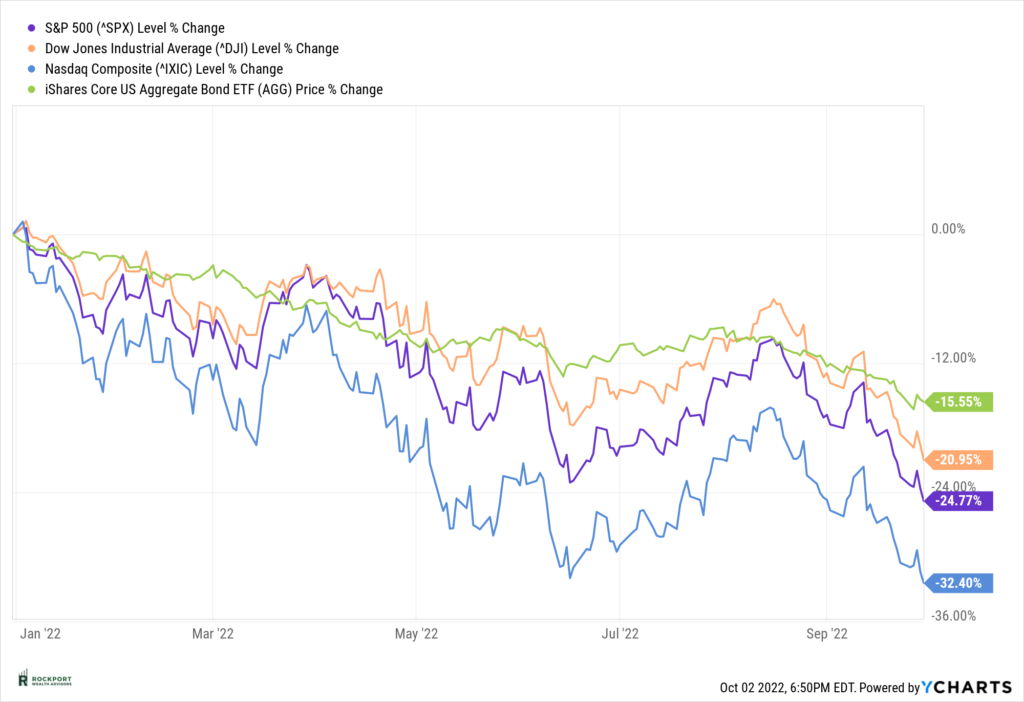

Another difficult month and quarter for the stock and bond markets. For the month the S&P 500 was down 9.61%. The index is now down 24.77% ytd. (Reference chart below with year to date returns) Pretty much the same story month to month this year with the Fed raising interest rates in the face of high inflation

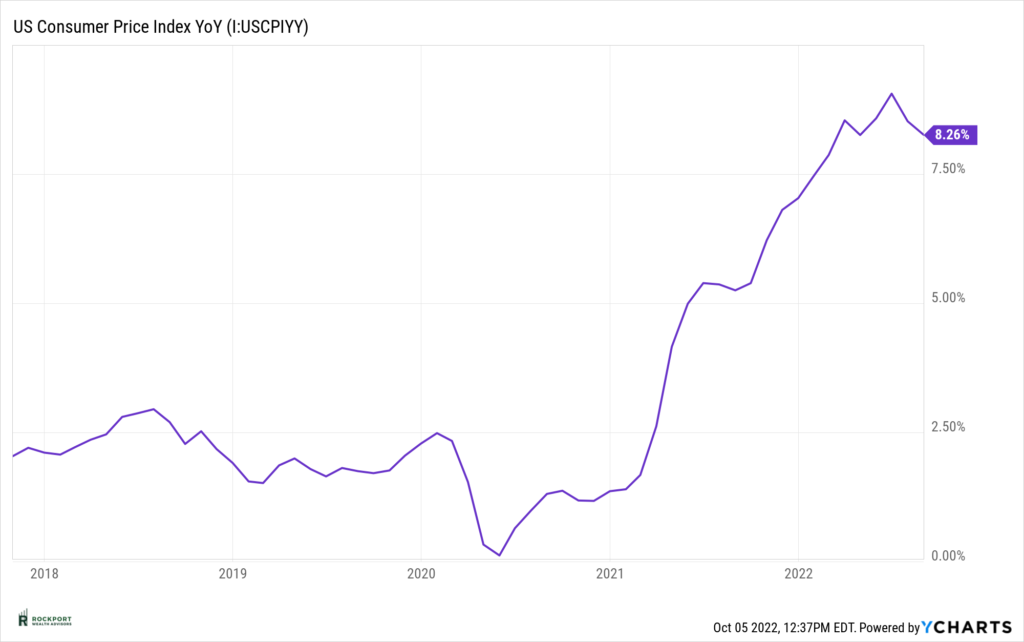

The Federal Reserve has now done three straight 75 basis point ( ie. ¾%) hikes to the fed funds rate in recent months and a couple more rate hikes seem extremely likely in November and December as inflation numbers remain high (reference our favorite CPI chart.) All of these rate hikes are taking their toll now on the housing market as the 30-year mortgage rates are now approaching 7% causing refinances to dry up and new and existing home sales to fall and asking prices are finally coming down. The automotive and other high ticket item sectors are also feeling the pinch.

