We hope all of you had a great Thanksgiving and we would like to wish you all Happy Holidays!

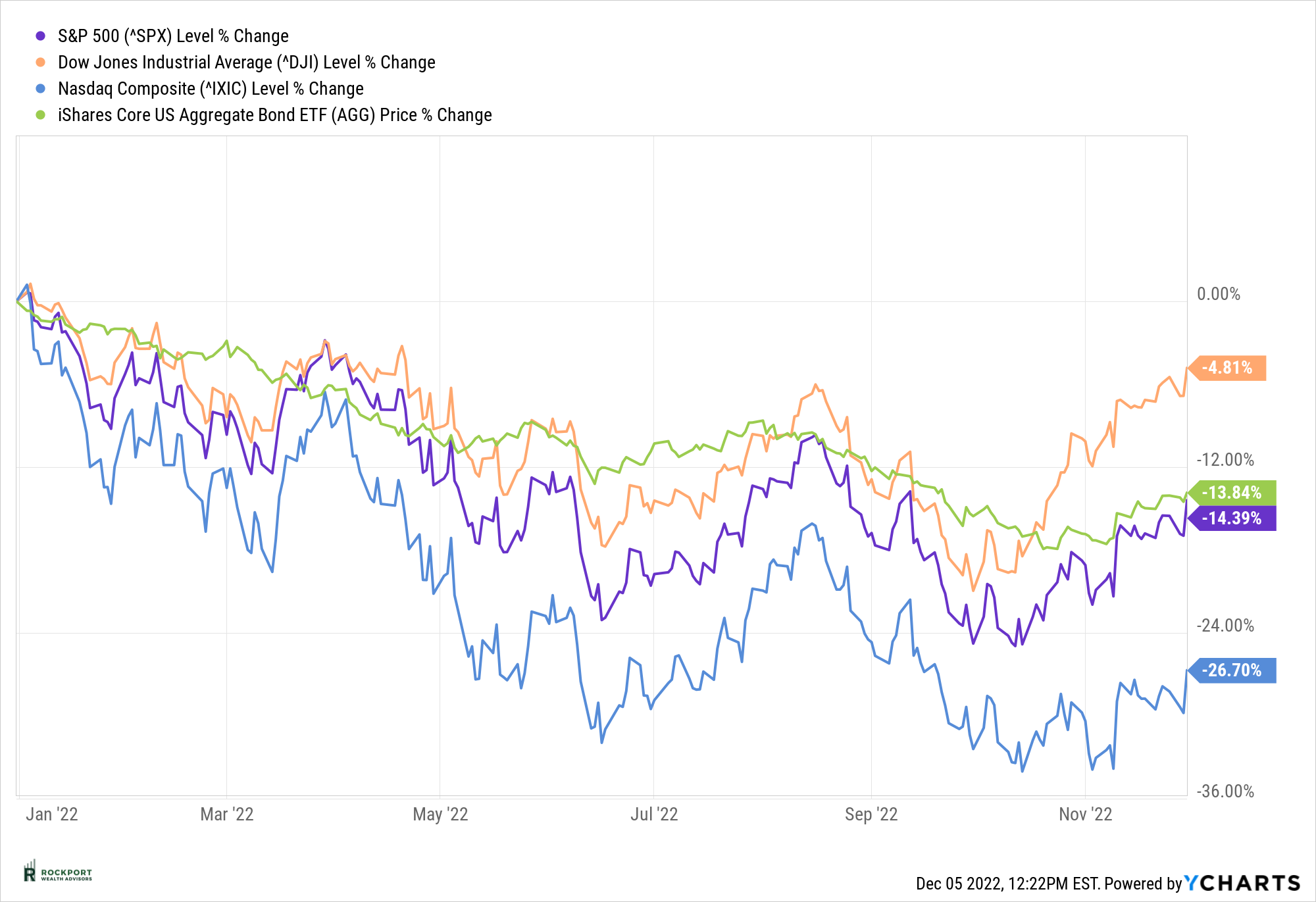

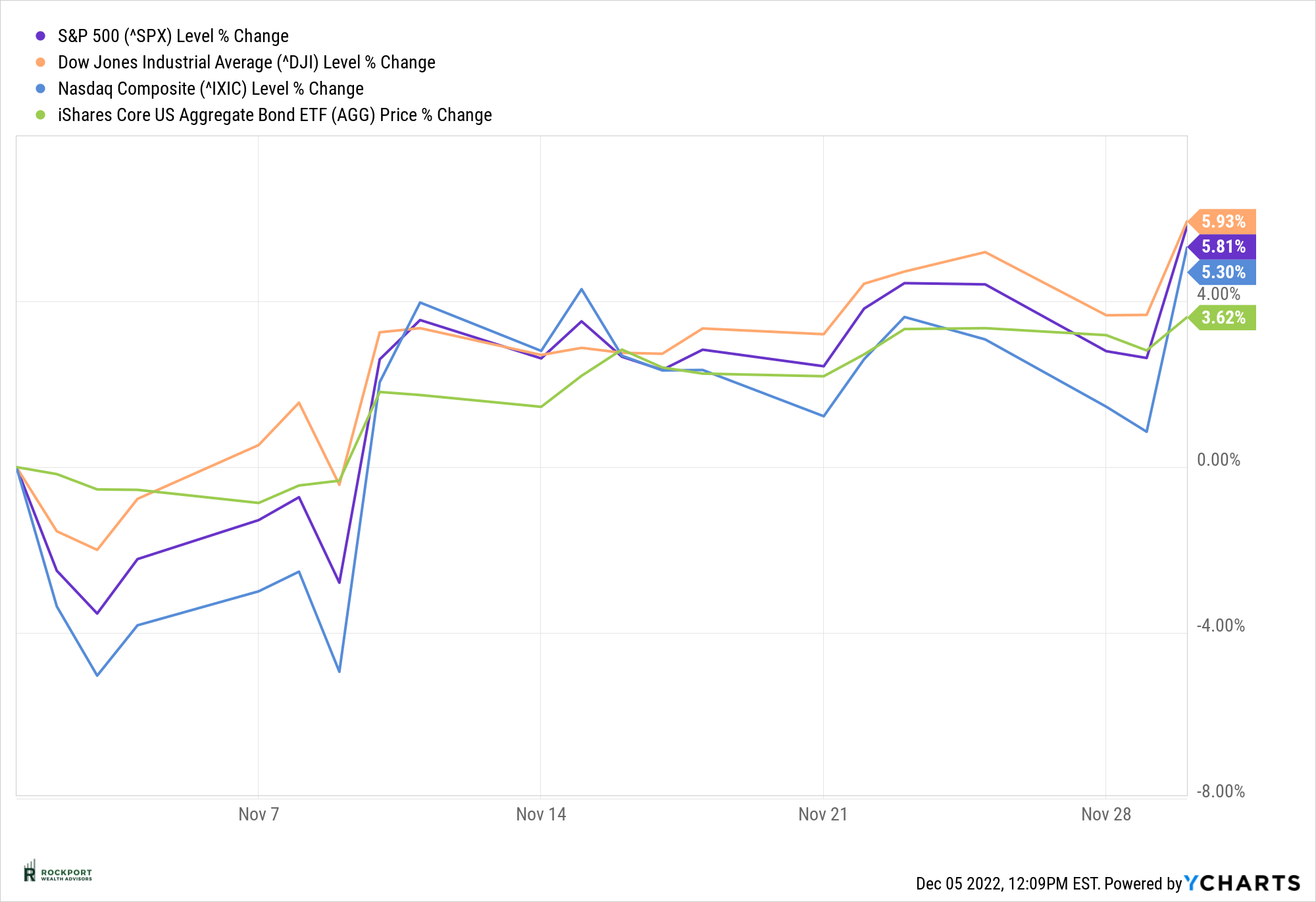

November was a very good month for most asset classes. The S&P 500 Index was up 5.81% for the month. This brings the index year to date return to -14.39% (see charts below). Even the bond market had nice returns for the month with the Aggregate Bond Index up 3.62%. However, even with this positive month the Aggregate Bond Index is still down -13.84% year to date. There were a couple reasons for the good month of returns.

