We are now 5 months into 2022 and things have yet to settle down in the markets. For the month the S&P 500 was nearly flat eking out a slight gain of .01% which leaves the index down nearly 13.5% year to date. Once again stocks staged a late month comeback as at mid month the S&P 500 index was approaching a 20% decline but staged a nice recovery back to where it started the month. Bonds did have their first positive month of the year as well.

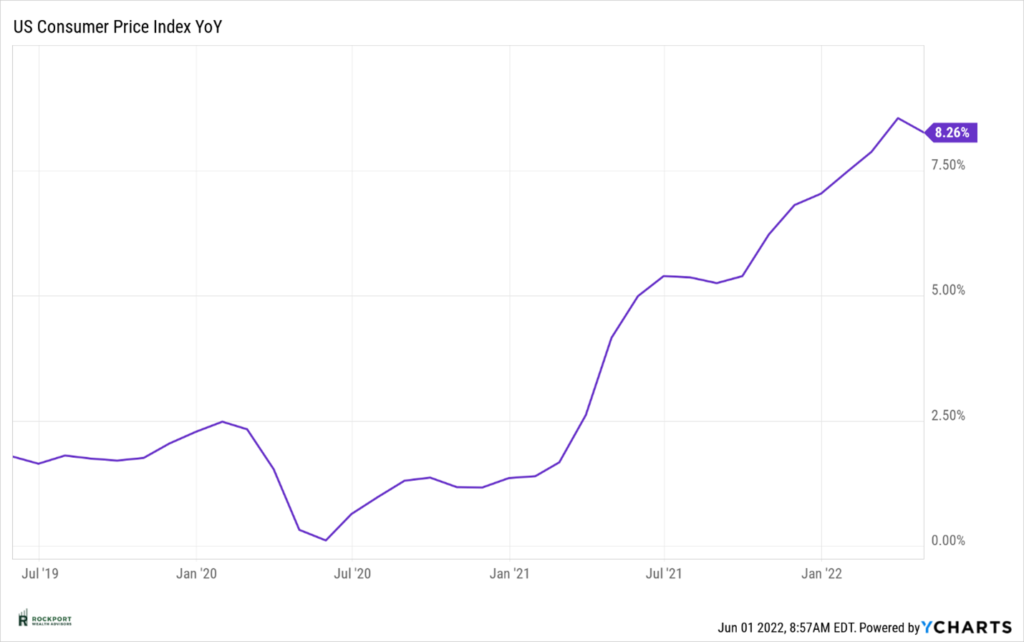

We have largely focused on inflation and the CPI (Consumer Price Index) for the first part of the year. In what is a slight bit of good news, the CPI (see chart) ticked down for the first time since August of 2021 from 8.54% to 8.26%. Let’s hope that this signals an end to the rise in inflation that we have seen for some time but it’s really to early to tell and one month does not signal a trend but clearly this bears watching.

The Federal Reserve did raise interest rates another ½ percent in May and forecasts do have several additional interest rate increases yet to come throughout this year. Clearly, they are still worried about inflation and its possible continuing rising trend and as we have mentioned in the past raising interest rates is their primary weapon against rising prices. Long story short they are trying to slow demand down just enough to not put us in a recession, knowing that lower demand will help decrease prices. This is a very, very fine line for them to walk and frankly one they have not had a great track record of getting right historically. As the year unfolds we will see how much they are willing and able to stick to the forecast for additional rate increases.

We want to address the volatility in the markets in a little more detail and give some reference as to how common market declines are. One thing we know for sure is that there has been no shortage of media coverage around the stock market’s volatility and as usual the media has the sky is falling perspective which doesn’t help investor psyche! But just how common is a 5%,10%, 15% and 20% + drop in the market? As you can see below these likely occur more often than most think and although uncomfortable are a part of investing. One issue regarding perception of the current market decline is that since the financial crisis of 2008 market declines have been relatively mild and/or have been short in duration so the longer drawn out down market cycles of the past have been forgotten for the most part which is why this may feel unusual. The point is by historical standards what we have experienced the first 5 months of this year is not terribly uncommon and if history holds true we likely have more time yet before this wave of volatility passes. We are constantly asked the question are things going to get worse? There is no way to tell. The answer likely lies in two factors, first one being the trajectory of inflation which could cause the Fed to tighten financial conditions more and second, will we actually experience a recession in the coming months/year, both of which could upset things further.

Lastly, the war between Russia and Ukraine continues on. This has not helped the inflation picture as energy prices remain inflated and as we have stated in the past it does disrupt supply chains further. National averages for a gallon of gas are at all time highs and food prices have soared in many cases. The Best we can hope for is a resolution sometime this year to that conflict which would help both the economic and more importantly the humanitarian side of things and would definitely help the psychology of the markets as well.

As always If you would like to schedule a time to review your portfolio and/or financial plan please reach out to us.

*The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. Results can be found at slickcharts.com.

*Treasury yields can be found at finance.yahoo.com.

*Charts produced at yCharts.com