March turned out to be a good month in the markets despite a very bumpy start. For the month the S & P 500 index was up nearly 4%. March 14th saw the low for the month and at that time the S& P 500 was down over 13% for the year. A massive rally then ensued to bring the index back to approximately 5% down for the year, a noticeable improvement over February’s close but still the worst Quarter since March of 2020.

The story has not changed in terms of the 2 major headlines that continue to dominate investor psychology those being the continued rise in Inflation and The Russian invasion of Ukraine.

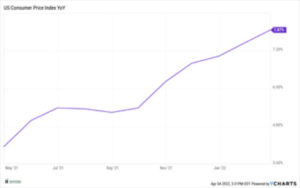

Inflation continues to move higher yet with the end of February reading being nearly a half point higher than end of January at 7.87% Year over year increase (See Consumer Price Index Chart below, we will stick with this chart until it no longer becomes a hot topic). It would be very surprising if the next reading for March showed improvement You have to go back to the early 1980’s to find Consumer Price Index readings as high as they are now.

Supply chains continue to be a problem and they have only tightened up more due to the Russia Ukraine War. Safe to say that any forecast for the supply chain improving has been pushed back as well as any forecasts for a reduction in inflation.

Speaking of Inflation, the Federal Reserve did do the first interest rate increase in several years in March. This was widely expected. What did come as a surprise was that when they raised rates their commentary stated that they are now expecting 7 interest rate hikes this year. This is far different than the 3-4 rate increases that were expected at the beginning of the year. This shows how concerned they are about inflation is that once that Genie gets out of the bottle he (or she) is tough to get back in. They are clearly thinking that they need to raise rates more in an attempt to get things under control on the inflation side. We would agree, however keep in mind that as interest rates rise the economy tends to slow and too much of a good thing can throw us into a recession. We would not want to be in their shoes.

Thinking back, we can’t recall a period of time that has the potential for such a wide range of outcomes.

Uncertainty is high to say the least and a significant market move in either direction would not surprise us. It is important to keep in mind that there have been plenty of times historically where negativity is high but outcomes have been favorable (and vice versa).

One final point to keep in mind as the quarter turns. Bonds have not been your friend this year to this point. In fact, in many cases bond funds are Down as much as or more than stocks funds. This does not happen often, however when it does more conservative portfolios can experience similar declines to more aggressive ones.

This is exactly what has happened this year. The base premise on bonds is that their prices fall as interest rates trend up. For the better part of the last 12 years interest rates have been declining or near zero which has been favorable for bonds. We have now entered for at least the time being the opposite environment with rates rising and prices falling. This does not mean you should abandon bonds as they are still a part of a diversified portfolio. Despite their declines they are still a less aggressive asset class than stocks with a smaller risk return profile. We did make changes to portfolios in late January to help with this scenario, but more conservative investors have still felt the pinch.

As always if you would like more detail or have questions please reach out. Happy Spring!

*The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. Results can be found at slickcharts.com.

*Treasury yields can be found at finance.yahoo.com.

*Charts produced at yCharts.com