One particularly huge issue in our opinion is the Federal Reserve Losing Credibility over the past 12 months. Thinking back to the things the Fed said one year ago: 1. Interest Rates will remain lower for longer. 2. We are unlike to raise rates until 2024. 3. We believe recession is unlikely. 4. Inflation is transitory and not a problem 5. Inflation should fall to 2% in 2022. Talk about a swing and miss on all fronts! It will take a long time for them to restore confidence in what they are doing and one of our biggest concerns at this point is that they over tighten (raise rates too much) and throw the country into a deep recession. We would love to see them take a break from the intense raising of interest rates, step back re-evaluate and then proceed accordingly. In short, we feel they have raised rates enough (too much??) for the time being. It’s important to keep in mind that interest rate hikes really don’t hit the system until 6-9 months out, so we really won’t feel full effects of what they have done until year end or 1st quarter of next year. This makes a recession increasingly likely as we move through 2023.

Enough beating the Fed up and sounding negative. Our job is to inform as to what’s happening and unfortunately at present time this is top of mind. On the positive front the markets are leaving what is historically the worst period of time on the calendar and moving into the best time of the year. This is called seasonality and while nothing has to happen the odds of better performing markets increase dramatically from August/September into October/December. Also, keep in mind markets are forward looking. A lot of bad news is already priced in, is enough bad news priced in already? This is $10,000 question.

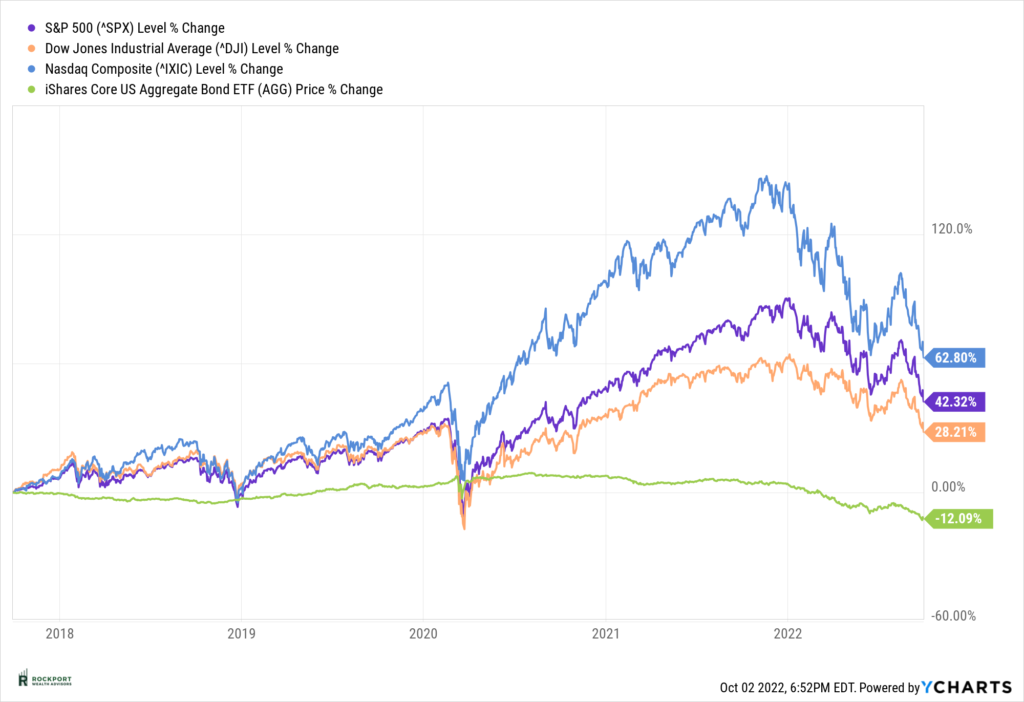

It is always important to focus on the long term in investing and at the present time this is of utmost importance. (Notice how much the market is still up in the chart below for the past 5 even with the decline this year) The swift recoveries of market declines in the past 15 years are unlikely to occur given present circumstances. This doesn’t mean you should abandon your current investment strategies. In fact, and as we have discussed with many of you we may be approaching a time when we can re-evaluate your present allocation and begin to position to more of a growth allocation if its appropriate. Let’s not forget the number one rule in investing….Buy Low Sell High! It will long go down as a mystery as to why investors won’t buy stocks when they are down. If Walmart has toilet paper 25% off people stock up. When stocks are down the same amount no one wants to go near them.

Lastly, the bond market continues to be an issue and has had nearly as difficult a year as stocks have (on the year to date chart notice the green line) As we have eluded to in past newsletters this has really affected conservative investors as there have been very few components in a portfolio that have moved up this year. It would be extremely helpful for bond yields to stabilize and even fall a little as this would likely stabilize the stock market some. The current trend is when bonds fall in price and yields rise stocks fall too. This has been the case for the past several months and is likely to continue until the stock market finds another indicator to latch on to and cause movement (both up and down.) So, if you’re looking for something to watch, watch bond yields. We are now 9 months into this cycle of rising interest rates and falling stock prices and like all other cycles this will come to an end at some point. As stated above, a lot of bad news has been priced in already but has it been priced in enough?

As always if you have any questions or would like to review your personal situation please feel to reach out.

*The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. Results can be found at slickcharts.com.

*Treasury yields can be found at finance.yahoo.com.

*Charts produced at yCharts.com