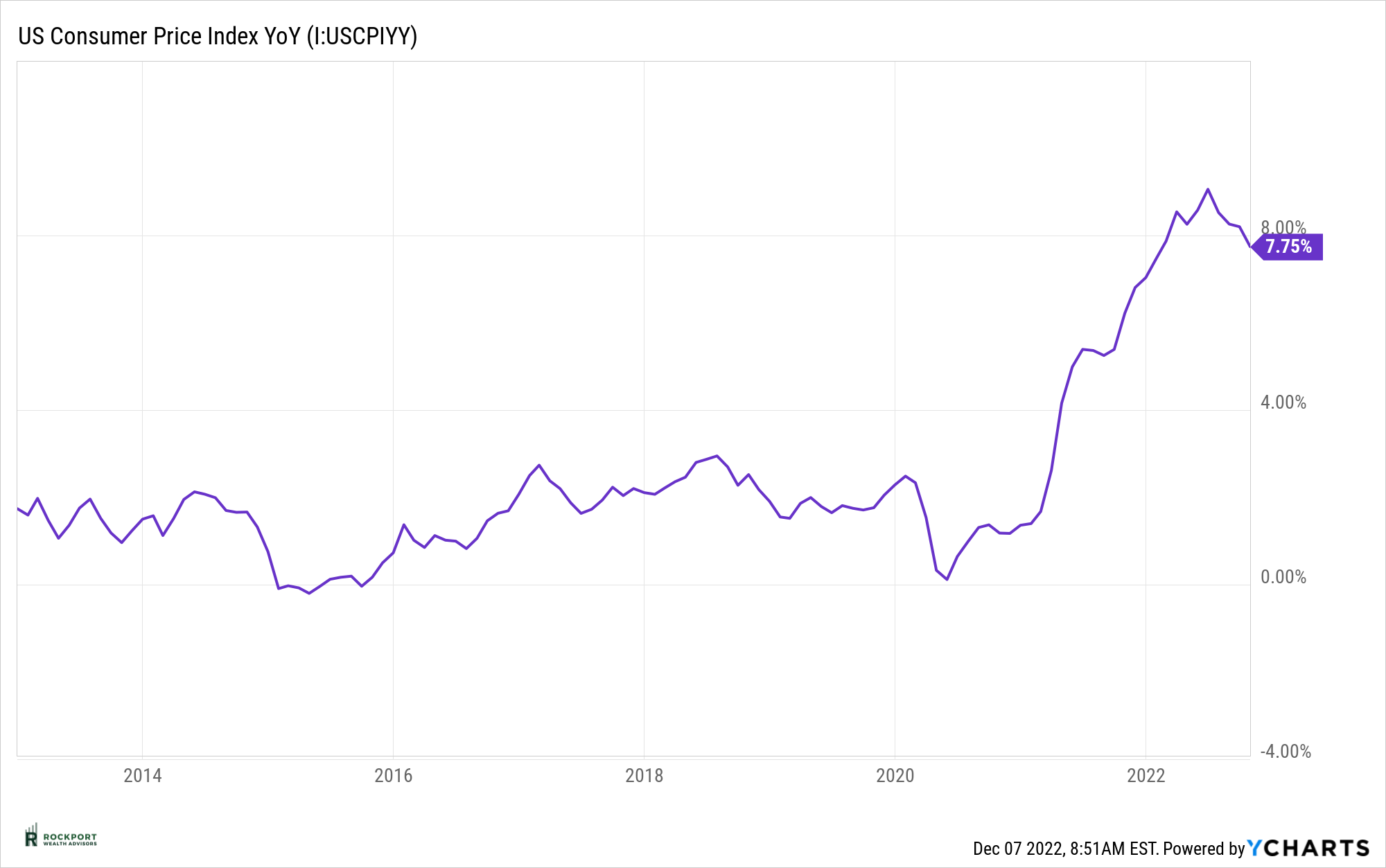

First, the CPI (Consumer Price Index) fell to +7.75% year over year increase. This was the 4th straight month of a decline in the Index which is now well off its established high in July of this year. Second, the CPI falling in consecutive months gave the markets confidence (Hope) that the Federal Reserve would be ending its interest rate raising cycle sooner rather than later or at the very least a hope that interest rates would increase at a slower pace. Third, some very important correlations that have evolved this year finally worked in favor for the markets instead of against. First, bond yields fell. Hence the positive return in the bond market (remember yields and bond prices move in opposite directions). For the entire year when bond yields have risen, stocks have fallen, and for most of the year bond yields have been going up not down so the falling yields took pressure off stocks. Second, the US Dollar weakened. Generally, when the Fed increases the federal funds rate, it typically increases interest rates throughout the economy, which tends to make the dollar stronger. The higher yields attract investment capital from investors abroad seeking higher returns on bonds and interest-rate products (Think of this in terms of buying US Dollars). Historically, increases or decreases in the federal funds rate have correlated fairly well with moves in the US Dollar exchange rate versus other currencies. A strong dollar is good, but too strong of a dollar is not as it makes stocks and bonds more expensive for non-US investors.

As we move into 2023, our main concern is has the Fed raised interest rates so high and fast that there will be a recession? Recession yes vs no? We hope to have more clarity as we move toward the end of the first quarter. Keep in mind that interest rate increases take months to actually work their way into the economic system. We are just now seeing the effects of the first few rate increases and as we all know there have been several large increases just since mid-year that likely still need to hit the system. The question we get often is have we seen the worst of things? No one knows the answer to this. We sincerely hope we have seen the worst of things this year. However, we do not feel as if there is an all clear yet and we are out of the woods. The Fed is still not finished raising rates and even though they have hinted at a slower pace of increases, their decisions will be data dependent. If the data does not show what they want, they are likely to keep tightening. In addition, we find it interesting that Wall Street earnings estimates for S&P 500 companies have not come down much. This is a sign of analysts being too optimistic and possibly operating on incorrect assumptions about a possible recession. In short, if the recession yes box is checked, earnings estimates will have to come down from where they are now which will pressure stock prices. We will maintain our allocations to alternative investments that have done well and in certain models our hedges for the foreseeable future, as these have both helped minimize portfolio declines on a relative basis.

Lastly, in the month of December we will be embarking on tax loss selling in our non-IRA accounts. In the down years it is one of the things you can do to help your overall situation as these losses will go towards helping to wipe out capital gains distributions, hence reducing your tax bill.

If you have any questions on anything we have talked about here or anything else that is on your mind, please feel free to reach out. If we don’t talk to you, please have a safe and healthy Holiday season!

*The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. Results can be found at slickcharts.com.

*Treasury yields can be found at finance.yahoo.com.

*Charts produced at yCharts.com