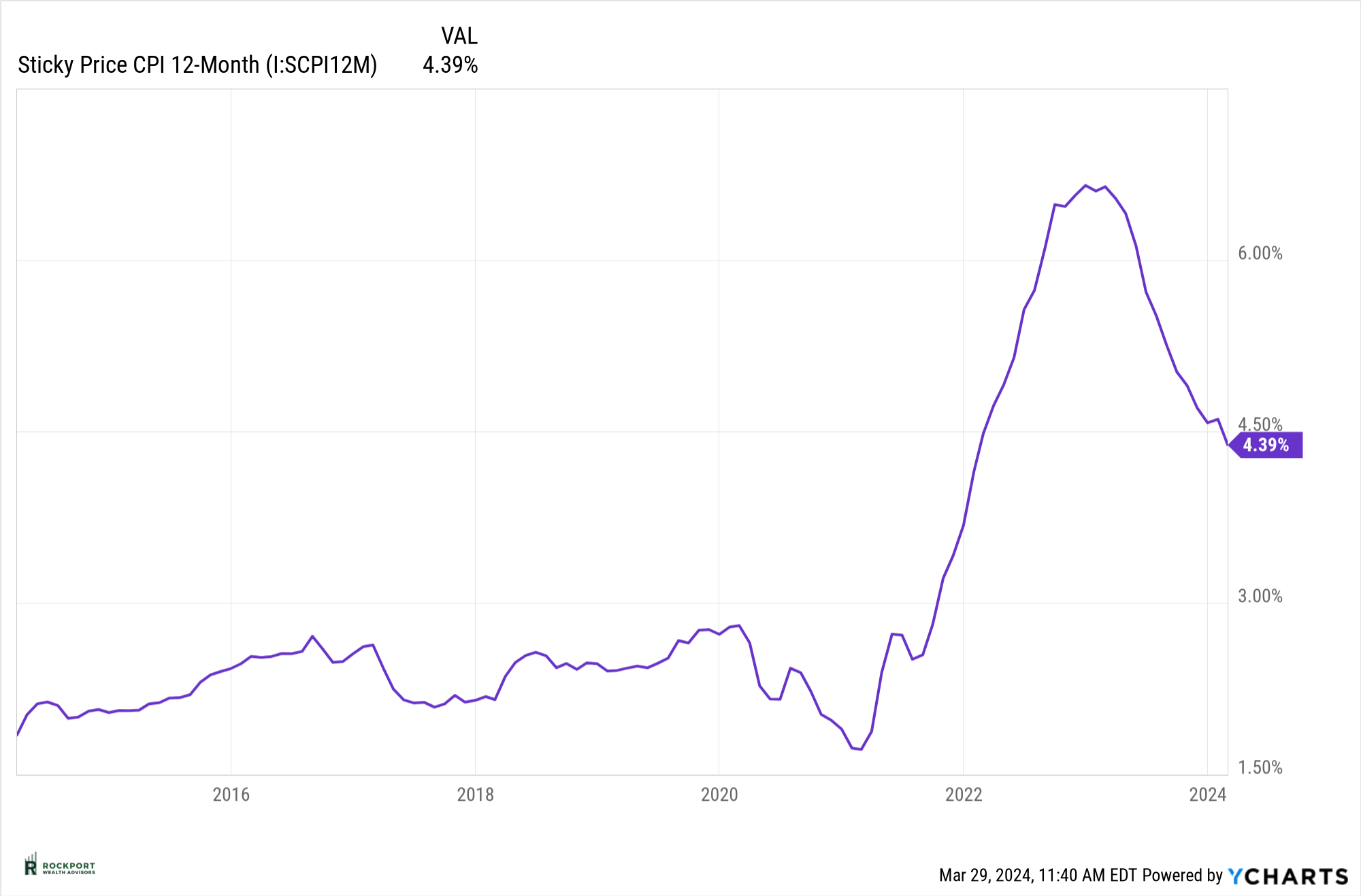

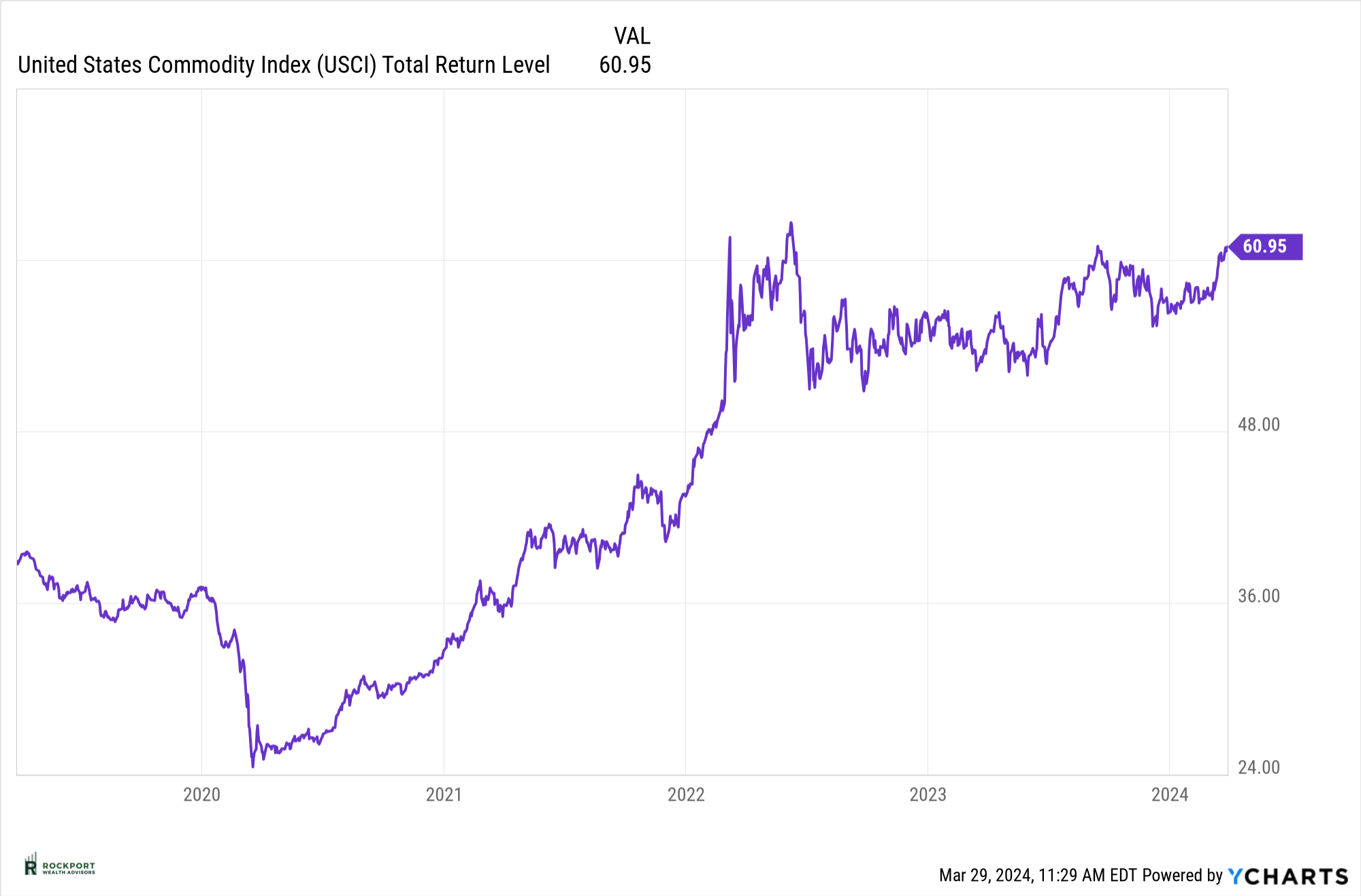

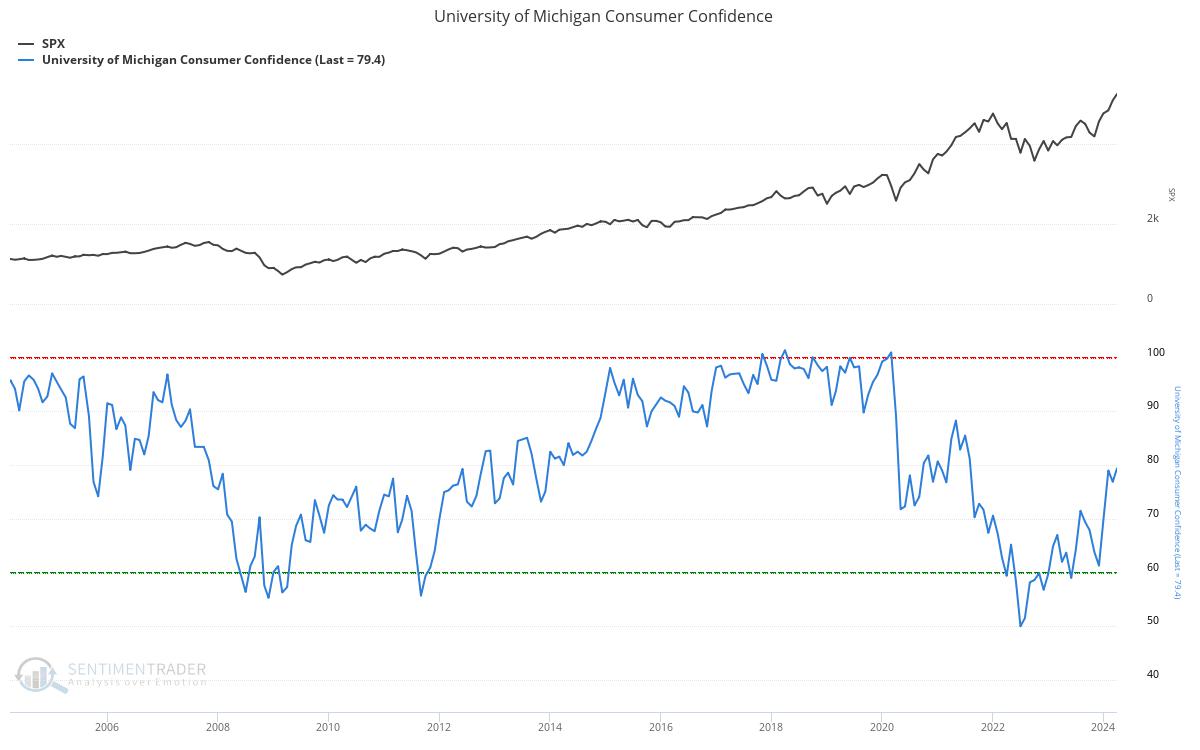

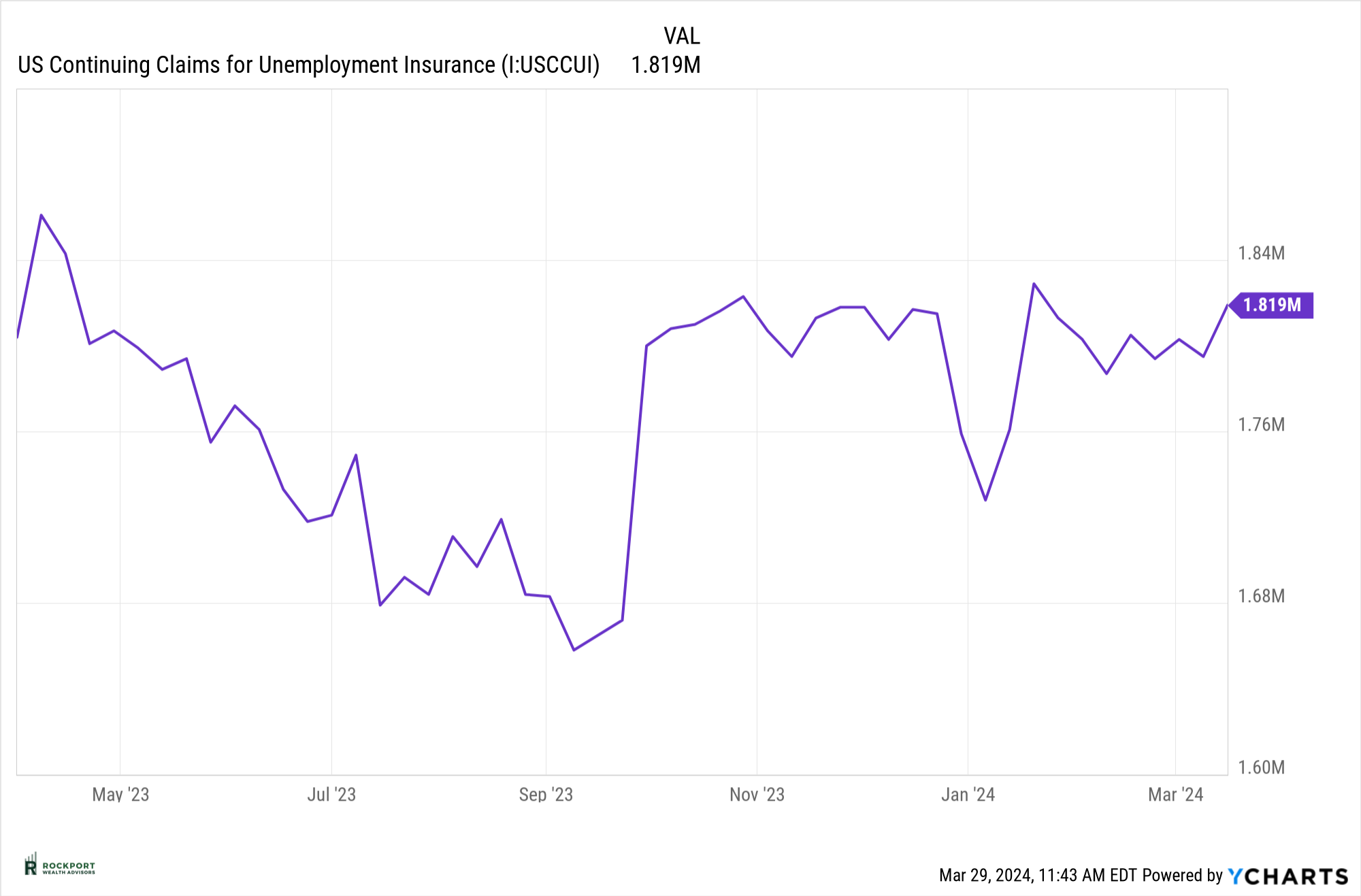

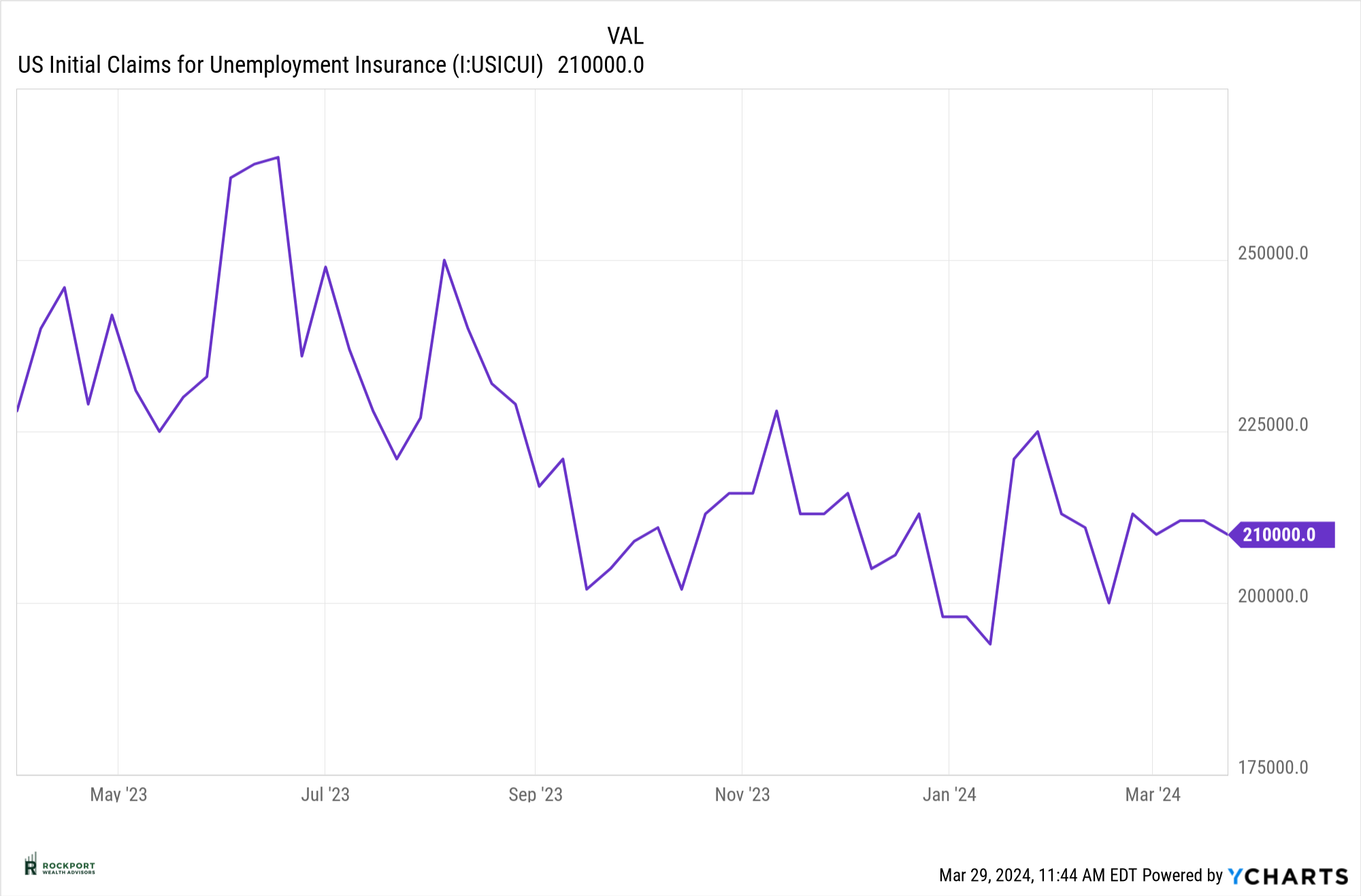

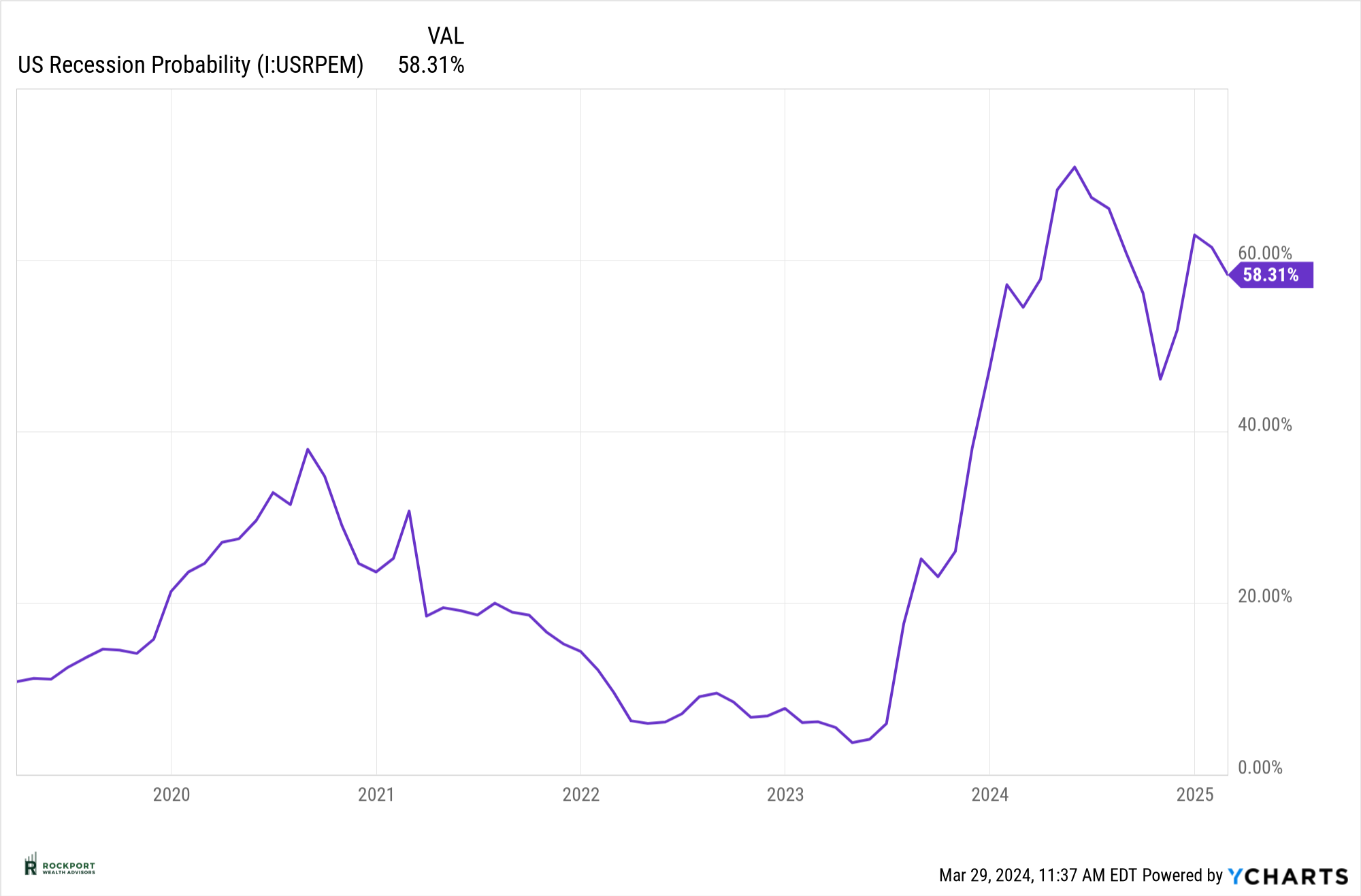

We continue to keep an eye on a few key factors that affect current conditions. Inflation, as measured by the CPI, is still hovering around 3%, while sticky CPI is gradually dropping and now below 4.5%. Commodity prices are on the rise, hitting their highest level since mid-2023, which poses challenges for the Fed’s efforts to control inflation. On a positive note, consumer confidence has seen a slight increase, which is good news. We mentioned last month that significant drops in confidence often precede recessions. Unemployment insurance claims have gone up again, though initial claims have slightly decreased. Finally, the New York Fed’s recession probability model shows a slight drop to 58.31%. There’s still much to consider as we enter the second quarter.

Tax Talk

Starting in 2024, 529 Plan to Roth IRA Rollovers are now available. Keep in mind:

- The maximum amount that can be rolled over is $35,000 and rollovers are subject to the annual Roth IRA contribution limit.

- The 529 beneficiary doing the rollover must have compensation in the year of the rollover at least equal to the amount being rolled over, and the 529 plan must have been open for more than 15 years.

Example: Joe had been diligently funding a 529 plan for his daughter Aly since she was 1 year old. He stopped funding the account when she reached age 16. Now, after Aly graduated college at age 23 and is joining the workforce, there is still $30,000 left in the account. SECURE 2.0 Act allows Joe to roll over the leftover funds in Aly’s 529 to her own Roth IRA, regardless if her income exceeds the Roth IRA threshold. Note, the amount that can be rolled over each year cannot exceed the annual Roth contribution limit in effect that year, and Aly must have taxable compensation that would otherwise allow her to make a contribution. The 529 plan must have been open for more than 15 years.

Other News

We are growing! Rockport Wealth Advisors recently closed on our purchase/merger with J Arnold Wealth Management Company in Youngstown, Ohio. With this acquisition, we are now 14 people strong between the two offices with the addition of added staff and two advisors. The staff and their managing partner Jon Arnold will be invaluable to us in terms of increased service levels and portfolio management.

Lastly, congratulations to our own Adam Stalnaker. Adam recently passed the Certified Financial Planner Test and is officially a CFP® . This is a tremendous accomplishment that requires many hours of hard work and study. Above all it shows his commitment to Financial Planning and making himself an even more valuable resource to all Rockport Clients. If you would like to congratulate Adam feel free to send him an email at adam@rockportwealth.com.

As always, if you have any questions on anything we have talked about here or anything else that is on your mind, please feel free to reach out.

*The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. Results can be found at slickcharts.com.

*Treasury yields can be found at finance.yahoo.com.

*Charts produced at yCharts.com

*Bonds can be found at bloomberg.com/markets/rates-bonds

*Fed Rate Probability Chart can be found at cmegroup.com/markets/interest-rates/cme-fedwatch-too

*The LEI can be found at conference-board.org/topics/us-leading-indicators

*Treasury Yield Curve can be found at Gurufocus.com

*University of Michigan Consumer Confidence produced at SentimenTrader

*Rockport Models – Please remember we are referencing our model portfolios, and your portfolio may differ from the models mentioned depending on your individual needs and circumstance.